Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 7 October 2025 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market opened last week on a quiet footing, with last Monday marked by subdued activity and thin transaction volumes. Yields held broadly steady as participants largely remained on the side lines ahead of the September CCPI release.

On Tuesday, conditions remained lacklustre for a second consecutive day, though yields edged up marginally. The release of September CCPI, which recorded a positive +1.5% year-on-year (Base 2021=100) compared with +1.2% in August, marked the second consecutive month of positive inflation after nearly a year of deflationary readings. The annual average stood at -1.4%. Despite the data, market sentiment remained cautious, with participants continuing to adopt a wait-and-see approach.

Midweek, yields climbed further, influenced by global developments. News of the US Government shutdown and the Asian Development Bank’s downward revision of Sri Lanka’s 2026 GDP growth forecast to 3.3% weighed on sentiment. However, renewed buying interest at higher yield levels provided some support, curtailing further upward movement.

The upward trajectory in yields persisted into Thursday and Friday, with four consecutive sessions of increases culminating in two-way quotes closing the week higher. This was despite renewed buying kicking in at the elevated levels and acting as a brake on yields pushing higher. Overall, trading was characterised by sporadic bursts of activity and healthy transaction volumes, interspersed between periods of virtual standstill. This reflected the market participants’ watchful stance.

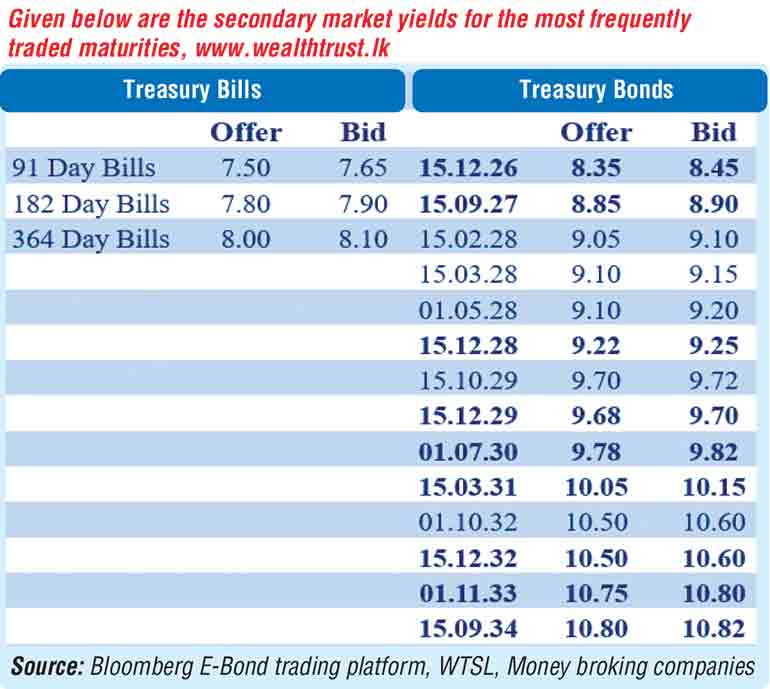

In terms of the weekly secondary Bond market trade summary, the 01.02.26 maturity was seen trading within the range of 8.00–8.05%, while the 01.06.26 changed hands at 8.25% and the 01.08.26 at 8.30%. The 15.09.27 maturity was seen trading up the range of 8.77–8.85%.

Among the 2028 maturities, the 15.01.28 traded at 9.00%, while the 15.02.28 traded up the range of 9.04%–9.05%. The 15.03.28 changed hands between 9.09-9.10%, with the 01.05.28 also at 9.10%. The 15.10.28 and 15.12.28 maturities were seen within 9.18–9.25% and 9.20–9.25% respectively. In the 2029 segment, the 15.06.29 maturity traded up from an intraweek low to a high of 9.48–9.60% and the 15.09.29 up the range of 9.50–9.71%. The 15.10.29 traded up from an intraweek low of 9.60% to a high of 9.70% and the yield on the 15.12.29 moved up from 9.60–9.68%.

Further along the curve, the 15.05.30 maturity traded within 9.74–9.78%, while the 01.07.30 traded up the range of 9.70–9.80%. In the 2032 maturities, the 01.07.32 was seen at trading at 10.65%, the 01.10.32 moved up from an intraweek low to a high of 10.40–10.50%, and the 15.12.32 at 10.55%. The 01.11.33 traded at 10.74–10.81%, while the 15.09.34 maturity was seen moving between 10.80-10.82%.

