Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 30 June 2025 02:56 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

By WealthTrust Securities

The Secondary Bond market witnessed significant volatility last week. Yields spiked sharply at the start of the week amid heightened risk aversion following reports that the US had bombed Iranian nuclear sites. This triggered widespread sell-offs in both the local bond and equity markets. Market sentiment worsened further as the Iranian Parliament threatened to close the Strait of Hormuz, a vital channel for global oil shipments, raising fears of broader market disruption.

However, a dramatic reversal began last Tuesday (24) after US President Donald Trump announced a ceasefire between Israel and Iran. The announcement sparked renewed buying interest and a strong recovery across both local and global markets. Despite ongoing uncertainty due to conflicting reports and ceasefire violations, investor sentiment improved, driving yields lower.

The recovery extended into Wednesday as the truce appeared to hold, boosting trading volumes and continuing the downward trend in yields. By Thursday, the market entered a consolidation phase, with yields mostly steady amid subdued activity as investors awaited the upcoming Treasury bond auction. Following a bullish outcome at the auction conducted on Friday, yields edged down further to close the week significantly lower on a week-on-week basis. Overall market activity and transaction volumes were at healthy levels for the week.

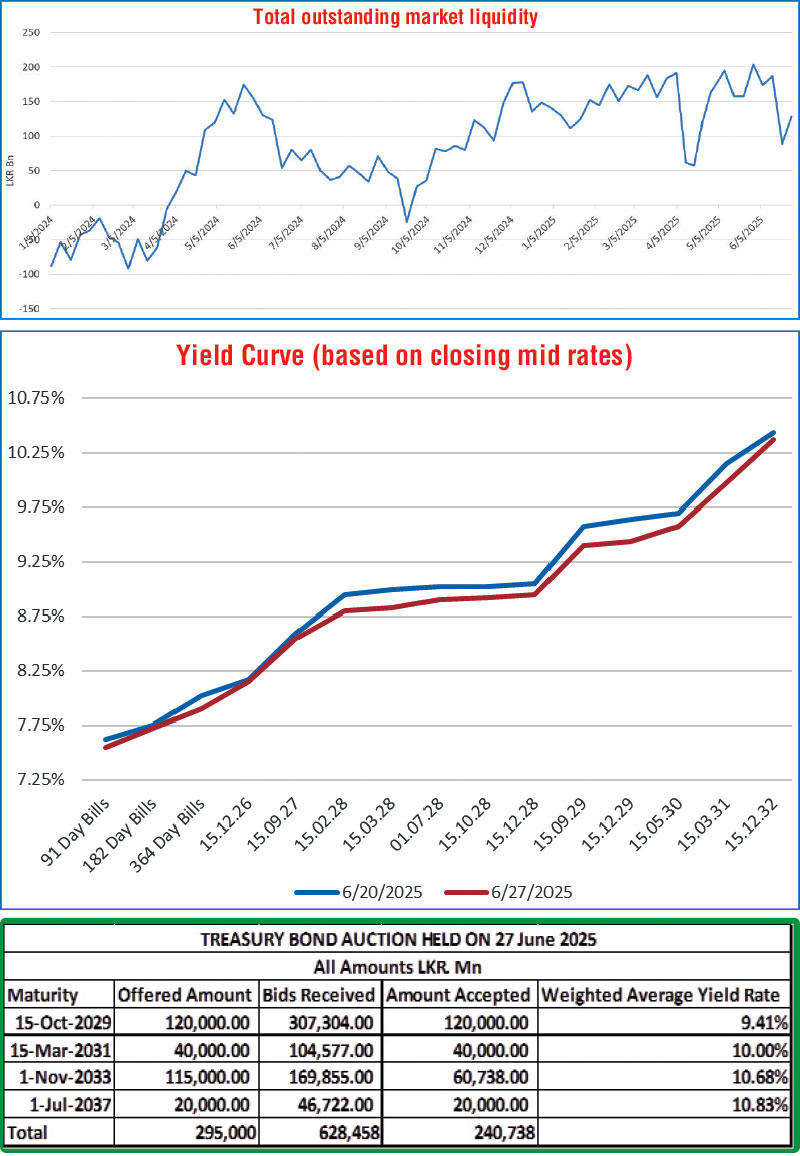

A landmark round of Treasury bond auctions was held last Friday, 27 June — the largest for the year 2025 to date and matching the all-time highest offered amount previously recorded on 13 June 2024. In the first phase of competitive bidding, Rs. 201.93 billion—equivalent to 68.45% of the Rs. 295 billion on offer—was successfully raised. Notably, all maturities except the 2033 tenor were fully subscribed at this stage. The opening of the second phase, limited to the 2033 maturity, increased the total subscriptions to 81.61% and raised Rs. 240.74 billion in aggregate – an impressive result given the scale of the issuance – and signalled a strong recovery from the risk-off sentiment observed just earlier last week stemming from the Israel-Iran conflict.

The 15.10.29 maturity (10.35% coupon) recorded a bullish outcome and was fully subscribed in the first phase at a weighted average yield of 9.41%, coming in below initial market expectations. For comparison, this was marginally lower than the opening secondary market two-way quotes of 9.40%/9.45% on the 15.10.29 maturity at the start of the day, and below the traded rate of 9.45% observed as the auction was ongoing.

The 15.03.31 maturity (11.25% coupon) also raised the entire maturity-wise offered amount of Rs. 40 billion at a weighted average yield of 10%. This was also below market expectations as the maturity was quoted at the rate of 10.05%/10.10% as the auction was ongoing.

