Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 22 December 2025 05:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

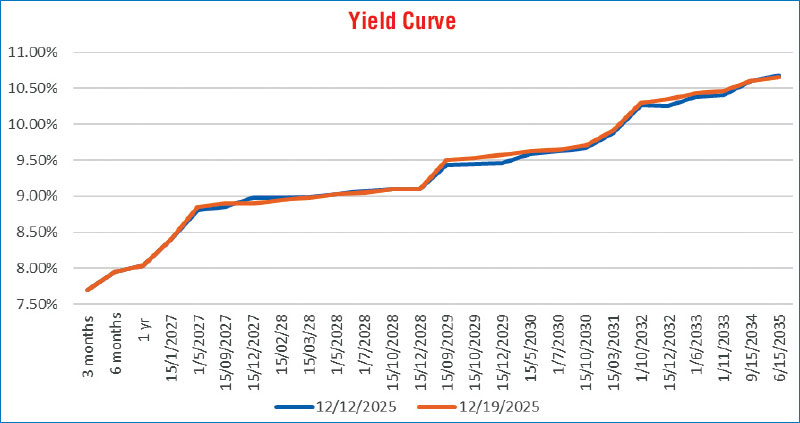

The secondary Bond market last week began on a subdued note, with yields largely holding steady amid limited early activity. As the week progressed, market sentiment shifted and quickly turned decisively positive, driving a midweek rally led by the short end of the yield curve. The 2028 and 2029 maturities rallied strongly, pulling short-term yields lower. As these tenors re-priced downwards, the yield curve increasingly reflected scope for further compression, prompting traders to pursue elevated term premiums further along the curve. This dynamic resulted in demand spilling over to longer maturities, which also registered declines in yields, albeit more modestly. Trading activity and transaction volumes increased in tandem with the improved sentiment.

The secondary Bond market last week began on a subdued note, with yields largely holding steady amid limited early activity. As the week progressed, market sentiment shifted and quickly turned decisively positive, driving a midweek rally led by the short end of the yield curve. The 2028 and 2029 maturities rallied strongly, pulling short-term yields lower. As these tenors re-priced downwards, the yield curve increasingly reflected scope for further compression, prompting traders to pursue elevated term premiums further along the curve. This dynamic resulted in demand spilling over to longer maturities, which also registered declines in yields, albeit more modestly. Trading activity and transaction volumes increased in tandem with the improved sentiment.

The decline in yields was underpinned by a marked improvement in macroeconomic and funding-related sentiment. Investor confidence was bolstered by confirmation of $ 120 million in emergency financing from the World Bank and a $ 200 million loan from the Asian Development Bank to continue the Mahaweli Water Security Investment Program – Stage 2 during the week. Sentiment was further reinforced by evidence of robust fiscal performance during January–October 2025, with the overall budget deficit narrowing by approximately 57% to Rs. 455.8 billion, supported by a strong 33% year-on-year increase in total revenue and grants and a 34% expansion in tax revenue. Expectations of additional support from the IMF, World Bank, ADB, and other multilateral lenders further strengthened confidence in near-term funding capacity and external reserve adequacy.

However, momentum eased towards the latter part of the week. Market activity moderated on Thursday, with the secondary Bond market largely at a standstill and yields consolidating following the earlier rally. On Friday, yields edged higher as profit-taking pressure emerged amid tighter overnight liquidity conditions, reduced funding availability, and rising funding costs. Sentiment was also weighed down by the announcement of the upcoming Treasury Bill auction, where the offered amount at Rs. 150 billion was set significantly above the

corresponding maturity volume estimated to be around Rs. 95 billion—marking a clear departure from the undersupply seen in recent weeks. This led to a reversal and as a result, secondary Bond market two-way quotes closed broadly unchanged week on week despite the midweek rally.

