Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 1 September 2025 04:48 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

The Secondary Bond market last week saw overall activity and transaction volumes at subdued levels. Sparse trades were observed on thin volumes focused on selected maturities. During the early part of the week, yields were seen holding broadly steady as the market consolidated. Market participants initially gravitated towards the sidelines, adopting a wait and see approach amid the absence of strong directional cues. However, at the tail-end of the week selling pressure kicked in and yields started to move up, following the period of stagnation. This upward movement was accompanied by a slight pick-up in volumes and activity. As a result, Secondary Bond market two-way quotes closed higher week-on-week. The yield curve was observed shifting upwards particularly more pronounced along the belly-end.

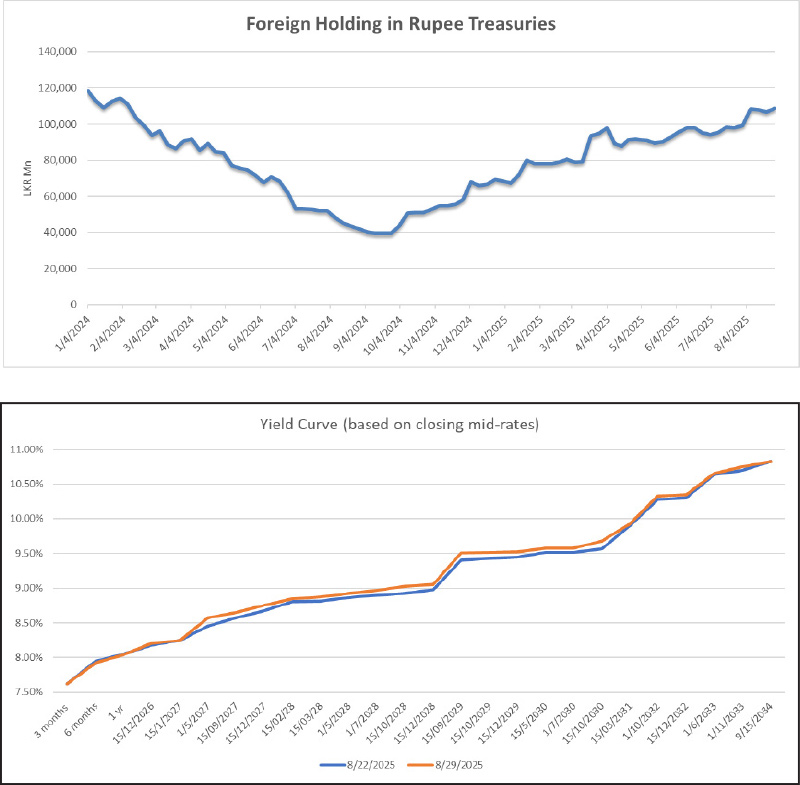

Nevertheless, foreign holdings in Rupee Treasuries recorded a net inflow of Rs. 2.10 billion – equivalent to a 2.00% week-on-week increase – during the week ending 28 August, following two consecutive weeks of outflows. This lifted the overall holding to Rs. 108.67 billion, with the fresh inflow more than offsetting the cumulative outflow of Rs. 1.63 billion seen over the prior two weeks. Notably, this marks the highest level of foreign holdings since early February 2024.

In Secondary Bond market, the 15.05.26, 01.08.26, 15.12.26 and 15.07.27 maturities traded between 8.05%–8.10%, 8.10%-8.12%, 8.20% and 8.18% respectively. The 01.05.27 and 15.09.27 maturities were seen at trading up the range of intraweek lows to highs of 8.47%-8.55% and 8.55% to 8.65% respectively. Moving further along, the 15.02.28, 01.05.28 and 15.12.28 maturities traded at rates of 8.80%, 8.85%-8.90% and 9.00%-9.05% respectively. In the 2029 space, the 15.09.29, 15.10.29 and 15.12.29 maturities were seen between 9.41%-9.50% collectively. On the medium to longer end, the 15.12.32 maturity changed hands between 10.28%-10.34%.

