Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 20 May 2025 02:59 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary bond market yesterday kicked off the week with yields moving up on the back of profit-taking selling pressure following last week’s rally. This came against the backdrop of the news that the Ceylon Electricity Board seeks to revise tariffs to offset a portion of the losses incurred from the last quarter, prompting traders to revise inflation expectations. This was compounded by market participants adopting a risk-off approach ahead of the impending Monetary Policy No.3 which was advanced to the 22 May (this Thursday).

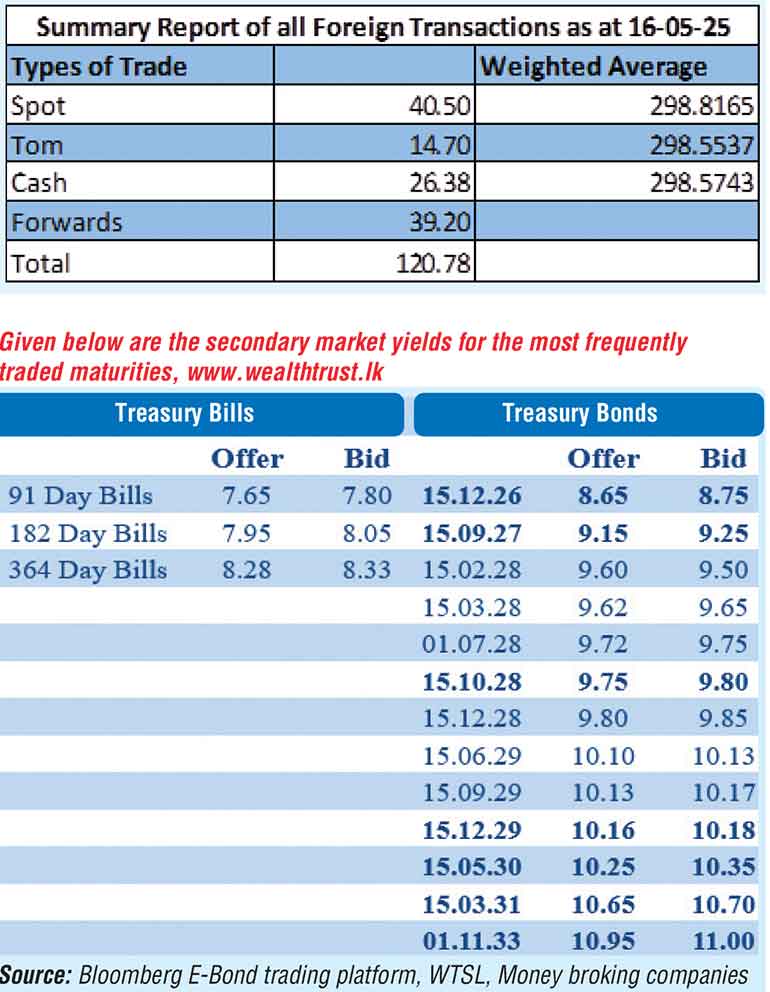

The 15.02.28, 15.03.28 and 01.07.28 maturities were seen trading at the rates of 9.64%, 9.65% and 9.72%-9.73% respectively. The 15.06.29, 15.09.29 and 15.12.29 maturities were seen trading higher at the rates of 10.10%, 10.12%-10.15% and 10.14%-10.18% respectively. The 15.03.31 and 01.11.33 maturities were seen trading at the rate of 10.63% to 10.68% and 11.00% respectively.

The total secondary market Treasury Bond/Bill transacted volume for 16 May was Rs. 20.68 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.97% and 7.98% respectively.

The net liquidity surplus stood at Rs. 157.91 billion yesterday. An amount of Rs. 0.71 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 158.62 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 299.85/300.05 as against 299.10/299.30 the previous day.

The total USD/LKR traded volume for 16 May was $ 120.78 million.

(References: Central Bank of

Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)