Meanwhile, the weekly Treasury Bill auction held last Wednesday (1 October), saw the entire Rs. 43 billion offered amount fully subscribed. This marked the first instance in 6 weeks that a T-Bill auction raised the entire targeted offered amount. The bids received to offered amount ratio stood at 1.88 times. The weighted average rates held broadly steady, with the exception of the 91-day maturity which registered a 04-basis point decline to 7.53%. The 182-day and 364-day tenors remained unchanged at 7.89% and 8.02% respectively. This marks the 11th week where T-Bill rates have stayed virtually tethered around prevailing levels.

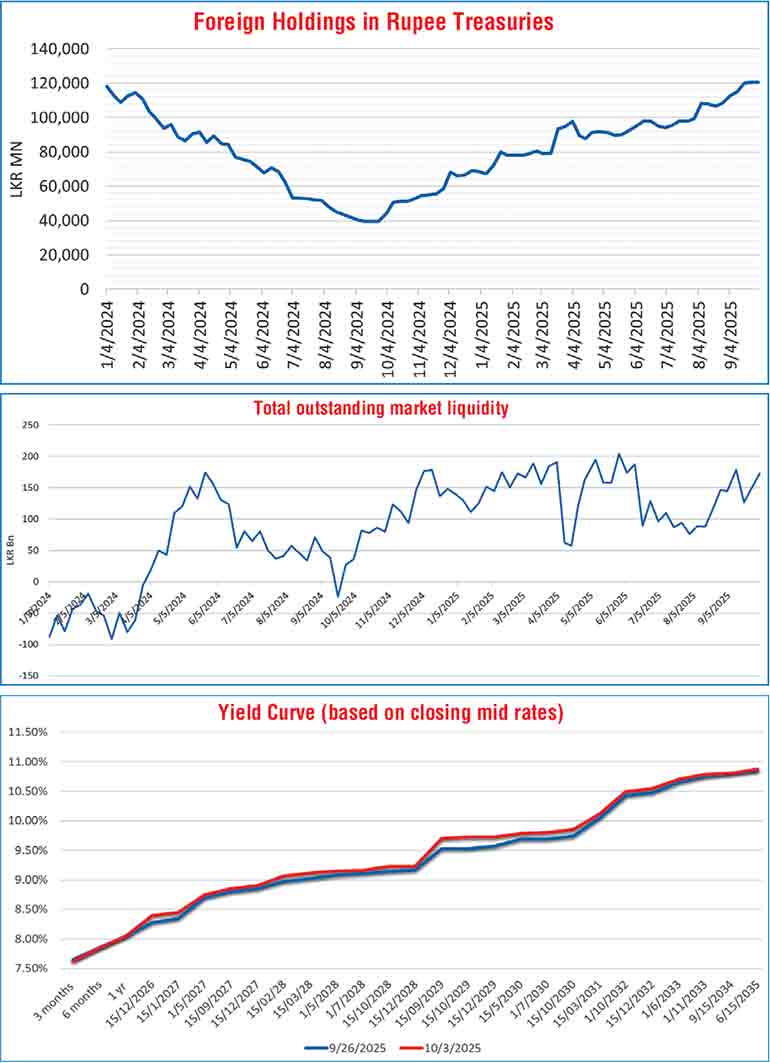

The foreign holdings of rupee-denominated Government securities held broadly steady last week. A very marginal net outflow of Rs. 17 million was recorded during the week ending 2 October, following five consecutive weeks of foreign inflows. As a result, total foreign holdings dipped to Rs. 120.60 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 172.36 billion as at the week ending 3 October, from Rs. 150.03 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.86%-7.87% and 7.88% respectively while the Central Bank of Sri Lanka (CBSL) holding of Government securities was registered at Rs. 2,508.92 billion as at the 3 October, unchanged against the previous week’s closing level.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 10.07 billion.

Forex Market

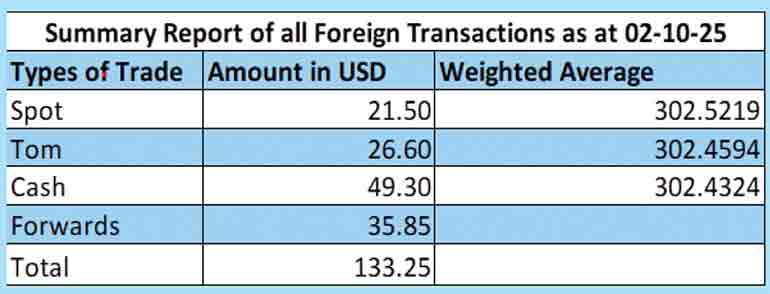

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week virtually unchanged at Rs. 302.45/302.50 as against the previous week’s closing level which was also Rs. 302.45/302.50. However, this was subsequent to trading at a high of Rs. 302.45 and a low of Rs. 302.65. The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 120.28 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)