Thursday Feb 05, 2026

Thursday Feb 05, 2026

Monday, 29 December 2025 00:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market last week began on a subdued note, with yields largely holding steady amid limited early activity. As the week progressed, market sentiment shifted following the outcome at the weekly Treasury Bill auction which recorded increases in weighted average rates across all three maturities, with the 364-day tenor rising by a notable 16 basis points. This marked a significant departure from the prior 22 weeks which had seen rates broadly anchored.

The secondary Bond market last week began on a subdued note, with yields largely holding steady amid limited early activity. As the week progressed, market sentiment shifted following the outcome at the weekly Treasury Bill auction which recorded increases in weighted average rates across all three maturities, with the 364-day tenor rising by a notable 16 basis points. This marked a significant departure from the prior 22 weeks which had seen rates broadly anchored.

Despite the upward adjustment in yields, the auction outcome reflected subdued demand conditions. Of the Rs. 150 billion on offer—the largest issuance size in the past 28 weeks—only Rs. 82.45 billion was raised, translating to a 54.97% subscription rate. The T-Bill auction was also notable for its shift in supply dynamics. It marked the first instance where the offered amount materially exceeded the estimated maturity volume of approximately Rs. 95 billion, signalling a clear departure from the undersupply conditions that had characterised recent weeks.

In response, secondary Bond market yields were seen increasing across the board as market participants adjusted to the pick-up in the very short end of the yield curve.

However, at the close of the week a partial recovery was seen as renewed buying interest kicked in at the elevated levels which pushed yields back down. Despite the downward retracement secondary market two-way quotes closed the week higher. Overall activity and transaction volumes were at healthy levels.

The details of the upcoming Treasury Bond auction, scheduled to be conducted on 30 December and the weekly Treasury Bill auction were announced. The T-Bond auction will have a total offered amount of Rs. 55 billion across two available maturities against its corresponding maturity volume estimated to be around Rs.53.50 billion, while the T-Bills auction will have a total offered amount of Rs. 120 billion against its corresponding maturity volume estimated to be around Rs. 117.98 billion.

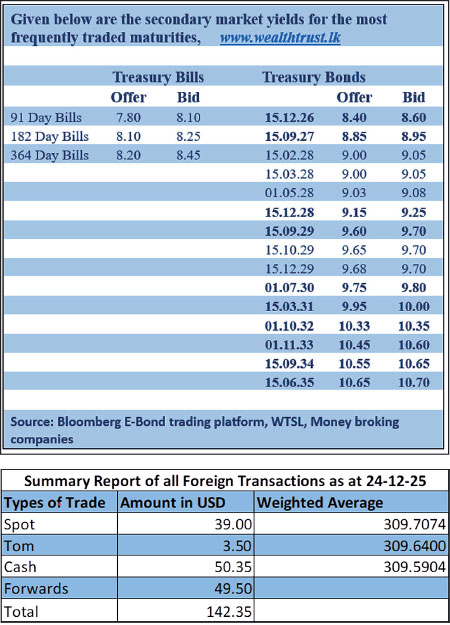

In terms of the secondary Bond market trade summary, the 15.09.27 maturity traded within the range of 9.05%–9.06% during the selling period when rates moved up.

The 15.02.28 and 15.03.28 maturities traded up to intraweek highs of 9.15% each, before recovering towards the close to trade at 9.00% each. The 15.10.28 maturity traded up to 9.23% mid-week before easing back to 9.15% by the end of the week. The 15.12.28 maturity traded at 9.20%.

Further along the curve, the 15.09.29 maturity traded up from 9.55% to an intraweek high of 9.75%, before retracing to trade at 9.65% towards the close. The 15.10.29 maturity traded up to 9.80% mid-week before trading down the range of 9.70%–9.65% at the tail end of the week. The 15.12.29 maturity traded up to 9.85% before easing to trade down the range of 9.83%–9.70%.

On the medium-to-long end, the 01.07.30 maturity traded up from 9.70% to an intraweek high of 9.95%, before trading down the range of 9.85%–9.75% towards the close. The 15.03.31 maturity traded up to 10.15% mid-week before easing back to 9.95%.

The 01.10.32 maturity traded within the range of 10.30%-10.33%, while the 01.11.33 maturity traded at 10.60%. At the long end, the 15.06.35 maturity traded at 10.68%. The long end remained somewhat anchored throughout.

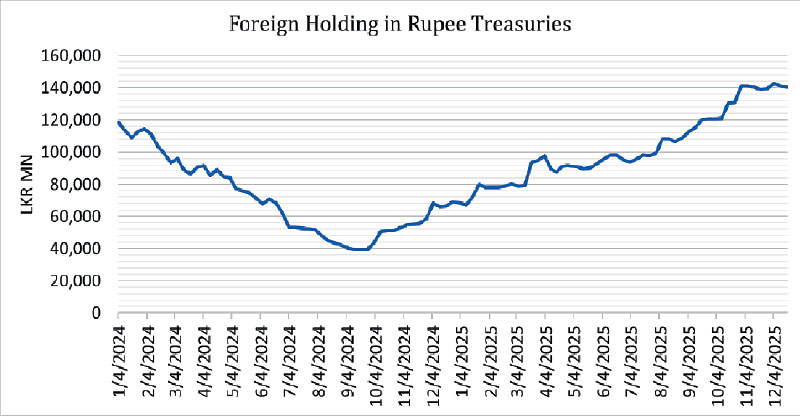

The foreign holdings of rupee-denominated Government securities recorded a net foreign outflow, amounting to Rs. 1.55 billion. Consequently, total holdings reduced to Rs. 140.43 billion during the week ending 24 December.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 14.17 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 111.66 billion as at the week ending 26 December 2025, from Rs. 65.92 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.99%-8.02% and 8.04%-8.05% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 26 December, unchanged against the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 309.65/309.75 as against the previous week’s closing level of Rs. 309.50/309.60. This was subsequent to trading at a high of Rs. 309.45 and a low of Rs. 309.75.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 64.18 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)