Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 11 November 2025 02:38 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The secondary Bond market kicked off the new trading week on a positive note yesterday, carrying over the bullish momentum from last week’s rally. Buying interest was witnessed across the yield curve which pushed yields lower. Activity and transaction volumes were high. Majority of the action was concentrated on 2028-2033 tenors, resulting in a downward shift of the yield curve.

This came against the backdrop of the news that the ADB has approved a $ 100 million financing package to boost Sri Lanka’s macroeconomic stability by strengthening public expenditure management, improving revenue mobilisation, and fostering private sector participation.

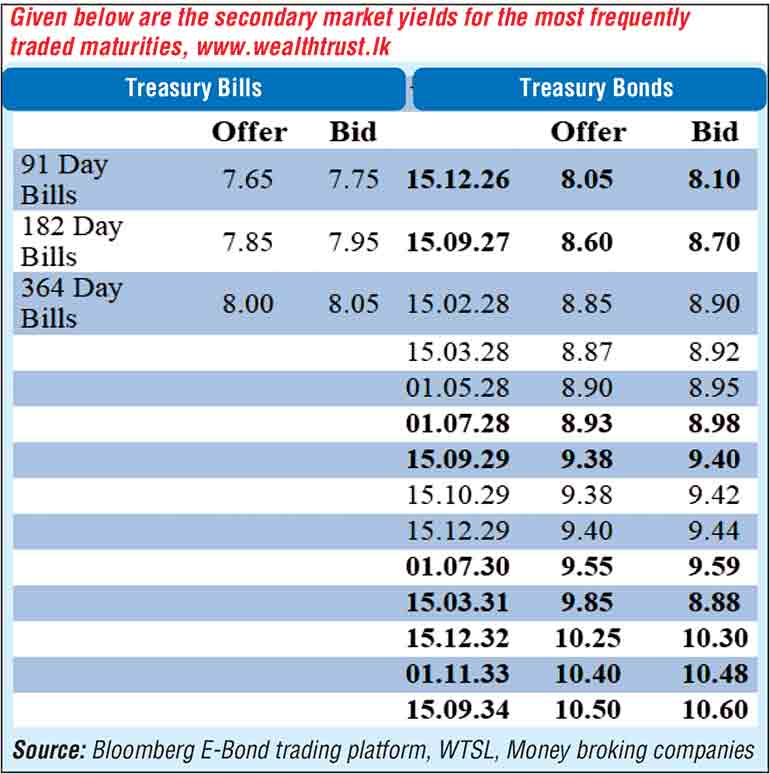

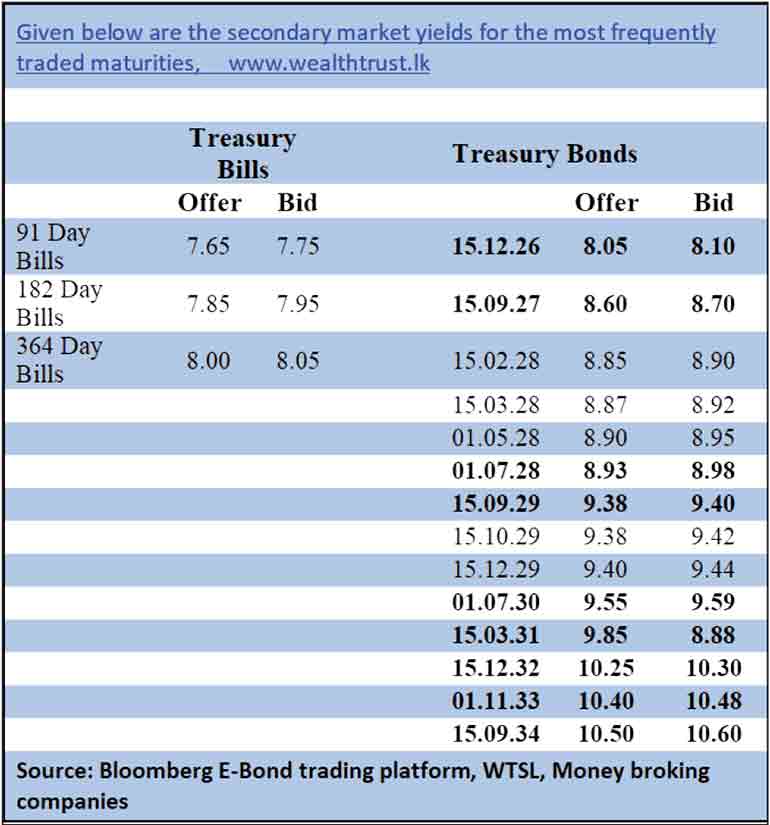

In terms of the secondary Bond market trade summary, the 01.05.27 maturity traded at the rate of 8.56%. The 15.02.28 and 15.03.28 maturities were seen trading at rates of 8.90% and 8.92% respectively. The 01.07.28, 01.09.28 and 15.10.28 maturities were seen trading at rates of 9.00%-8.97%, 9.00% and 9.00%-8.99%. The 15.06.29, 15.09.29, and 15.12.29 maturities were seen trading lower at the rates of 9.35%, 9.42%-9.40% and 9.45%-9.44% respectively. The 15.05.30 and 01.07.30 maturities were seen trading at the rate of 9.56% and down the range of 9.60%-9.57% respectively. The 15.03.31 maturity