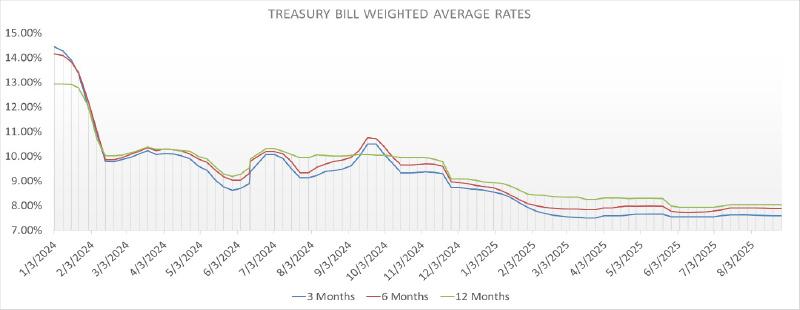

At the weekly Treasury Bill auction held last Wednesday, only raised 62.37% or Rs. 51.14 billion in successful bids out of the total offered amount of Rs. 82.00 billion at the first phase in competitive bidding. The weighted average yields overall held broadly steady, as the rate on the 182-day and 364-day maturities remained unchanged at 7.89% and 8.03% week-on-week respectively. However, the weighted average yield rate on the 91-day maturity registered a marginal decline of 1 basis point week-on-week. Notably, this marked the fourth consecutive week where the weighted average yield on at least one tenor recorded a decline. Further to the auction, an additional amount of Rs. 20 billion was raised at Phase II.

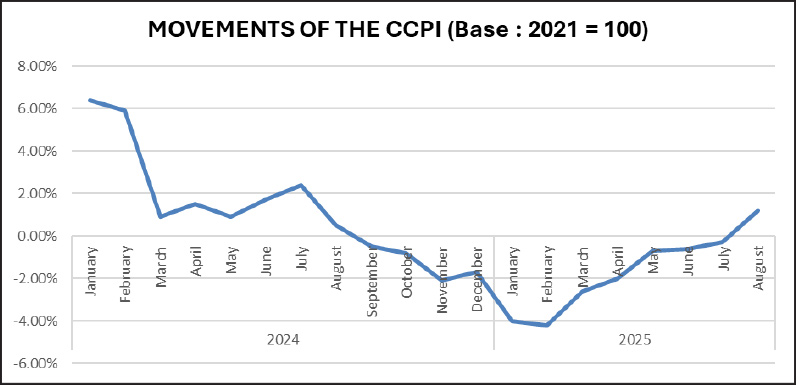

The Colombo Consumer Price Index (CCPI; Base 2021=100) for the month of August was recorded at a positive 1.2% on its point to point, ending a spell of deflation of 11 consecutive months. This is as against its previous month’s figure of negative 0.3% (deflation). The annual average was registered at -1.5% as at August. This was broadly in line with market expectations and a Bloomberg Estimate of 1.1%.

The daily Secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 12.36 billion.

In money markets, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 146.54 billion as at the week ending 22 August, from Rs. 116.40 billion recorded the previous week. This marks the highest value since Mid-June this year. The weighted average interest rates on call money and repo were recorded within the ranges of 7.86% and 7.87% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 22 August, unchanged against the previous week’s closing level.

Forex market

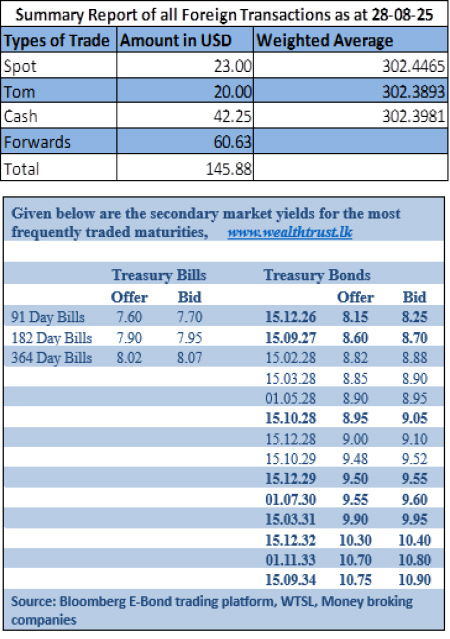

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week broadly steady at Rs. 302.00/302.10 as against the previous week’s closing level of Rs. 301.95/302.05. However, this was subsequent to trading at a high of Rs. 302.00 and a low of Rs. 302.45.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 99.42 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)