Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 17 December 2025 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday initially saw yields edge up; however renewed buying interest kicked in at the elevated levels and saw yields drop back down sparking a recovery. Interest was mostly concentrated on the 2028-2029 tenors which caused the rest of the yield curve to adjust downwards accordingly. Activity and transaction volumes were observed increasing as well.

The improved demand conditions and market sentiment was supported by the news that the World Bank confirms $ 120 million in emergency support to Sri Lanka and news that the Asian Development Bank (ADB) confirmed a $ 200 million loan to continue the Mahaweli Water Security Investment Program – Stage 2.

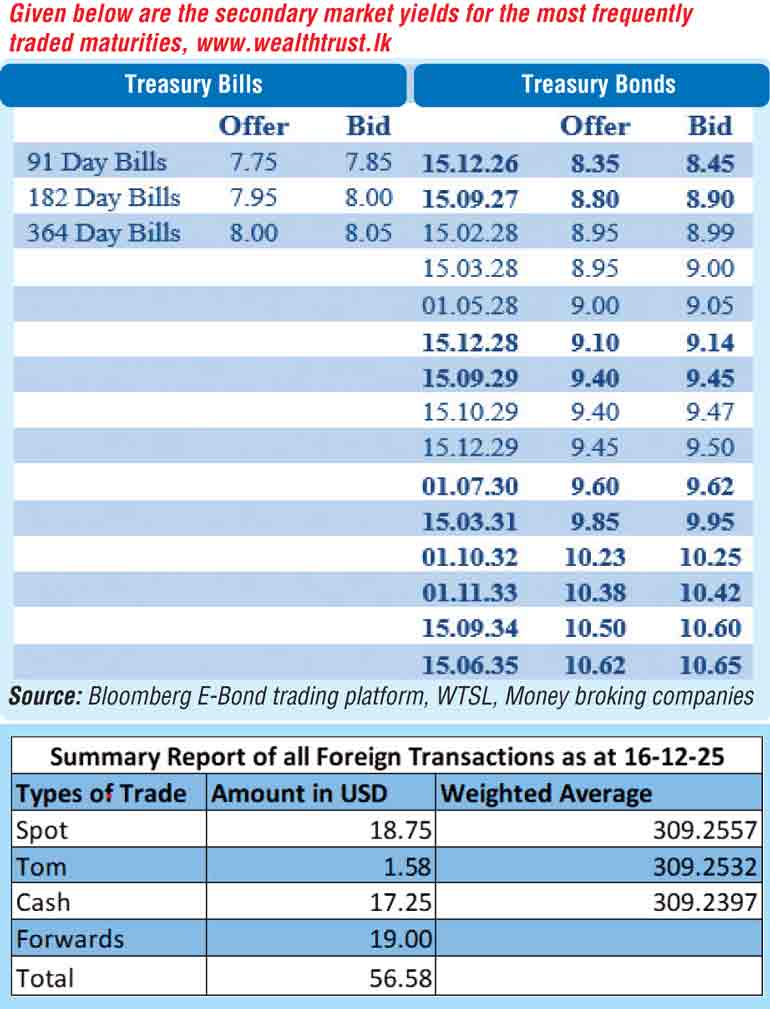

In terms of the secondary Bond market trade summary, 15.02.28 and 01.05.28 maturities were seen trading at the rates of 8.99% and 9.05%. The 15.12.28 maturity traded down the range of 9.15%-9.12%. The 15.06.29 and 15.09.29 maturity were seen trading at the rates of 9.40% and down the range of 9.49%-9.45% respectively. The 01.10.32 maturity traded within the range of 10.28%-10.25%. The 01.11.33 maturity traded at the rate of 10.40%. The 15.06.35 maturity traded within the range of 10.66%-10.65%.

This comes ahead of today’s scheduled weekly Treasury Bill auction. The auction will have on offer a total amount of Rs. 48 billion. The auction will comprise of Rs. 10 billion in 91-day Bills, Rs. 25 billion in 182-day Bills, and Rs. 13 billion in 364-day Bills. This marks the seventh consecutive auction where the offered amount is considerably below the maturing volume, which is estimated at around Rs. 131 billion.

For context, at the previous weekly Treasury Bill auction held last Wednesday (10 December) the weighted average yields remained unchanged. Accordingly, the 91-day, 182-day and 364-day tenors were recorded at 7.51%, 7.91% and 8.03%, respectively. This marks the 21st consecutive week in which Treasury Bill yields have remained broadly anchored at prevailing levels. The auction was fully subscribed, with the entire Rs. 48 billion on offer successfully raised. Notably, this represents the first full subscription in six consecutive auctions. Total bids received amounted to 2.19 times the accepted amount, reflecting healthy investor demand.

The total secondary market Treasury Bond/Bill transacted volume for 15 December was Rs. 7.40 billion.

In money markets, the net liquidity surplus increased to Rs. 74.21 billion. An amount of Rs. 91.88 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 17.67 billion was withdrawn from its SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on call money and repo were registered at 7.97% and 8.02% respectively.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 309.50/309.60 as against Rs. 309.25/309.35 the previous day.

The total USD/LKR traded volume for 15 December was $ 56.58 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)