Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 2 May 2025 00:10 - - {{hitsCtrl.values.hits}}

By Wealthtrust Securities

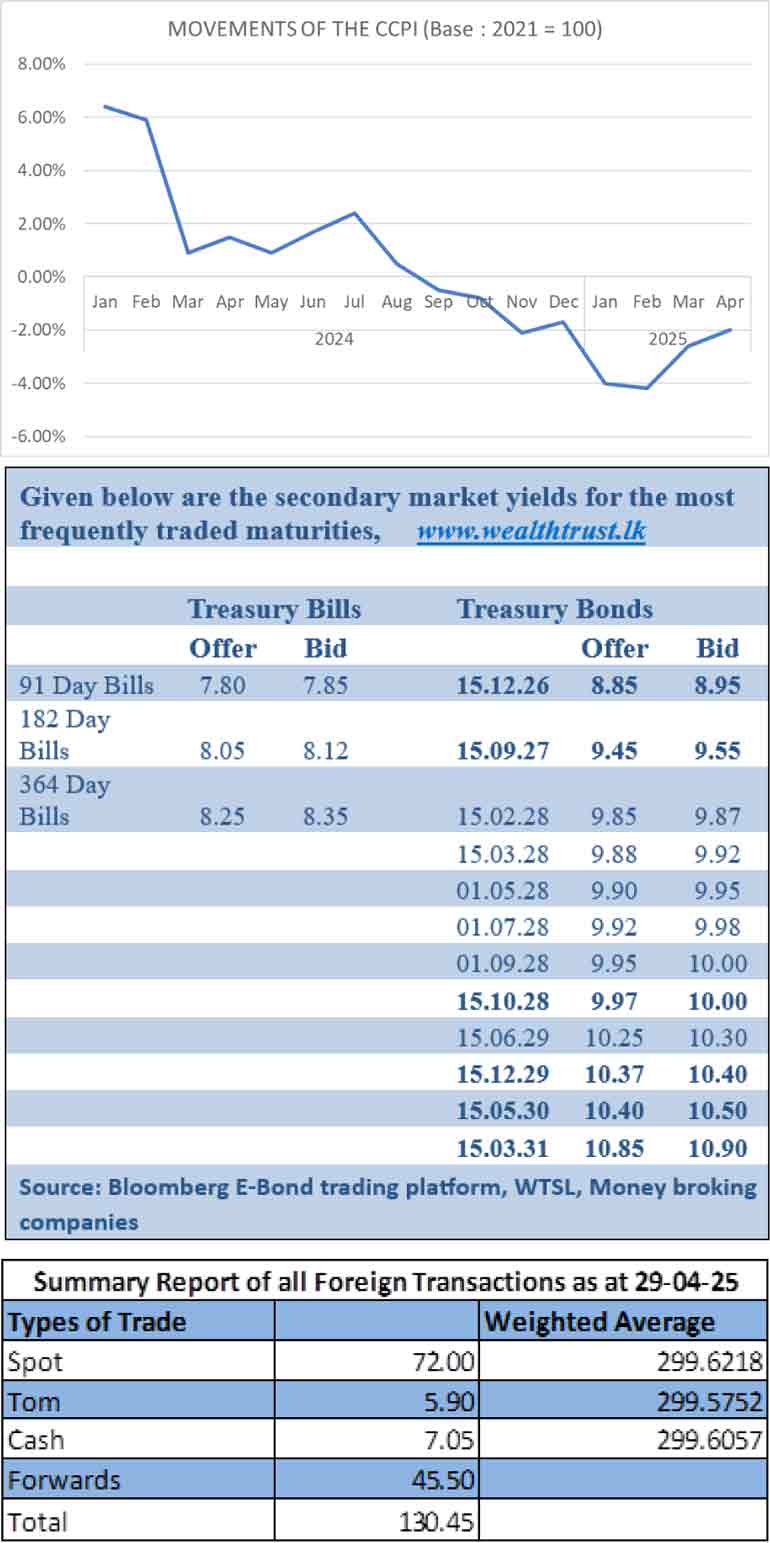

The Secondary Bond market on Wednesday witnessed a very slight uptick in yields on select maturities, primarily in the 2028-2029 range, driven by marginal profit-taking. The remainder of the yield curve remained broadly stable, while market activity and transaction volumes continued at healthy levels.

The 15.10.28 maturity was seen trading at the rates of 10.00%-10.05%. The 15.12.28 maturity was seen trading at the rate of 10.04%. The 15.06.29 and 15.12.29 maturities were seen trading at the rates of 10.28%-10.30% and 10.40%-10.42%. The 15.03.31 maturity was seen trading at the rate of 10.90%.

Meanwhile, the Colombo Consumer Price Index – CCPI (Base: 2021=100) for the month of April was recorded at – 2.00% on a year-on-year basis as against – 2.60% recorded in March. The annual average as at April was -1.10%.

The total secondary market Treasury bond/bill transacted volume for 30 April was Rs. 13.69 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.98% and 7.98% respectively.

The net liquidity surplus increased further to Rs. 168.88 billion yesterday. Rs. 1.78 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 170.65 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 299.52/299.55 as against its previous day’s closing level of Rs. 299.60/299.65.

The total USD/LKR traded volume for 29 April 2025 was $ 130.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)