Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 18 December 2025 06:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday saw yields continue to decline with the shorter 2028 tenors rallying strongly. Robust demand was observed pushing rates down notably on those maturities. This resulted in a steepening of the yield curve. With shorter tenors re-pricing downwards, the curve increasingly reflected scope for further compression as traders pursued elevated term premiums further along the curve. T

The secondary Bond market yesterday saw yields continue to decline with the shorter 2028 tenors rallying strongly. Robust demand was observed pushing rates down notably on those maturities. This resulted in a steepening of the yield curve. With shorter tenors re-pricing downwards, the curve increasingly reflected scope for further compression as traders pursued elevated term premiums further along the curve. T

his dynamic saw demand spill over to the rest of the yield curve, which followed suit and registered declines in yields as well, albeit modestly. Activity and transaction volumes were seen increasing further as market sentiment was buoyed by news that the Executive Board of the International Monetary Fund is scheduled to meet on 19 December to consider Sri Lanka’s request for a $ 200 million facility under the Rapid Financing Instrument.

This carries forward the positive sentiment observed last week and earlier this week, driven by favourable developments including continued robust fiscal performance in Jan–Oct 2025, with the overall budget deficit narrowing by approximately 57% to Rs. 455.8 billion, supported by a strong 33% YoY increase in total revenue and grants, underpinned by a 34% expansion in tax revenue. Sentiment was further reinforced by news that the World Bank, ADB, and other multilateral lenders would provide support to bolster near-term funding capacity and foreign exchange reserves.

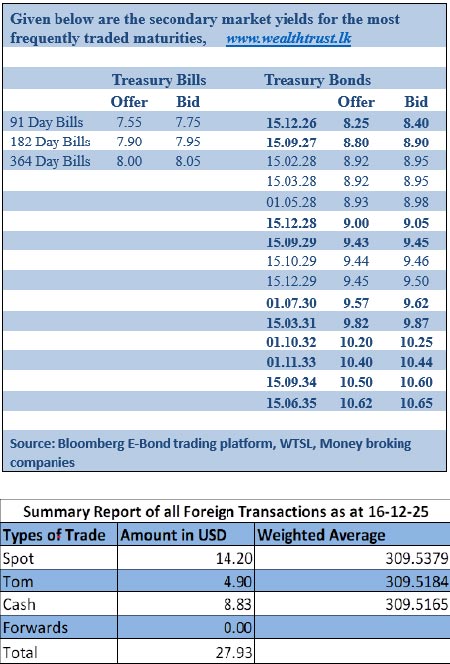

In terms of the secondary Bond market trade summary, the 01.05.27 maturity was seen trading within the range of 8.85%-8.82%. The 15.01.28 and 15.02.28 maturities were seen trading at the rates of 8.95% and 8.95%-8.93% respectively. The 01.05.28 and 01.07.25 maturities traded down the range of 9.05%-8.95% and 9.07%-8.95% respectively. The 15.12.28 maturity traded at the rate of 9.02% and down the range of 9.10%. The 15.06.29 and 15.12.29 maturities traded down the ranges of 9.39%-9.38% and 9.48%-9.47% respectively. The 15.03.31 maturity traded at the rate of 9.85%. The 15.12.32 maturity traded down the range of 10.26%-10.22% respectively.

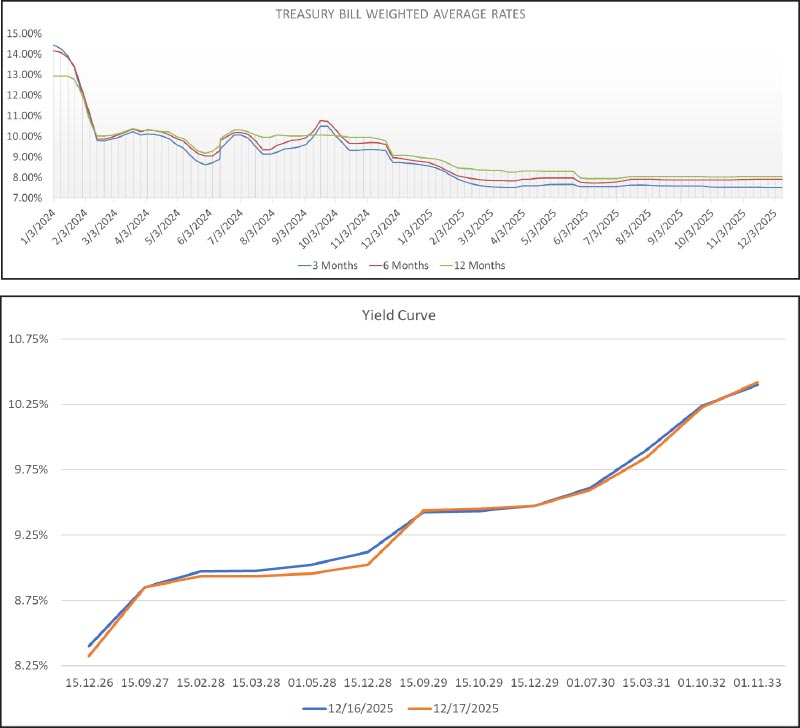

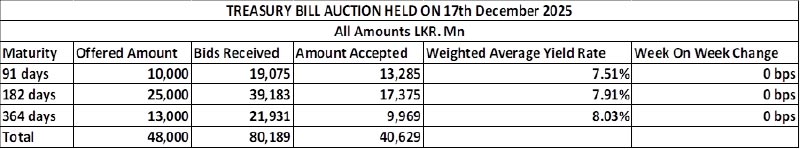

Meanwhile, the weighted average rates at the weekly Treasury Bill auction conducted yesterday held steady. Accordingly, the yields on the, 91-day, the 182-day and the 364-day tenors were recorded unchanged at 7.51%, 7.91% and 8.03%. This marks the 22nd week where T-Bill rates have stayed broadly anchored around prevailing levels.

The auction was undersubscribed, raising only 84.64% or Rs. 40.629 billion out of the entire Rs. 48 billion offered. The bids received to accepted amount ratio was 1.67 times.

The Phase II of subscription is now open for 182-day and 364-day maturities until 3.00 pm of business day prior to settlement date (i.e., 18.12.2025) at the WAYRs determined for the said ISINs at the auction (see table for details of the auction - Phase 1).

The total secondary market Treasury Bond/Bill transacted volume for 16 December was Rs. 11.18 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.98% and 8.01% respectively.

The net liquidity surplus increased marginally to Rs. 79.98 billion yesterday as an amount of Rs. 92.10 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%. An amount of Rs. 12.12 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%.

Forex market

In the forex market, the USD/LKR rate on spot contracts closed the day at 309.65/309.72 as against its previous day’s closing level of Rs. 309.50/309.60.

The total USD/LKR traded volume for 16 December 2025 was $ 27.93 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)