Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 29 September 2025 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market opened last week on a strong footing, buoyed by S&P Global Ratings’ upgrade of Sri Lanka’s sovereign credit rating to CCC+ from Selective Default (SD) with a stable outlook. This spurred a notable pick-up in activity and volumes on Monday, with demand concentrated in the 2029–2033 maturities, which saw yields edge lower.

Momentum tapered off thereafter, with trading largely confined to narrow ranges ahead of the monetary policy announcement. On Wednesday, the Central Bank of Sri Lanka delivered its fifth policy review of the year, holding the Overnight Policy Rate steady at 7.75%. As the decision was widely anticipated and priced in, yields remained stable, and activity stayed subdued through midweek, with markets consolidating.

However, on Friday, shorter tenors such as the 2026-2028 maturities came under selling pressure, while renewed buying interest was noted on the 2030 tenor, which saw its yield edge down marginally. Overall, trading volumes were healthy at both ends of the week, while midweek conditions were quiet. The yield curve closed up on the very short end but broadly steady along the rest of the curve resulting in a slight flattening.

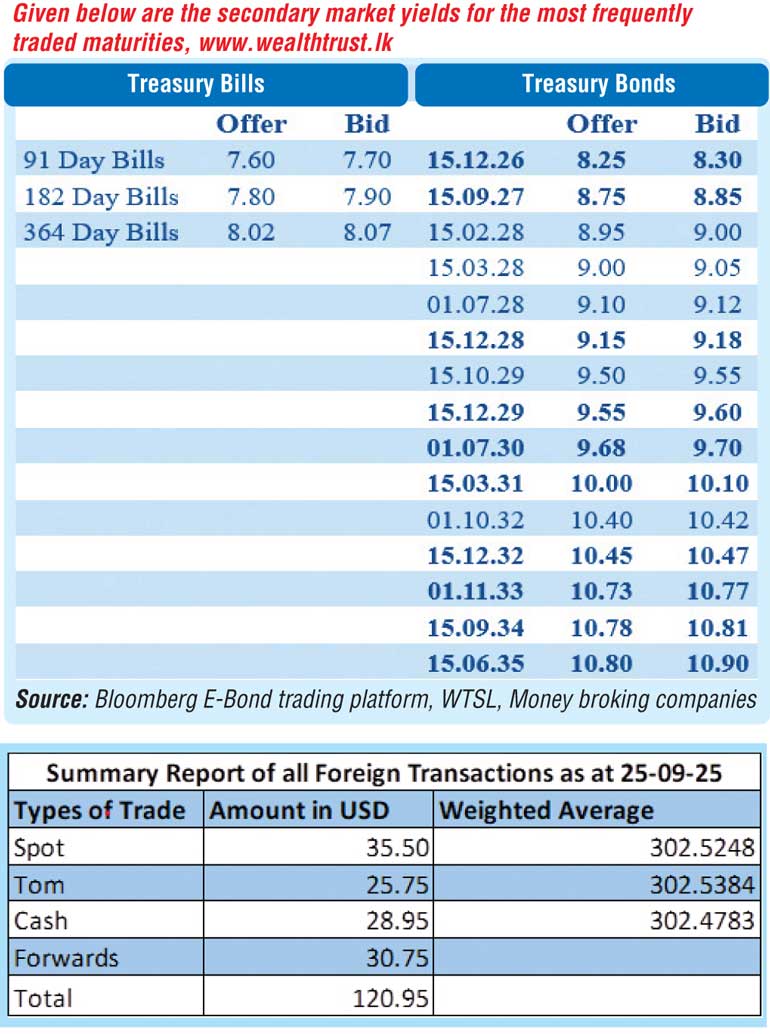

In the secondary Bond market, the 15.05.26 maturity was seen trading between 8.18%-7.99%, while the 01.08.26 changed hands at 8.20%, and the 15.12.26 maturity was seen at 8.30%. In the 2028 maturities, the 15.02.28 was seen moving up the ranges of 8.92%–8.95%, and the 15.03.28 changed hands at 8.95%-9.02%, while the 01.05.28 was seen trading up the range of 9.00%-9.11%, the 01.07.28 traded up from 9.05%–9.12%.

In the 2029 segment, the 15.06.29 maturity traded at 9.40%, the 15.09.29 was seen within 9.50%–9.48%, and the 15.12.29 maturity changed hands at 9.50%. The 01.07.30 maturity traded down from 9.72% to 9.68%.

Further along the curve, trades were seen on the 01.10.32 maturity within 10.40%–10.39%, while the 15.12.32 within 10.45%–10.44%. The 01.06.33 maturity changed hands at 10.73%, while the 01.11.33 traded between 10.75% to 10.66%. The 15.09.34 maturity was seen trading at 10.80%. At the longer end, the 15.06.35 traded within 10.86%–10.85%.

At the weekly Treasury Bill auction held last Wednesday (17), the weighted average yields remained unchanged. Accordingly, the rate on the 91-day, 182-day and 364-day tenors remained at 7.57%, 7.89% and 8.02% respectively. This marks the 10th week where T-Bill weighted averages have stayed mostly unchanged at auctions.

However, in terms of subscription, 90.41% of the total offered amount was raised, with successful bids amounting to Rs. 34.35 billion against the Rs. 38.00 billion on offer in the first phase of competitive bidding. This marked the fifth consecutive auction that fell short of fully raising the targeted amount.

In the money market, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 150.03 billion as at the week ending 26 September, from Rs. 126.81 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.86% and 7.87%-7.88% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 26 September 2025, unchanged against the previous week’s closing level.

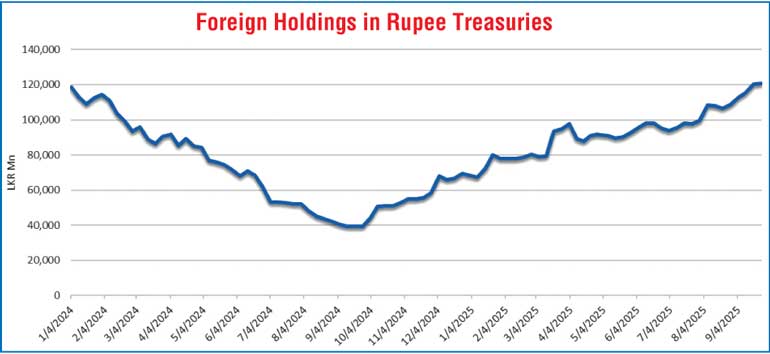

Meanwhile, the recovery in foreign holdings of rupee-denominated Government securities continued last week. A net inflow of Rs. 334 million was recorded during the week ending 25 September, marking the fifth consecutive week of foreign inflows. As a result, total foreign holdings rose to Rs. 120.61 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 13.03 billion.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week broadly steady to Rs. 302.50/302.55 as against the previous week’s closing level of Rs. 301.45/302.50. However, this was subsequent to trading at a high of Rs. 302.12 and a low of Rs. 302.62.

The daily USD/LKR average traded volume for the first four trading days of the week stood at US $ 120.95 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)