Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 25 August 2025 01:47 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

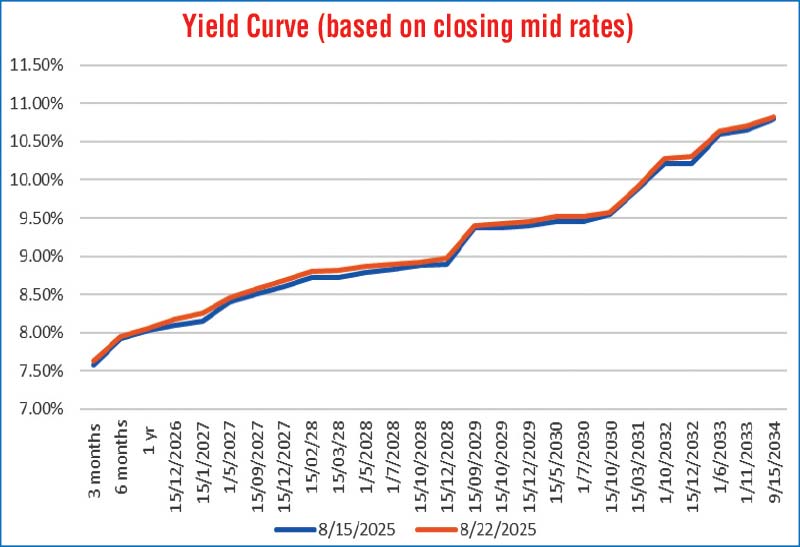

The Secondary Bond market started off last week with healthy activity levels while yields were seen increasing on the back of selling interest, though buying interest at higher levels capped further increases. However, towards the latter part of the week, overall activity and transaction levels were seen at subdued levels despite sporadic bouts of activity interspersed between the lull periods. The yield curve recorded a marginal parallel shift upwards as the secondary market two-way quotes closed marginally higher on a week-on-week basis.

The Secondary Bond market started off last week with healthy activity levels while yields were seen increasing on the back of selling interest, though buying interest at higher levels capped further increases. However, towards the latter part of the week, overall activity and transaction levels were seen at subdued levels despite sporadic bouts of activity interspersed between the lull periods. The yield curve recorded a marginal parallel shift upwards as the secondary market two-way quotes closed marginally higher on a week-on-week basis.

On the short end of the yield curve, the 01.02.26 and 01.08.26 maturities traded between 7.95%-7.98% and 8.05%-8.10% respectively, while the 15.01.27 maturity traded at 8.15%. The 15.09.27 and 15.12.27 maturities traded at rates of 8.55%-8.58% and 8.68% respectively at the tail end of the week. The 15.02.28, 15.03.28, 01.05.28, and 01.07.28 maturities changed hands within 8.75%-8.80%, 8.75%-8.83%, 8.80%-8.87%, and 8.88%-8.90% respectively. In the 2029 space, the 15.06.29 maturity traded at 9.33%-9.35%, while the 15.09.29, 15.10.29, and 15.12.29 maturities ranged between 9.40%, 9.41%-9.44%, and 9.43%-9.45% respectively. On the medium end of the curve, the 15.05.30 maturity was seen trading at 9.50%, while the 15.03.31 maturity ranged between 9.88%-9.95%. Further, the 01.07.32 and 15.12.32 maturities traded between 10.35%-10.44% and 10.25%-10.30% respectively, while the long end saw the 01.06.33 and 01.11.33 maturities change hands at 10.60% and 10.70% respectively. The 15.09.34 maturity traded at the rate of 10.85% at the tail end of the week.

