Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 8 October 2025 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday kicked off the new trading week on a dull note, with overall activity at subdued levels. However, selective buying interest was observed on the longer end of the yield curve, specifically centred around 2034-2035 maturities.

This drove turnover to be seen at healthy levels despite the relatively low activity. Yields were seen holding broadly steady along the curve, as this concentrated demand kept rates anchored around prevailing levels. The exception being the 2029 tenors which saw rates edge up further marginally.

In the secondary Bond

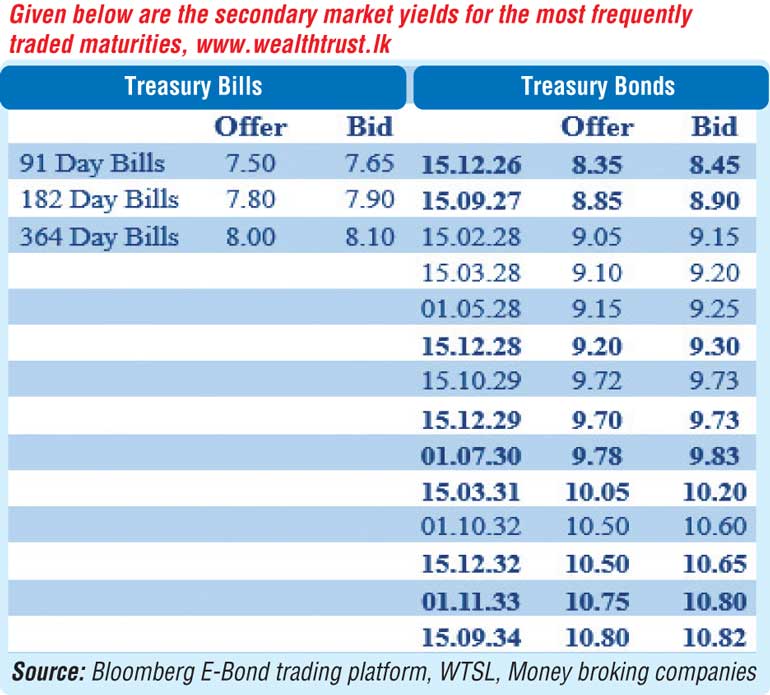

market, the 01.05.27 maturity was seen trading at the rate of 8.76%. The 15.10.28 maturity was seen trading at the rate of 9.25%. The 15.06.29, 15.10.29 and 15.12.29 maturities were seen trading at the rates of 9.75%-9.70%, 9.72%, 9.73%-9.71%. The 15.09.34 maturity traded at the rate of 10.82%-10.79% and 15.06.35 maturity within the range of 10.90%-10.87%.

In secondary market Bills, trades were observed on November 2025 maturities were seen trading at the rates of 7.57%-7.55%. Meanwhile, the Treasury Bills auction scheduled to be conducted today will have a total offered amount of Rs. 33.50 billion, a decrease of Rs. 9.50 billion over the previous week. The auction will consist of Rs. 6.00 billion on the 91-day, Rs. 23.50 billion on the 182-day and Rs. 4.00 billion on the 364-day maturities.

For context, at the previous weekly Treasury Bill auction (01 October) saw the entire Rs. 43.00 billion offered amount fully subscribed. This marked the first instance in six weeks that a T-Bill auction raised the entire targeted offered amount.

The bids received to offered amount ratio stood at 1.88 times. The weighted average rates held broadly steady, with the exception of the 91-day maturity which registered a 04-basis point decline to 7.53%. The 182-day and 364-day tenors remained unchanged at 7.89% and 8.02% respectively. This marks the 11th week where T-Bill rates have stayed virtually tethered around prevailing levels.

The total secondary market Treasury Bond/Bill transacted volume for 03 October was Rs. 7.81 billion.

In money markets, the net liquidity surplus was recorded at Rs. 152.22 billion yesterday. An amount of Rs. 162.22 billion was deposited at Central Bank's SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 10.00 billion was withdrawn from the Central Bank's SLFR (Standard Lending Facility Rate) of 7.25%.

The weighted average rates on call money and repo were registered at 7.87% and 7.88% respectively.

Forex market

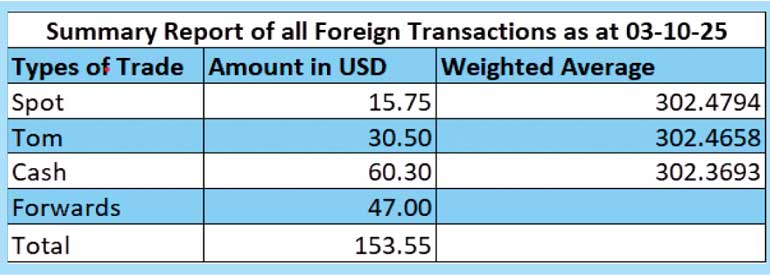

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating slightly to Rs. 302.52/302.59 as against Rs. 302.45/302.50 the previous day. The total USD/LKR traded volume for 03 October was $ 153.55 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)