Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 20 June 2025 00:12 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The Secondary Bond market saw yields rise further yesterday as sentiment turned increasingly bearish, driven by fresh developments in the Israel-Iran conflict — including reports that the US President has privately approved attack plans against Iran, though no final order has been issued, and ongoing tit-for-tat strikes between the two nations. This was compounded by the US Federal Reserve holding its policy rates steady. Rates moved up considerably as markets priced in a higher risk premium, though renewed buying interest at elevated levels helped contain excessive increases. Market activity and volumes showed brief bursts of intensity early on, but trading slowed noticeably towards the latter part of the session.

The Secondary Bond market saw yields rise further yesterday as sentiment turned increasingly bearish, driven by fresh developments in the Israel-Iran conflict — including reports that the US President has privately approved attack plans against Iran, though no final order has been issued, and ongoing tit-for-tat strikes between the two nations. This was compounded by the US Federal Reserve holding its policy rates steady. Rates moved up considerably as markets priced in a higher risk premium, though renewed buying interest at elevated levels helped contain excessive increases. Market activity and volumes showed brief bursts of intensity early on, but trading slowed noticeably towards the latter part of the session.

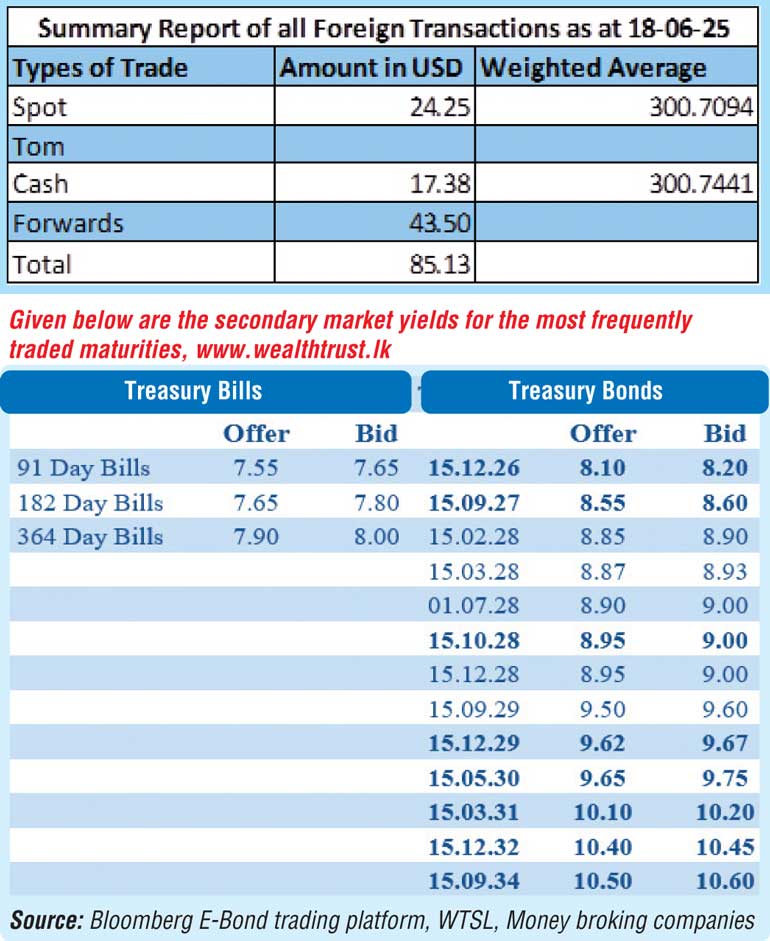

The 01.08.26 maturity was seen trading at the rate of 8.00%. The 01.05.28 and 15.10.28 maturities were seen trading at the rates of 8.95% and 9.00% respectively. The 15.06.29, 15.10.29 and 15.12.29 maturities were seen trading at the rates and up the ranges of 9.50%, 9.50%-9.54% and 9.55%-9.65% respectively. The 15.12.32 maturity traded at the rate of 10.40%. The 15.09.34 maturity traded at the rates of 10.56% and 10.57% respectively. The 15.03.35 maturity trades at the rate of 10.60%.

The total Secondary market Treasury bond/bill transacted volume for 18 June was Rs. 83.53 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.70% and 7.72% respectively.

The net liquidity surplus stood at Rs. 115.13 billion yesterday. An amount of Rs. 2.43 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 117.56 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciated marginally to Rs. 300.55/300.75 as against 300.40/300.60 the previous day.

The total USD/LKR traded volume for 18 June was $ 85.13 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)