Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 19 September 2025 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

It was announced that the US Federal Reserve cut its benchmark interest rate by 25 basis points to a target range of 4.00%–4.25%, marking the first reduction since December 2024. The move came amid signs of a weakening labour market. The Fed indicated more cuts would likely follow at meetings in October and December, stating that the softening job market was now top of the mind for policymakers.

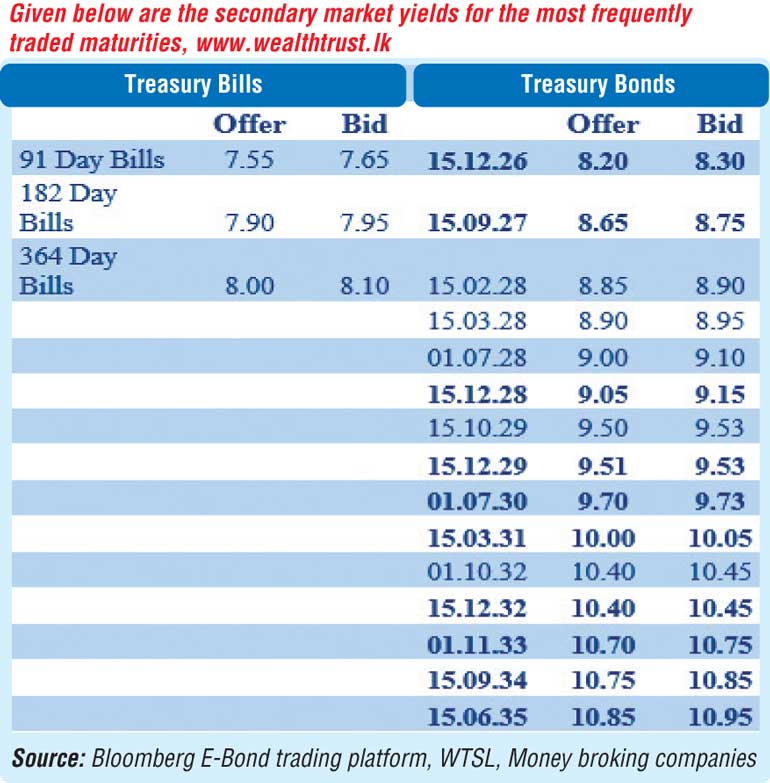

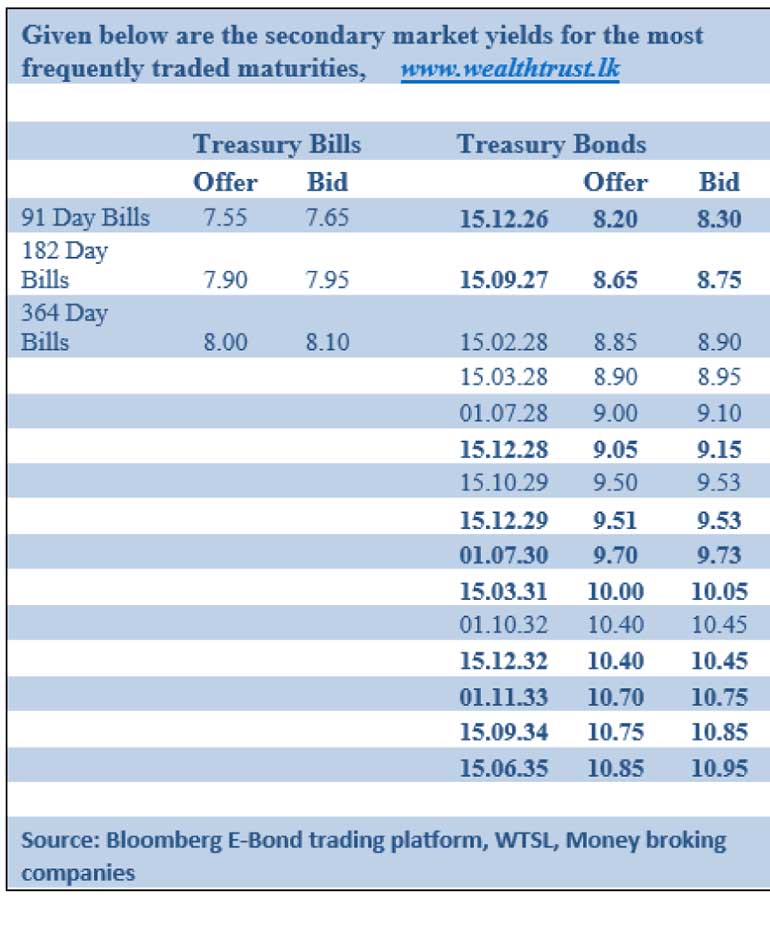

The domestic secondary Bond market yesterday reacted positively to the US monetary policy rate cut, with trading activity and transaction volumes increasing considerably in contrast to the subdued sessions of recent times. In addition, yields edged lower as strong renewed buying interest emerged, particularly concentrated in the 2029 to 2033 maturities. As a result, secondary Bond market two-way quotes were seen closing marginally lower.

The 01.05.28 maturity was seen trading at the rate of 8.97%. The 15.06.29, 15.09.29 and 15.2.29 maturities were seen trading at the rates of 9.43%, 9.50% and 9.55%-9.50%. The 15.05.30 and 01.07.30 maturities were seen trading at the rates of 9.68% and 9.72% respectively. The 15.03.31 maturity was seen trading at the rate of 10.02%. The 15.12.32 maturity traded at the rate of 10.40%. The 01.06.33 and 01.11.33 maturity traded within the rates of 10.70% and 10.75%-10.70% respectively.

The total secondary market Treasury Bond/Bill transacted volume for 17 August was Rs. 33.74 billion.

The net liquidity surplus was recorded at Rs. 133.50 billion yesterday. An amount of Rs. 10.25 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 143.75 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 7.25%.

The weighted average rates on overnight call money and Repo stood at 7.86% and 7.87% respectively.

Forex market

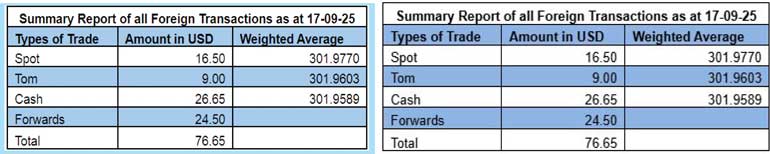

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 302.05/302.18 as against Rs. 301.96/302.00 the previous day.

The total USD/LKR traded volume for 17 August was $ 76.65 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking

companies)