Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 7 January 2026 03:30 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Bond market saw rates initially drop on the belly end of the yield curve specifically on the 2029-2030 tenors. This was accompanied by more aggressive bids across the yield curve and secondary market two-way prices quoted lower. However, towards the latter part of the day the 2027-2028 tenors saw a sell off which caused rates to increase on the short end of the yield curve, on the back of profit taking pressure. Nevertheless, the medium-to-long end of the yield curve remained stable. This resulted in a flattening of the yield curve overall. Activity and transaction volumes were seen at healthy levels boosted by several block trades.

The Secondary Bond market saw rates initially drop on the belly end of the yield curve specifically on the 2029-2030 tenors. This was accompanied by more aggressive bids across the yield curve and secondary market two-way prices quoted lower. However, towards the latter part of the day the 2027-2028 tenors saw a sell off which caused rates to increase on the short end of the yield curve, on the back of profit taking pressure. Nevertheless, the medium-to-long end of the yield curve remained stable. This resulted in a flattening of the yield curve overall. Activity and transaction volumes were seen at healthy levels boosted by several block trades.

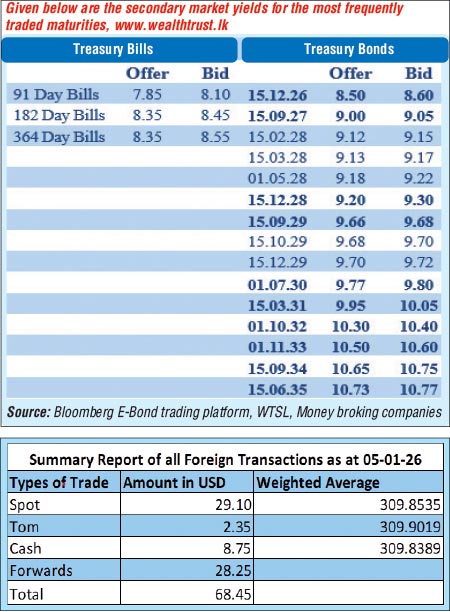

On the shorter end where rates picked up the 15.12.26 and 01.05.27 maturities traded at the rate of 8.50% and 8.95% respectively. The 01.05.28, 01.07.28 and 15.10.28 maturities were seen trading up the range of 9.14%-9.20%, 9.22% and at the rate of 9.26% respectively.

On the belly to the long end where rates remained broadly anchored, the 15.12.29 traded lower down the range of 9.73%-9.71%, the 15.05.30 at the rate of 9.76% and the 01.07.30 maturity down the range of 9.80%-9.78% respectively. The 01.10.32 and 15.09.34 maturities traded at the rate of 10.35% and 10.70% respectively and the 15.06.35 maturity at the rate of 10.75%-10.76%.

This comes ahead of today’s scheduled weekly Treasury Bill auction. The auction will have on offer a total amount of Rs. 100 billion. The auction will comprise of Rs. 20 billion in 91-day bills, Rs. 50 billion in 182-day bills, and Rs. 30 billion in 364-day bills. The offered amount is in line with the maturing volume, which is estimated at around Rs. 97.73 billion.

For context, at the weekly Treasury Bill auction held last Wednesday (31 December), weighted average yields recorded an upwards movement across the board for a second consecutive week. Accordingly, the weighted average yield on the 91-day Bill rose by 19 basis points to 7.74%, the 182-day by 32 basis points to 8.27%, and the 364-day by 26 basis points to 8.45% respectively. Total funds raised amounted to Rs. 57.39 billion against an offered amount of Rs. 120 billion, translating to a 47.83% subscription ratio.

The total secondary market Treasury Bond/Bill transacted volume for 6 January was Rs. 14.71 billion.

In money markets, the net liquidity surplus increased steadily for the fourth consecutive day to Rs. 175.21 billion yesterday. An amount of Rs. 200.21 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 25 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%. The weighted average rates on overnight call money and Repo stood at 8.00% and 8.03% respectively.

Forex market

In the Forex market, the USD/LKR rate on spot contracts were seen depreciating slightly to Rs.310.00/310.10 as against its previous day’s closing level of Rs. 309.95/310.05.

The total USD/LKR traded volume for 5 January 2026 was $ 68.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)