Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 5 January 2026 04:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

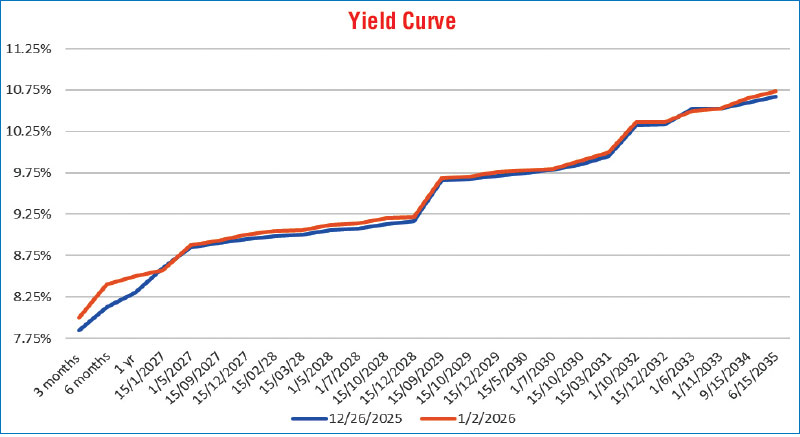

The secondary Bond market opened last week on a positive footing, with yields initially easing on the back of residual buying interest carried over from the latter part of the previous week. However, this momentum tapered off, as participation thinned and market activity turned cautious amid back-to-back primary Treasury Bill and Bond auctions, leading to limited follow-through in secondary trades and yields edging back up.

The secondary Bond market opened last week on a positive footing, with yields initially easing on the back of residual buying interest carried over from the latter part of the previous week. However, this momentum tapered off, as participation thinned and market activity turned cautious amid back-to-back primary Treasury Bill and Bond auctions, leading to limited follow-through in secondary trades and yields edging back up.

Mid-week conditions remained subdued, with market participants largely adopting a wait-and-see stance amidst the successive primary market auctions. Secondary market activity was limited, as focus shifted toward assessing post-auction signals. In this context, secondary Bond yields were seen adjusting upwards, particularly following the weekly Treasury Bill auction, which recorded across-the-board increases in weighted average rates for the second consecutive week, prompting a measured re-pricing across the curve.

However, sentiment improved toward the latter part of the week, as renewed buying interest emerged, triggering a recovery. This movement was most evident in the belly of the yield curve, particularly across the 2028–2033 maturities, where yields declined on the back of firmer demand. Market activity and transaction volumes improved during this phase.

The recovery extended into the final session of the week, supported by sustained buying interest, with yields closing lower on the day. Overall, despite the muted conditions observed earlier in the week, secondary market activity ended on a firmer note, with improved sentiment and healthier transaction volumes toward the close. In conclusion secondary Bond market two-way quotes closed the week broadly steady week on week.

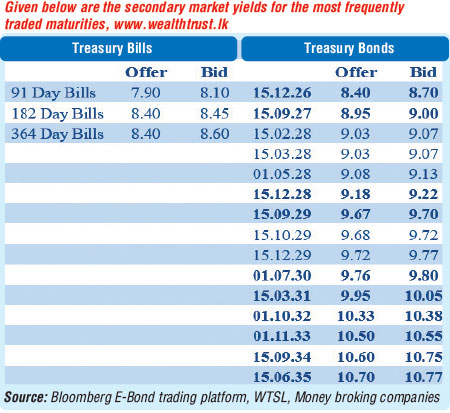

In terms of the secondary Bond market trade summary: last week, the 01.05.27 maturity traded at 8.92%-8.89%, while the 15.09.27 maturity traded at 8.95%.

Moving into the 2028 tenors, the 15.02.28 maturity traded at 9.05%. The 01.05.28 maturity initially traded up to 9.20% before trading down the range of 9.20%–9.15% towards the latter part of the week. The 01.07.28 maturity traded up to 9.25% before easing to trade down to an intraweek low of 9.14% at the close of the week. The 01.09.28 maturity traded at 9.18%, while the 15.10.28 and 15.12.28 maturities were seen trading at 9.20% and 9.22%-9.20% respectively.

Further along the curve, the 15.09.29 maturity traded up to 9.80% before easing back to 9.75%, while the 15.10.29 maturity saw its yield ease from a high of 9.75% to a low of 9.70%. The 15.12.29 maturity traded up to 9.87% before trading down the range of 9.86%–9.75% at the tail end of the week during the recovery rally.

The 01.07.30 maturity traded up to 9.91% post-auction T-Bill auction before trading down the range of 9.87%–9.80% as the market recovered and retraced downwards. The 15.03.31 maturity traded at 10.00%. The 01.10.32 maturity traded up to 10.40% before easing to trade back down to 10.35%. The 01.06.33 and 01.11.33 maturities traded at the rate of 10.50% at the close of the week.

Meanwhile, the Bond auctions held on Tuesday (30 December 2025) raised Rs. 43.18 billion, representing 78.51% of the Rs. 55 billion on offer, across two available maturities. The 01.07.2037 maturity was fully subscribed at a weighted average yield of 10.90%, raising the entire maturity-wise offered amount of Rs. 25 billion at the first phase in competitive bidding. The 01.07.2030 maturity was issued at 9.80%. However, the maturity was undersubscribed at the 1st and 2nd phases.

This was followed by the weekly Treasury Bill auction held last Wednesday, where weighted average yields recorded an upwards movement across the board for a second consecutive week. Accordingly, the weighted average yield on the 91-day bill rose by 19 basis points to 7.74%, the 182-day by 32 basis points to 8.27%, and the 364-day by 26 basis points to 8.45% respectively. Only an amount of Rs. 57.39 billion was raised in total, out of a total offered amount of Rs. 120 billion, translating to a 47.83% subscription ratio.

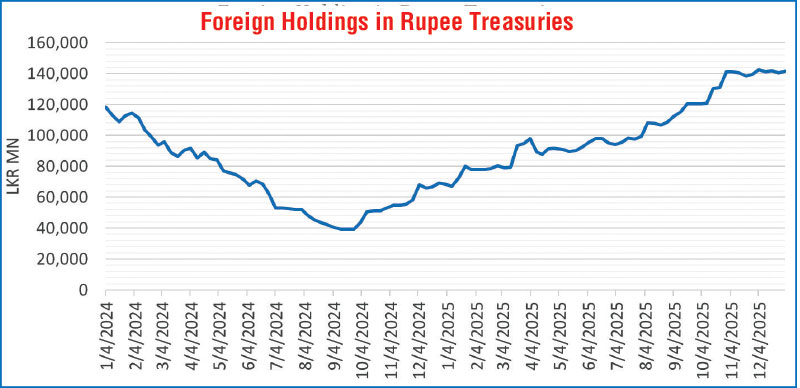

Meanwhile, the foreign holdings of rupee-denominated Government Securities recorded a net foreign inflow, amounting to Rs. 938 million. Consequently, total holdings increased to Rs. 141.36 billion during the week ending 1 January.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 15.19 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market increased steadily to Rs. 134.48 billion as at the week ending 2 January 2026, from Rs. 111.66 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 8.03%-8.04% and 8.05%-8.06% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 2 January, unchanged against the previous week’s closing level.

Forex market

In the forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 309.75/309.85 as against the previous week’s closing level of Rs. 309.65/309.75. This was subsequent to trading at a high of Rs. 309.40 and a low of Rs. 310.25.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 59.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)