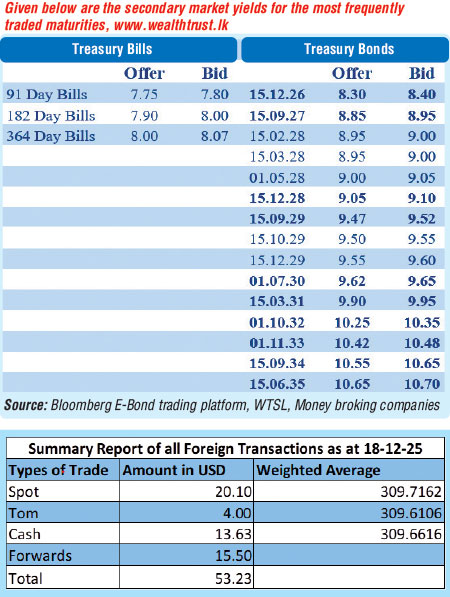

In terms of the Secondary Bond Market Trade Summary: During the last week, the 01.06.26 maturity traded at 8.30%, while the 01.08.26 maturity traded within the range of 8.40%-8.35%. The 01.05.27 maturity traded within the range of 8.85%–8.80%.

Moving into the 2028 tenors, the 15.02.28 maturity traded down the range of 8.99%–8.93% during the rally but moved up to trade at an intraweek high of 9.02% during the reversal. The 01.05.28 maturity traded down from an intraweek high of 9.05% to a low of 8.95%, before trading up later in the week back up to 9.05%–9.02% during the close of the week.

The 01.07.28 maturity traded down the range of 9.07%–8.95%, before retracing towards the close of the week to trade within the range of 9.10%-9.05%. The 15.12.28 maturity traded down from 9.15% to 9.02% midweek before moving back up to trade at 9.10% at the tail end of the week.

Further along the curve, the 15.09.29 maturity traded down the range of 9.49%–9.45%, before moving back up to trade within the range of 9.52%-9.50%. The 15.10.29 maturity touched a low of 9.48% but subsequently moved back up to trade at a high of 9.55%.

On the medium-to-long end, the 15.03.31 maturity traded up the range of 9.85%–9.90%. The 01.10.32 maturity initially traded down the range of 10.28%–10.25%, but moved back up to trade at a high of 10.30% at the close of the week. The 15.12.32 maturity initially traded down the range of 10.26%–10.22%, but also traded up to hit a high of 10.36% at the close of the week. The 01.11.33 maturity traded at 10.40%-10.45%, and at the long end, the 15.06.35 maturity traded within the range of 10.68%–10.65%.

At the weekly Treasury Bill auction held last Wednesday (17) the weighted average rates held steady. Accordingly, the yields on the, 91-day, the 182-day and the 364-day tenors were recorded unchanged at 7.51%, 7.91% and 8.03%. This marked the 22nd week where T-Bill rates have stayed broadly anchored around prevailing levels. The auction was undersubscribed, raising only 84.64% or Rs. 40.63 billion out of the entire Rs. 48 billion offered. The bids received-to-accepted amount ratio was 1.67 times.

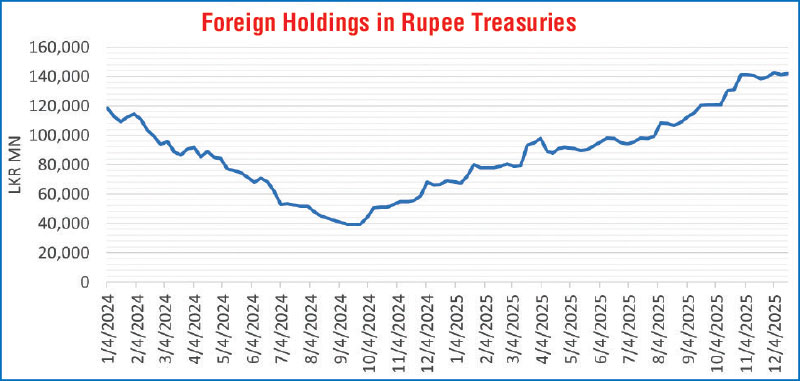

Meanwhile, the foreign holdings of rupee-denominated Government securities recorded a net foreign inflow, amounting to Rs. 0.75 billion. Consequently, total holdings increased to Rs. 141.97 billion during the week ending 18 December.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 16.60 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market decreased to Rs. 65.92 billion as at the week ending 19 December 2025, from Rs. 106.77 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.97%-7.99% and 8.01%-8.03% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government securities was registered at Rs. 2,508.92 billion as at 19 December, unchanged against the previous week’s closing level.

Forex market

In the forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 309.50/309.60 as against the previous week’s closing level of Rs. 309.05/309.15. This was subsequent to trading at a high of Rs. 309.20 and a low of Rs. 309.90.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 53.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)