Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 23 September 2025 00:17 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

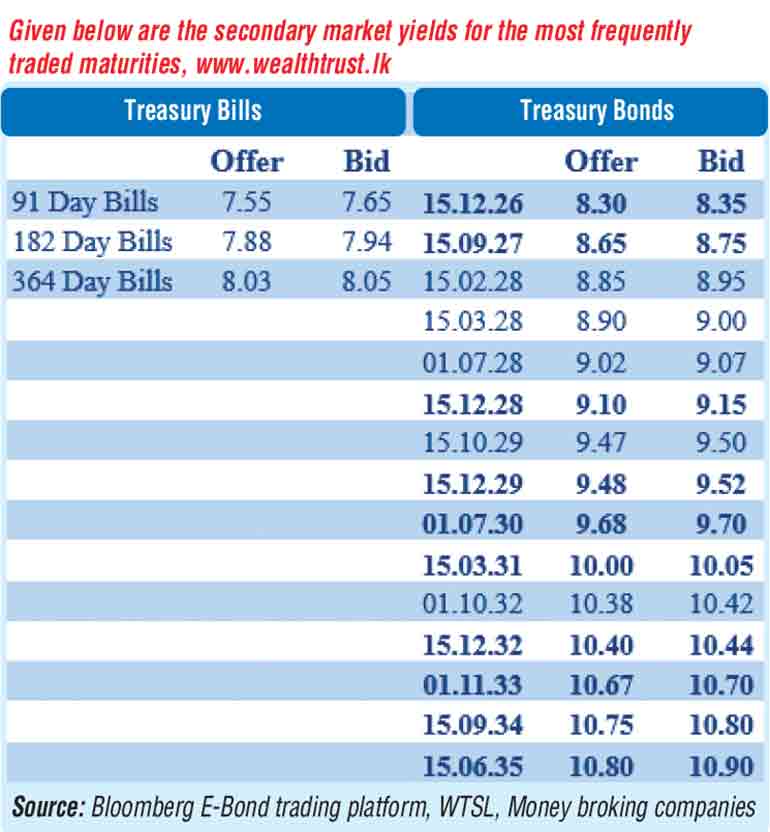

The secondary Bond market yesterday started the week on a positive note, spurred by S&P Global Ratings’ upgrade of the country’s credit rating to CCC+ from Selective Default (SD), with a stable outlook. This upgrade fuelled a surge in activity and transaction volumes in the secondary bond market. Demand was observed predominantly on 2029-2033 tenors which saw yields edge lower. This was a clear break from recent market dynamics, which were characterised by dull activity and rates trading within a narrow range. However, this initial momentum tapered off, with activity cooling off significantly later in the day. Despite this, the secondary Bond market two-way rates were quoted lower at the close of business yesterday.

The 15.06.29, 15.09.29 and 15.12.29 maturities were seen trading lower at the rates of 9.40%, 9.48 and 9.50% respectively. The 01.07.30 maturity was seen trading down the range of 9.70%-9.68%. The 01.10.32 and the 15.12.32 maturities were seen trading at the rates of 10.39% and 10.44% respectively. The 01.11.33 maturity saw its yield drop from an intraday high of 10.70% to a low of 10.66%. In addition, maturities of 2026’s (i.e. 15.05.26, 01.08.26 and 15.12.26), 2028’s (i.e. 01.05.28 and 01.07.28) and the 15.06.35 maturity transacted at the rate of 7.99%-8.00%, 8.20%, 830%, 9.00%, 9.05% and 10.86% respectively.

This comes ahead of the announcement of the Monetary Policy Announcement for the Fifth Monetary Policy Review for 2025 due tomorrow at 7.30 a.m.

To recap: At its fourth Monetary Policy Review for 2025, the CBSL held the Overnight Policy Rate at 7.75%, following a 25-bps cut in May. Accordingly, the SDFR and SLFR remained at 7.25% and 8.25%, while the SRR was unchanged at 2.00%.

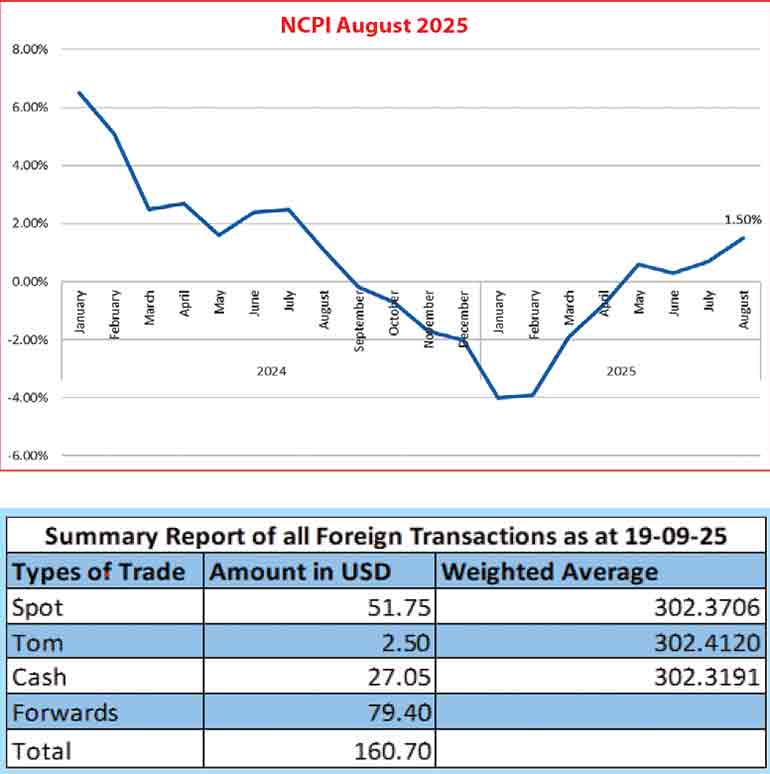

On the inflation front, the National Consumer Price Index – NCPI (Base: 2021=100) or National inflation for the month of August 2025 was recorded at + 1.50 % on its point to point as against + 0.70% recorded in July 2025, while the annual average inflation was recorded at -1.00%.

The total secondary market Treasury Bond/Bill transacted volume for 19 September was Rs. 12.54 billion.

The net liquidity surplus was recorded at Rs. 140.76 billion yesterday. An amount of Rs. 8.04 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 148.80 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

The weighted average rates on call money and repo were registered at 7.86% and 7.87% respectively.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day broadly steady at Rs. 302.45/302.60 as against Rs. 302.45/302.50 the previous day.

The total USD/LKR traded volume for 19 September was $ 160.70 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)