The 01.11.33 maturity was undersubscribed at the first phase which prompted the opening of the second phase. Across both phases, the maturity raised Rs. 60.74 billion (against an offered amount of Rs. 115 billion) in successful bids and was issued at a weighted average of 10.68%. This was broadly in line with market expectations as a shorter tenor 15.12.32 maturity was quoted at 10.40%/10.45% and a longer tenor 15.09.34 maturity was quoted at 10.50%/10.70% just prior to the auction.

The longer tenor 01.07.37 maturity also raised the entire maturity-wise offered amount of Rs. 20 billion and was issued at a weighted average rate of 10.83% – an impressive outcome as it recorded a narrow term premium of only 15 basis points for a period of over 3.5 years.

In the Secondary Bond market, the 15.12.26 maturity traded down from an intraweek high of 8.30% to a low of 8.15%. The 15.09.27 maturity was seen trading down the range of 8.80%-8.53% during the week. The 15.02.28 and 15.12.28 maturities were seen trading down from intraweek highs to lows of 9.10%-8.85% and 9.20%-8.94%, respectively. The 15.12.29 maturity was seen hitting an intraweek high of 9.80% before recovering dramatically to trade at a low of 9.44% at the end of the week. The 15.12.32 maturity hit a high of 10.65% before renewed buying interest pushed rates back down to a low of 10.40%. The 15.09.34 maturity traded at the rates of 10.68%-10.70%.

The weekly Treasury bill auction conducted last Wednesday (25) went undersubscribed for a second consecutive week as only an amount of Rs. 60.49 billion or 93.05% of the total offered volume of Rs. 65 billion was accepted in successful bids. This was despite total bids received exceeding the offered amount by 1.86 times. Interestingly, the weighted average yield rate on the 182-day tenor increased marginally by two basis point to 7.73%. However, the weighted average yield rate on the 91-day and 364-day tenors remained steady at 7.55% and 7.94%, respectively.

Foreign holdings in Rupee treasuries recorded a net outflow for the second consecutive week, amounting to Rs. 2.84 billion and, as a result, the total holding reduced to Rs. 95.067 billion as at 26 June.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 22.51 billion.

In money markets, the total outstanding liquidity surplus in the inter-bank money market increased considerably to Rs. 128.78 billion as at the week ending 27 June, from Rs. 89.15 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.72%-7.74% and 7.75%, respectively, while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 27 June, unchanged against the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating to close the week at Rs. 299.88/299.95 as against the previous week’s closing level of Rs. 300.50/300.65, and subsequent to trading at a high of Rs. 299.90 and a low of Rs. 301.20.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 76.59 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)