Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 20 February 2026 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday saw rates continue to pick up on the back of further profit taking. However, activity and transaction volumes were seen at healthy levels supported by several block trades.

Accordingly, the 15.03.28 maturity traded at the rates of 8.99%-9.00% and the 01.05.28 maturity saw its yield rise up the range of 9.02%-9.05%. The 15.06.29 traded up the range of 9.35%-9.40%. The 01.03.30 and 01.07.30 maturities traded at the rates of 9.54% and 9.55% respectively.

The 01.10.32 saw its yield increase notably from an intraday low of 10.16% to a high of 10.25%. The 01.06.33 maturity traded higher at the rate of 10.50% and the 01.11.33 at the rates of 10.52%-10.54%. The 15.06.34 maturity traded at the rate of 10.70%. The 15.06.35 maturity traded up the range of 10.77%-10.80%. The 01.07.37 maturity traded at the rates of 10.88%-10.90%.

In the meantime, the net liquidity surplus in the money market was recorded at Rs. 283.22 billion yesterday. An amount of Rs 260.74 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25% as against an amount of Rs 7.52 billion withdrawn from the Central Bank’s SDFR (Standing Deposit Facility Rate) of 8.25%.

The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 30 billion by way of overnight repo auction at a weighted average rate of 7.63%.

The weighted average rates on overnight call money and Repo yesterday stood at 7.67% and 7.68% respectively.

Forex market

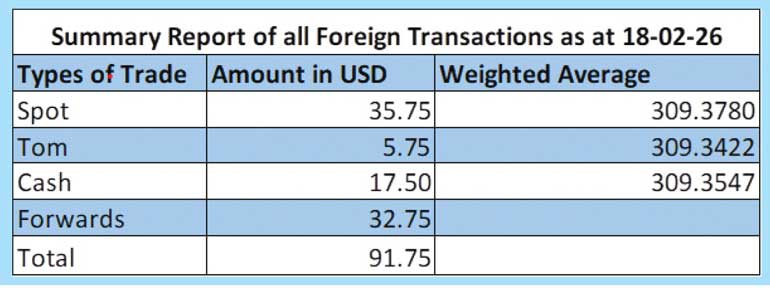

In the forex market, the USD/LKR rate on spot contracts were seen closing the day at Rs.309.30/309.35 as against its previous day’s closing level of Rs. 309.35/309.40.

The total USD/LKR traded volume for 18 February 2026 was $ 91.75 million.

(References: Public Debt Management Office- Ministry of Finance, Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)