Saturday Feb 07, 2026

Saturday Feb 07, 2026

Friday, 6 February 2026 02:59 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

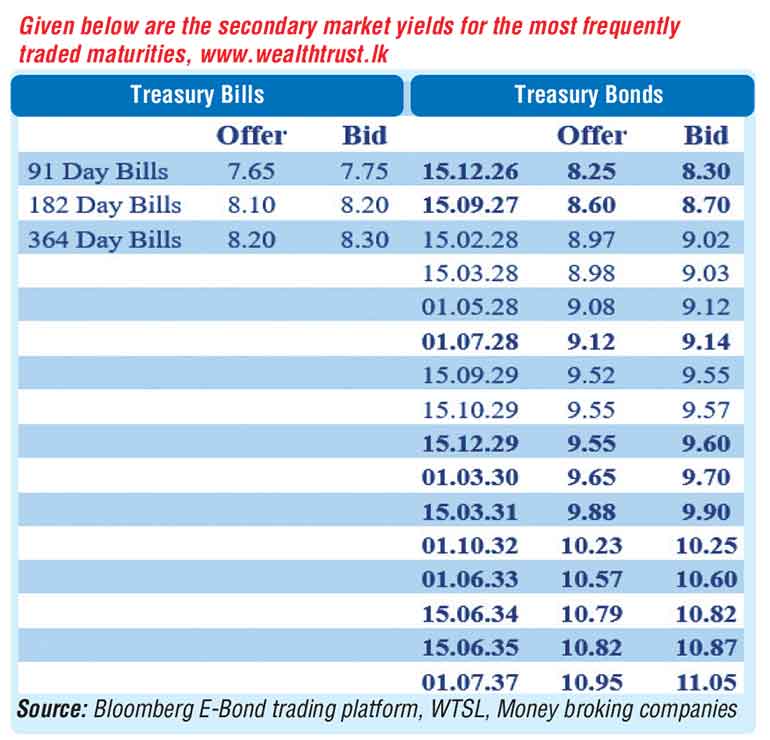

The secondary Bond market yesterday extended its bullish momentum and saw rates continue to drop on the back of strong demand. Majority of the action was along the belly-to-long end of the curve.

Aggressive buying interest was observed centred around 2029-2035 tenors as traders looked to capitalize on the curve’s steepness, shifting attention into higher relative value opportunities further along the curve, to lock in attractive carry and roll-down potential.

Accordingly, the 01.05.27 maturity traded at the rate of 8.60% and the 15.09.27 maturity trade at the rate 8.68%. The 15.03.28 maturity traded at the rate of 9.00%. The 01.05.28 maturity and 01.07.28 maturities traded at the rates of 9.10% and within the range of 9.14%-9.12%.

The 15.09.29 and 15.12.29 maturities traded down the ranges of 9.57%-9.54% and 9.60%-9.56% respectively. The 01.03.30 and 01.07.30 maturities traded lower at the rates of 9.69%-9.67% and 9.75%-9.72% respectively. The 15.03.31 maturity traded down the range of 9.92%-9.90%.

The 01.10.32 traded down the range of 10.32%-10.25% and the 15.12.32 maturity down from 10.32%-10.28%. The 01.06.33 maturity traded at the rate of 10.60% and the 15.06.34 maturity down the range of 10.85%-10.80%. The 15.06.35 maturity traded down the range of 10.91%-10.83%.

The total secondary market Treasury Bond/Bill transacted volume for 3 February was Rs. 58.63 billion.

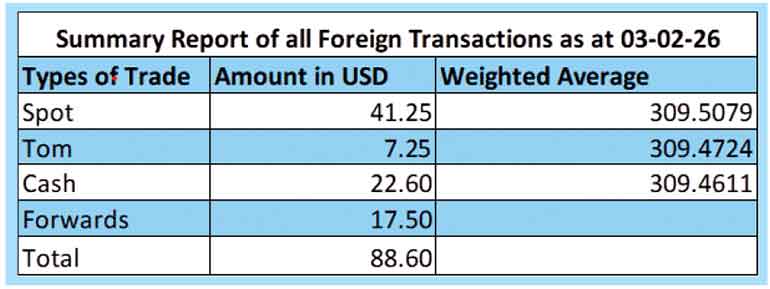

Forex market

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day broadly steady at Rs.309.45/309.50 as against its previous day’s closing level of Rs. 309.45/309.55.

The total USD/LKR traded volume for 3 February 2026 was $ 88.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)