Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 12 January 2026 01:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

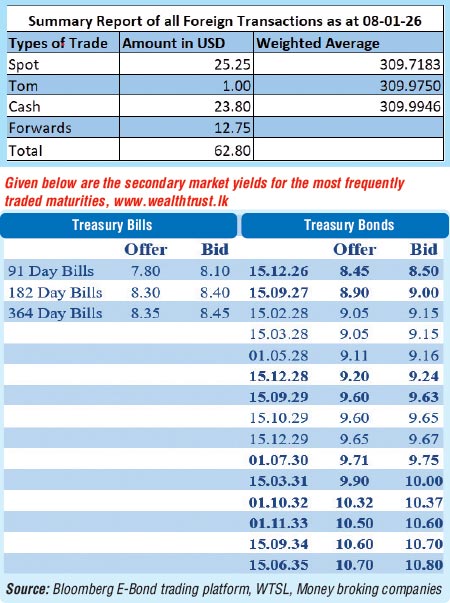

Secondary Bond market yields trended broadly lower last week, driven by sustained buying interest concentrated in the belly of the curve, particularly across the 2029–2030 maturities. While the short end (2026–2028 tenors) faced intermittent profit-taking and selling pressure, the medium-to-long end consistently remained stable or dropped lower throughout. The short end later also posted a slight recovery toward the end of the week as well. Market activity and transaction volumes were generally healthy, supported by several block trades.

Secondary Bond market yields trended broadly lower last week, driven by sustained buying interest concentrated in the belly of the curve, particularly across the 2029–2030 maturities. While the short end (2026–2028 tenors) faced intermittent profit-taking and selling pressure, the medium-to-long end consistently remained stable or dropped lower throughout. The short end later also posted a slight recovery toward the end of the week as well. Market activity and transaction volumes were generally healthy, supported by several block trades.

However, sentiment softened toward the latter part of the week as participants adopted a cautious, wait-and-see stance ahead of the upcoming Treasury Bond auction. This resulted in some late-week profit-taking and a marginal uptick in yields. Nevertheless, two-way secondary market quotes closed lower on a week-on-week basis.

The short end experienced a sell off midweek but then recovered marginally at the tail end of the week. During the week, the 01.06.26 maturity traded at 8.45%, while the 15.12.26 maturity traded at 8.50%. The 01.05.27 maturity traded within 9.00%–8.95%, while the 15.09.27 maturity traded at 9.00%. Moving into the 2028 tenors, the 15.03.28 maturity traded initially traded up the range of 9.07%–9.16% before easing to 9.10% towards the latter part of the week. The 01.05.28 maturity traded up to 9.20% before trading down the range of 9.20%–9.12%. The 01.07.28 maturity traded up to 9.22% before easing to trade lower at 9.15% at the close of the week. The 15.10.28 maturity traded up to 9.26% before easing back to 9.20%.

The belly to longer end saw rates drop throughout the week despite a slight reversal at the close of the week. The 15.06.29 maturity traded down the range of intraweek highs to lows of 9.60%–9.50%. The 15.09.29 maturity traded at 9.70% early in the week before easing to trade down to trade at 9.55%. The 15.10.29 maturity traded down the range of intraweek highs to lows of 9.65%–9.60%, while the 15.12.29 maturity traded at 9.75% before trading down to 9.60%. The 01.07.30 maturity traded down the range of 9.80%–9.70%.

The 15.03.31 maturity traded down the range of 9.95%–9.88%. The 01.10.32 maturity traded down the range of 10.35%–10.30%, while the 15.12.32 maturity traded down the range of 10.33%–10.30%. At the longer end, the 01.06.33 maturity traded at 10.54%, the 01.11.33 maturity traded within 10.55%–10.50%, the 15.09.34 maturity traded at 10.70%, and the 15.06.35 maturity traded within 10.76%–10.75%.

