Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 10 February 2026 04:54 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market opened the new trading week on a positive note, extending last week’s bullish momentum, with yields continuing to trend lower.

The secondary Bond market opened the new trading week on a positive note, extending last week’s bullish momentum, with yields continuing to trend lower.

Trading activity was largely concentrated in the belly-to-long end of the curve, where tenors between 2029 and 2037 attracted sizeable demand, resulting in a further decline in yields. In contrast, the short end of the curve was seen consolidating, as 2028 maturities—despite also witnessing several block transactions—saw yields hold broadly steady. Overall market activity remained strong, with transaction volumes recorded at robust levels.

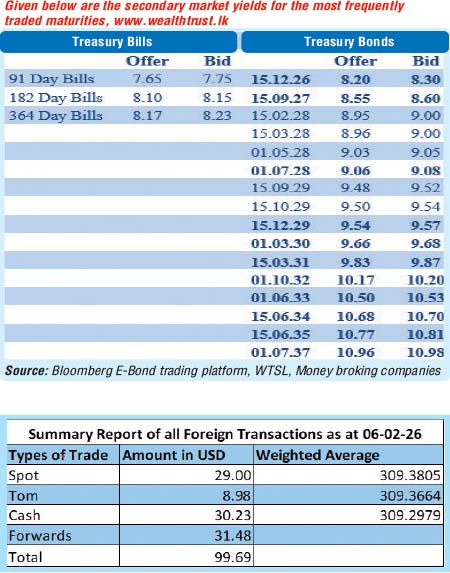

The 01.08.26 maturity was seen trading at the rate of 8.12%. The 15.09.27 maturity was seen changing hands at the rates of 8.64%-8.60%. The 15.02.28, 01.05.28 and 15.10.28 maturities were seen trading at the rates of 9.00%, 9.07%-9.03% and 9.17%-9.14%.

The 15.09.29 and 15.12.29 maturities were seen trading at the rates of 9.48% and 9.55%-9.54% respectively. The 01.03.30 maturity traded at the rates of 9.68%-9.65% and the 01.07.30 maturity at the rates of 9.68%-9.66%. The 15.03.31 maturity traded at the rate of 9.88%. The 15.12.32 and 01.06.33 maturities traded at the rate of 10.18% and 10.50% respectively. The 15.06.34 and 15.06.35 traded down the ranges of intraday highs to lows of 10.70%-10.67% and 10.83%-10.77% respectively whiles the 01.07.37 and 15.08.39 maturities changed hands at levels of 10.98% to 10.97% and 11.02% respectively.

In Secondary Market Treasury Bill transactions January/February 2027 maturities were seen collected at the rates of 8.27%-8.20% both on the back of notable volumes.

The total secondary market Treasury Bond/Bill transacted volume for 6 February was Rs. 21.25 billion.

In money markets, the net liquidity surplus remained elevated and was recorded at Rs. 278.20 billion yesterday. An amount of Rs 278.51 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25% as against an amount of Rs. 0.31 billion withdrawn from the Central Bank’s SDFR (Standing Deposit Facility Rate) of 8.25%.

The weighted average rates on overnight call money and Repo stood at 7.70% and 7.75% respectively.

Forex market

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day at Rs. 309.43/309.50 as against its previous day’s closing level of

Rs. 309.37/309.42.

The total USD/LKR traded volume for 6 February 2026 was $ 99.69 million.

(References: Public Debt Management Office - Ministry of Finance, Central Bank of Sri Lanka, Bloomberg E-Bond Trading Platform, Money Broking Companies)