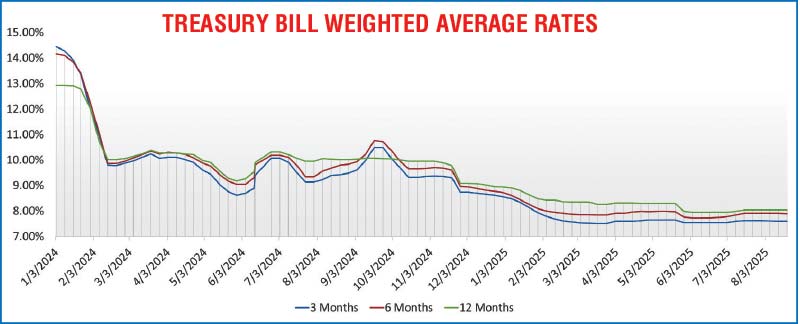

At the weekly Treasury Bill auction held last Wednesday, weighted average yields eased further albeit very marginally, marking the third straight week of declines on at least one tenor. The 91-day and 182-day maturities dipped by 1 basis point each to 7.59% and 7.89%, while the 364-day tenor held steady at 8.03%. The auction was fully subscribed for the third consecutive week, raising the total offered amount of Rs. 78.50 billion in the first phase through competitive bidding. Total bids received exceeded the offered amount by 1.97 times. Notably, the longer-tenor 364-day maturity raised more than the respective offered amount, while the 91-day and 182-day maturities raised less than their respective offered amounts.

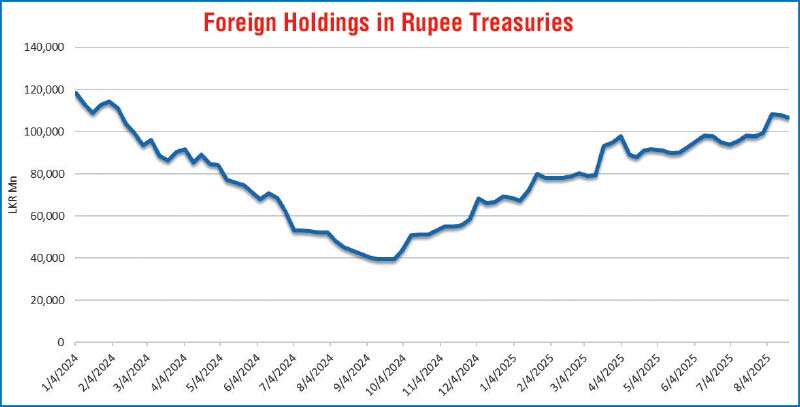

The foreign holding in Rupee Treasuries recorded a net outflow for a second consecutive week, to the tune of Rs. 1.34 billion, for the week ending 22 August. As a result, the total holding reduced to Rs. 106.57 billion.

The daily Secondary market Treasury Bond/Bill transacted volumes for the first three days of the week averaged at Rs. 11.32 billion.

In money market, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 116.40 billion as at the week ending 22 August, from Rs. 88.33 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.85%-7.88% and 7.86%-7.89% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 22 August, unchanged against the previous week’s closing level.

Forex market

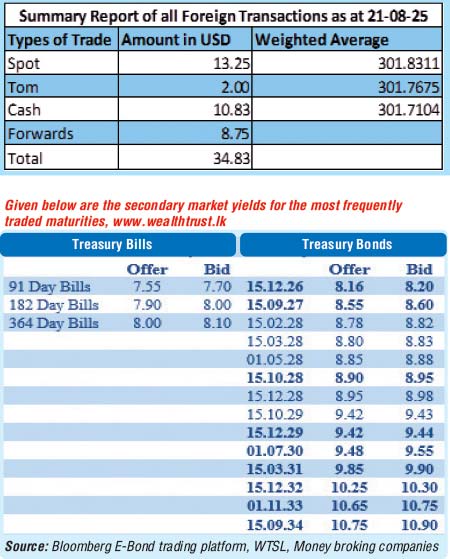

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating to close the week at Rs. 301.95/302.05 as against the previous week’s closing level of Rs. 300.90/301.05, subsequent to trading at a high of Rs. 301.05 and a low of Rs. 302.02.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 67.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)