Monday Feb 23, 2026

Monday Feb 23, 2026

Sunday, 27 April 2025 00:15 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The Secondary Bond market for the week ending 25 April initially started off slowly and with yields remaining range-bound. During this period, the market was in a lull state, with muted activity and transaction volumes.

The Secondary Bond market for the week ending 25 April initially started off slowly and with yields remaining range-bound. During this period, the market was in a lull state, with muted activity and transaction volumes.

However, the market became active following the news that Sri Lanka is likely to secure a staff-level agreement with the International Monetary Fund (IMF) in the near future for the disbursement of the next tranche of the Extended Fund Facility (EFF), according to Bloomberg. It was also reported that Sri Lanka expects to finalise an arrangement covering its bilateral trade relationship with the US before the expiry of a 90-day suspension on the 44% tariff imposed on the island nation. Yields declined on the back of strong demand predominantly on 2028-2029 tenors, pushing rates considerably lower, with the momentum holding until the close of the week.

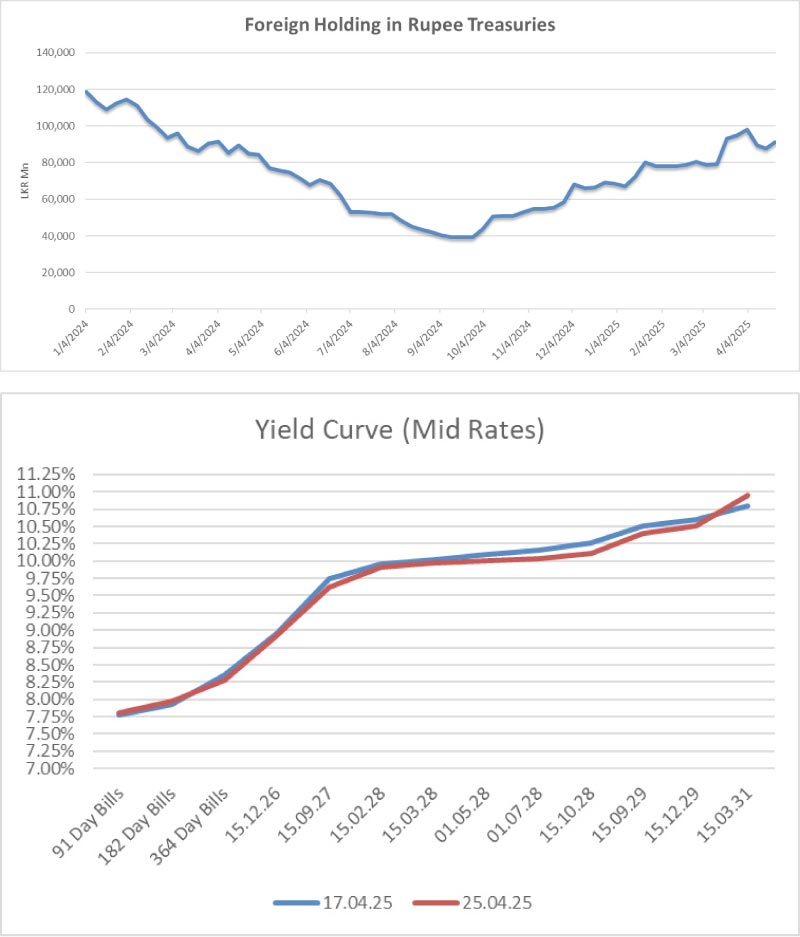

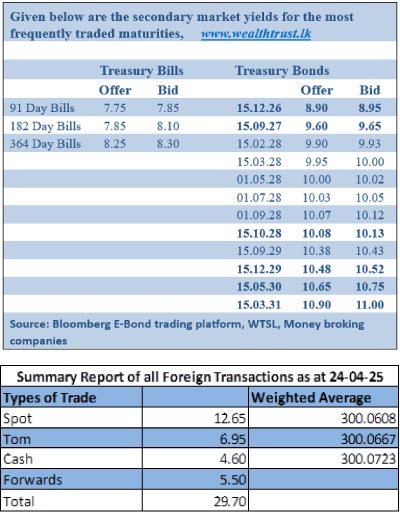

As a result, secondary market two-way quotes were seen closing the week notably lower. The 01.08.26 traded from 8.80% to 8.70%. The 15.09.27 maturity traded down the range of 9.70%-9.65% intraweek. The 15.03.28 maturities saw yields trade down the range of 10.00%-9.95%. The 01.09.28 maturity was seen trading down from intraweek highs to lows of 10.20%-10.10% and the 15.10.28 maturity down the range of 10.25%-10.10%, respectively. The 15.09.29 and 15.12.29 maturities traded down the range of intraweek highs to lows of 10.55%-10.40% and 10.65%-10.53%, respectively. The 15.03.31 maturity was seen trading within the range of 11.02%-11.00%.

