Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 10 December 2025 03:57 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday saw activity and transaction volumes increase marking a shift in tone following a spell of defensive trading following Cyclone Ditwah seen in recent sessions. Renewed demand was observed at the higher yield levels sparking a robust recovery and downward retracement.

Yields were pushed lower on the back of strong buying interest amidst the backdrop of news of additional external financing linked to ongoing and future potential IMF engagement. This included the request for $ 200 million through the IMF’s Rapid Financing Instrument and a new review in January 2026. These developments boosted confidence around near-term funding capacity and policy supervision, fiscal discipline and external credibility.

The enthusiasm was also supported by market expectations of further US Monetary Policy easing, with the CME Fedwatch tool showing an 89.4% probability of an additional 25 basis point rate cut at the FOMC’s December meeting with the decision due imminently, which could spur further foreign investment in Rupee Treasuries.

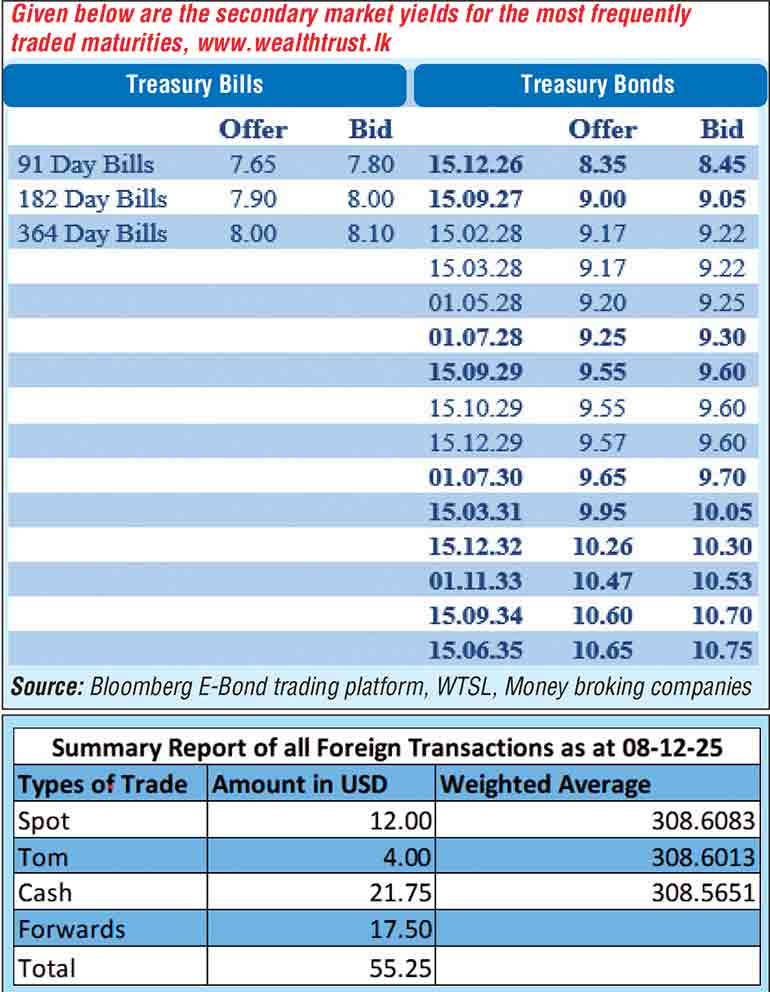

In terms of the secondary Bond market trade summary, 15.02.28 and 01.05.28 maturities were seen trading at the rates of 9.20% and 9.25% respectively. The 15.06.29 maturity saw its yield drop down the range of 9.52%-9.50%.

The 01.07.30 maturity traded at the rate of 9.70%. The 15.03.31 maturity was observed trading at the rate of 10.00%. The 2032 and 2033 tenors saw strong demand which saw rates drop notably on those maturities.

The 15.12.32 maturity experienced a 10-basis point intraday drop, trading down from an intraday high of 10.35% to a low of 10.25%. The 01.06.33 maturity and 01.11.33 maturity also saw around a 10 basis drop intraday trading down the ranges of 10.60%-10.50% and 10.58%-10.50% respectively.

This comes ahead of today’s scheduled weekly Treasury Bill auction. The auction will have on offer a total amount of Rs. 48 billion. The auction will be comprising of Rs. 10 billion in 91-day bills, Rs. 20 billion in 182-day bills, and Rs. 18 billion in 364-day bills.

This marks the sixth consecutive auction where the offered amount is considerably below the maturing volume, which is estimated at around Rs. 134.15 billion.

For context, at the previous weekly Treasury Bill auction held last Wednesday (2 December) the weighted average rates held steady. Accordingly, the yields on the, the 182-day and the 364-day tenors were recorded unchanged at 7.91% and 8.03%. However, the 91-day tenor recorded a very marginal drop of 01 basis point to 7.51%. This marks the 20th week where T-Bill rates have stayed broadly anchored around prevailing levels. Nevertheless, the auction was undersubscribed despite the bids received-to-offered amount ratio standing at 1.81 times.

In addition, the details of the next upcoming Treasury Bond auction, scheduled to be conducted on 11 December (this Thursday) were announced. The round of auctions will have a total offered amount of Rs 143.00 billion across three available maturities.

The auction will be comprised of: Rs. 43 billion from a 01 March 2030 Maturity bearing a coupon rate of 09.50%; Rs. 30 billion from a 01October 2032 Maturity bearing a coupon rate of 09.00%; Rs. 70 billion from a 15 June 2035 Maturity bearing a coupon rate of 10.70%. The settlement for which will be held on 15 December 2025.

The total secondary market Treasury Bond/Bill transacted volume for 08 December was Rs. 1 billion.

In money markets, the net liquidity surplus increased to Rs. 101.35 billion. An amount of Rs. 101.41 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 0.07 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on call money and repo were registered at 7.94% and 7.99% respectively.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day steady at Rs. 308.64/308.66 as against Rs. 308.63/308.68 the previous day.

The total USD/LKR traded volume for 08 December was $ 55.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)