Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 8 September 2025 04:17 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Bond market last week saw subdued overall activity and relatively low transaction volumes, with trading largely confined to selected maturities. During the early part of the week, yields held broadly steady and the market consolidated across the medium to long end of the yield curve. However, some upward movement was noted on shorter tenors, particularly in the 2026 to early 2029 maturities. Investor sentiment was cautious at the start of the week, with participants largely staying on the sidelines in the absence of clear directional signals. However, at the close of the holiday shortened week, renewed buying interest supported a recovery in sentiment, accompanied by a modest improvement in volumes and trading activity. As a result, two-way quotes in the Secondary Bond market closed broadly steady on a week-on-week basis, aside from a slight upward adjustment on the shorter maturities.

The Secondary Bond market last week saw subdued overall activity and relatively low transaction volumes, with trading largely confined to selected maturities. During the early part of the week, yields held broadly steady and the market consolidated across the medium to long end of the yield curve. However, some upward movement was noted on shorter tenors, particularly in the 2026 to early 2029 maturities. Investor sentiment was cautious at the start of the week, with participants largely staying on the sidelines in the absence of clear directional signals. However, at the close of the holiday shortened week, renewed buying interest supported a recovery in sentiment, accompanied by a modest improvement in volumes and trading activity. As a result, two-way quotes in the Secondary Bond market closed broadly steady on a week-on-week basis, aside from a slight upward adjustment on the shorter maturities.

In Secondary Bond market, the 15.12.26 and 15.01.27 maturities traded at the rate of 8.25%, and 8.30% respectively. The 01.05.27 maturity was seen trading within intraweek lows to highs of 8.59%-8.65%. Moving further along, the 01.07.28 and 15.10.28 maturity traded at the rate of 8.98% and 9.00% respectively. In the 2029 space, the 15.06.29 maturity saw a sharp recovery to trade at the intraweek low of 9.40% from an intraweek high of 9.48%. Similarly, the 15.09.29, 15.10.29 and 15.12.29 maturities were seen trading down from intraweek highs of 9.53%-9.48%, 9.52%-9.50% and 9.56%-9.52% respectively. The 15.09.34 maturity changed hands at the rate of 10.80%.

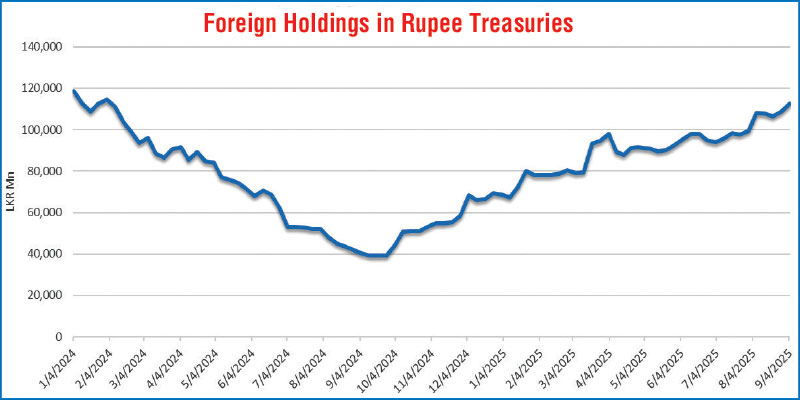

The recovery story in the foreign holdings of Rupee Treasuries continued last week. Recording a sizeable a net inflow of Rs. 3.84 billion – equivalent to a 4% week-on-week increase – during the week ending 4 September. This marked the second consecutive week of net inflows. This lifted the overall holding to Rs. 112.51 billion. Notably, this marks the highest level of foreign holdings since early February 2024.

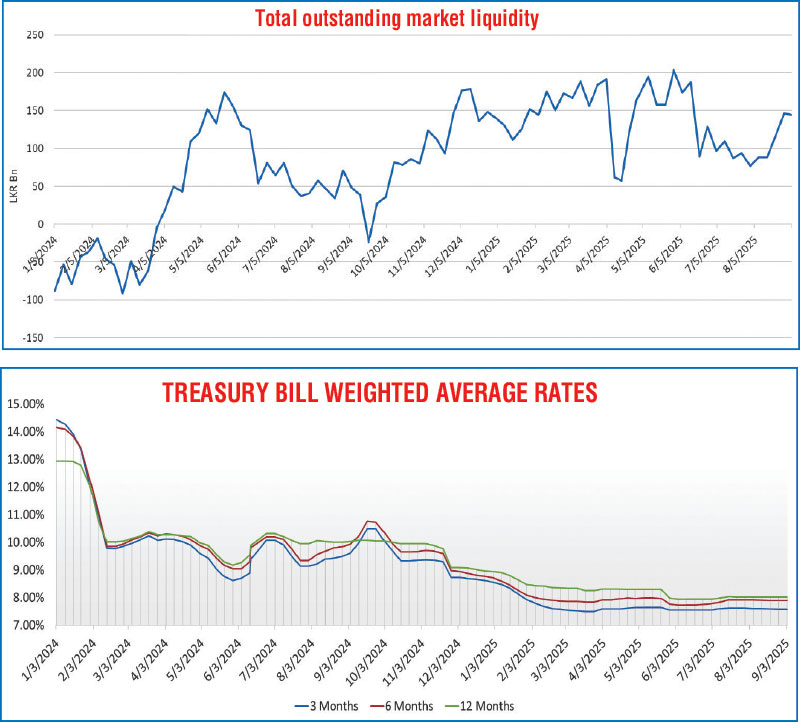

The weekly Treasury Bill auction held last Wednesday, raised only 67.10% of the total offered, with successful bids amounting to Rs. 49.67 billion against the Rs. 74 billion on offer in the first phase of competitive bidding. This marked the second consecutive auction that fell short of fully raising the targeted amount. Weighted average yields remained unchanged across all maturities, with the 91-day, 182-day, and 364-day bills holding steady at 7.58%, 7.89%, and 8.03%, respectively. This broke a four-week trend during which at least one tenor had recorded a decline in yields at auction. Interestingly, the 182-day maturity raised more than its respective offered amount, while the 91-day and 364-day maturities raised less than their respective offered amounts.

The daily secondary market Treasury Bond/Bill transacted volumes for the first three days of the week averaged at Rs. 13.38 billion.

In money market, the total outstanding liquidity surplus in the inter-bank money market remained broadly steady at Rs. 144.37 billion as at the week ending 4 September 2025, from Rs. 146.54 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.85%-7.86% and 7.87% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 4 September 2025, unchanged against the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week appreciating slightly at Rs. 301.97/302.02 as against the previous week’s closing level of Rs. 302.00/302.10. However, this was subsequent to trading at a high of Rs. 301.95 and a low of Rs. 302.25.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 71.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)