was seen taken at 9.85%. The 01.07.32, 01.10.32 and 15.12.32 maturities were seen trading lower at the rates of 10.40%, 10.30% and down the range of 10.35%-10.28% respectively. The 01.11.33 maturity traded down the range of 10.53%-10.49%.

In addition, the details of the next upcoming Treasury Bond auction, scheduled to be conducted on 13 November (this Thursday) were announced. The round of auctions will have a total offered amount of Rs. 80 billion across three available maturities.

The auction will be comprised of:

01. Rs. 35 billion from a 1 July 2030 Maturity bearing a coupon rate of 09.75%

02. Rs. 45 billion from a 15 June 2035 Maturity bearing a coupon rate of 10.70%

The settlement for which will be held on 17 November.

The total secondary market Treasury Bond/Bill transacted volume for 7 November was Rs. 16.12 billion.

In money markets, the net liquidity surplus was recorded at Rs. 142.49 billion yesterday. An amount of Rs. 142.89 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 0.40 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on call money and repo were registered at 7.93% and 7.96% respectively.

Forex Market

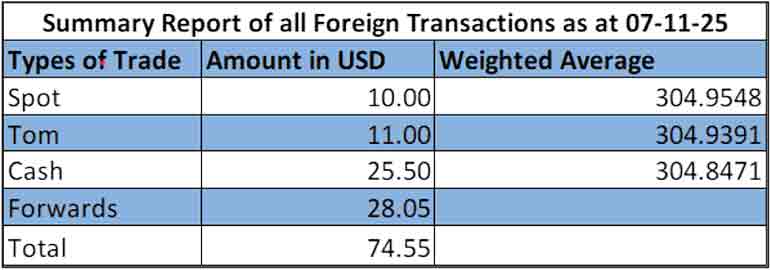

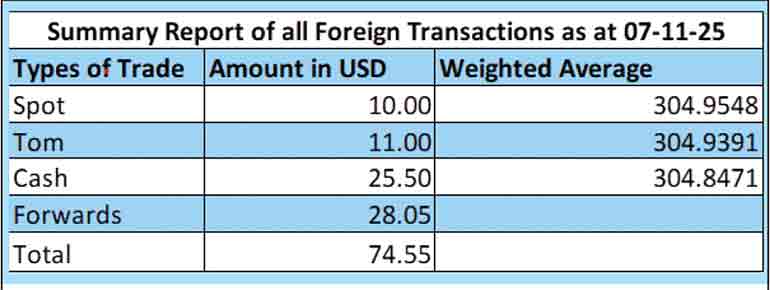

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 304.15/304.20 as against Rs. 304.80/304.90 the previous day.

The total USD/LKR traded volume for 7 October was $ 74.55 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)