This comes ahead of the Rs. 115 billion Treasury bond auction due on 28 April (today). The auction will be comprised of:

The settlement for which will be on 2 May 2025.

For context, the previous round of Treasury bond auctions conducted last Thursday (10) successfully raised the entire Rs. 100 billion at the first phase in competitive bidding. The total bids received exceeded the offered amount by a healthy 2.75 times. The 15.12.29 maturity (11.75% coupon) was issued at a weighted average yield of 10.64%, while the medium tenor 15.09.34 maturity (10.25% coupon) was issued at the weighted average rate of 11.21%.

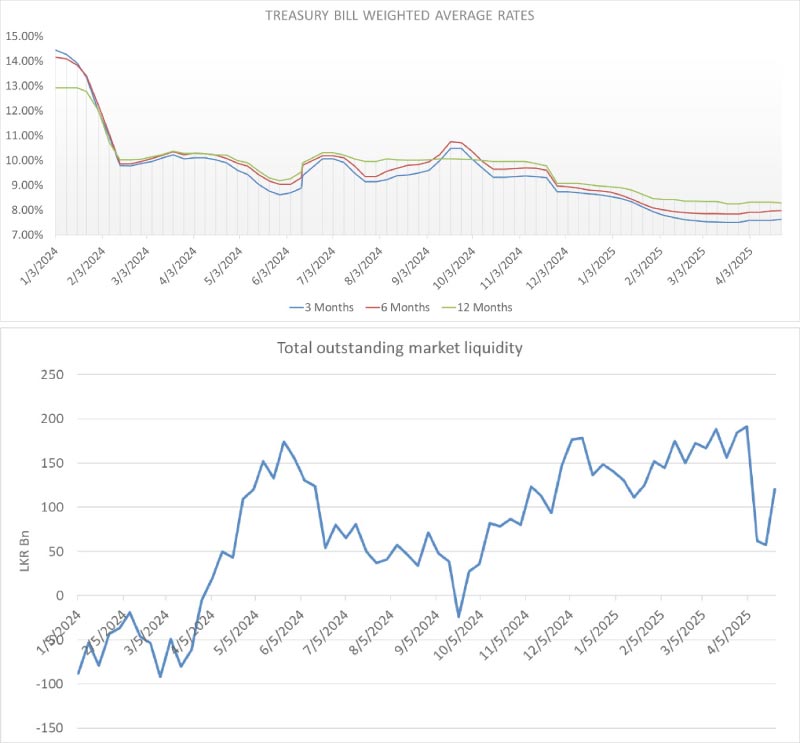

The weekly Treasury bill auction conducted last Wednesday (23) went undersubscribed at its first phase for a fifth consecutive week, raising 83.15% or Rs. 95.62 billion of the total Rs. 115 billion on offer accepted. This was despite total bids received exceeding the offered amount by 2.01 times.

The auction saw weighted average yield rates exhibit mixed results. Accordingly, the weighted average rates on the 91-day tenor increased by three basis points to 7.62% and the 182-day tenor rose by two basis points to 7.98%. However, the weighted average rate on the 364-day tenor declined by two basis points to 8.29%.

An additional amount of Rs. 21.27 billion was raised at the second phase of the auction.

Foreign holdings in Rupee treasuries recorded a net inflow for the week ending 24 April amounting to Rs. 3.33 billion for the following two consecutive weeks of decline, and as a result, the total holdings increased to Rs. 91.15 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 18.19 billion.

The total outstanding liquidity surplus in the inter-bank money market increased to Rs. 120.76 billion as at the week ending 25 April, from Rs. 57.33 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.97%-7.99% and 7.98%-8.00%, respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,511.92 billion as at 25 April, unchanged from the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating to close the week at

Rs. 299.65/299.75 as against the previous week’s closing level of Rs. 299.00/299.10, and subsequent to trading at a high of Rs. 299.45 and a low of Rs. 300.20.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 78.32 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)