At the weekly Treasury Bill auction held last Wednesday (7 January), weighted average yields recorded an upwards movement across the board for a third consecutive week. Accordingly, the weighted average yield on the 91-day Bill rose by 14 basis points to 7.88%, the 182-day by 17 basis points to 8.44%, and the 364-day by 02 basis points to 8.47% respectively. The auction was fully subscribed for the first time in 4 weeks raising the entire Rs. 100 billion on offer as the 182-day Bill dominated the auction, reflecting 80.46% of the total accepted amount or Rs. 80.46 billion.

The details of the next upcoming Treasury Bond auction, scheduled to be conducted today, 12 January are as follows. The round of auctions will have a total offered amount of Rs. 205 billion across four available maturities.

The auction will be comprised of:

The settlement for which will be held on 16th January 2026.

For context, the previous Bond auctions held on 30 December 2025 raised Rs. 43.18 billion, representing 78.51% of the Rs. 55 billion on offer, across two available maturities. The 01.07.2037 maturity was fully subscribed at a weighted average yield of 10.90%, raising the entire maturity-wise offered amount of Rs. 25 billion at the first phase in competitive bidding. The 01.07.2030 maturity was issued at 9.80%. However, the maturity was undersubscribed at the 1st and 2nd phases.

This will be followed by the Weekly Treasury Bill Auction which will be conducted this Tuesday, 13 January and will see a total of Rs. 100 billion on offer. The auction will be comprised of Rs. 32 billion on the 91-day tenor, Rs. 48 billion on the 182-day tenor and Rs. 20 billion on the 364-day tenor.

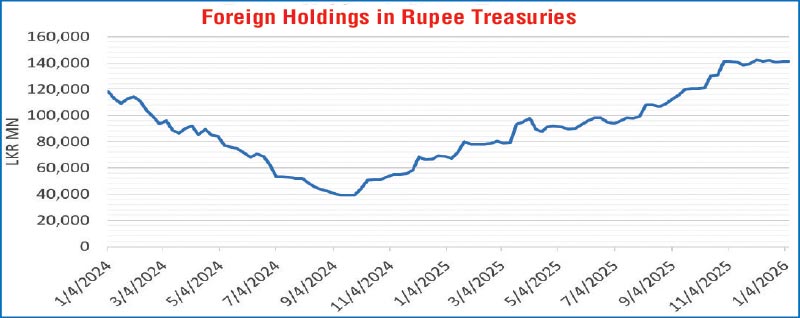

Foreign holdings of rupee-denominated Government Securities recorded a very marginal net foreign inflow, amounting to Rs. 57 million. Consequently, the total holdings increased to Rs. 141.42 billion during the week ending 9 January.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 65.49 billion.

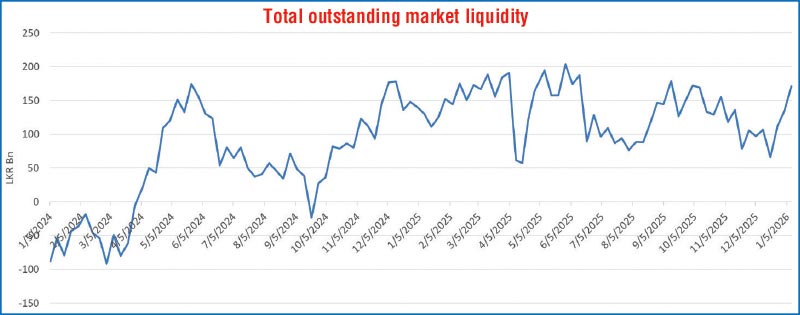

In the money market, the total outstanding liquidity surplus in the inter-bank money market continued to increase steadily trending upwards to Rs. 171.03 billion as at the week ending 9 January 2026, from Rs. 134.48 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.96%-8.03% and 7.99%-8.04% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 9 January, unchanged against the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week appreciating to Rs. 309.00/309.30 as against the previous week’s closing level of Rs. 309.75/309.85. This was subsequent to trading at a high of Rs. 309.21 and a low of Rs. 310.18.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 64.81 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)