Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 15 December 2025 00:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market last week initially started off slowly, as market participants adopted a wait and see approach ahead of back-to-back auctions. Subsequently, activity and transaction volumes increased on the back of renewed buying interest sparking a robust recovery and downward retracement.

This was supported by news of ongoing and future potential IMF engagement; these developments boosted confidence around near-term funding capacity, policy supervision, fiscal discipline and external credibility. Market sentiment was also backed by US Monetary Policy Easing as the FED cut rates by 25 basis points for the third straight time.

This rally was further supported by the Treasury Bond auction conducted last Thursday which saw rates come in-line with or above expectations, reflecting the bullish momentum of the secondary market. As a result, the market continued to see yields decline culminating in a downward shift of the yield curve as secondary bond market two-way quotes closed down on a week-on-week basis.

During the week, the 15.09.27 maturity traded down from high of 9.01% to a low of 8.85% whiles the 15.02.28 maturity traded down the range of 9.20%–8.95% and the 01.05.28 maturity the range of 9.25%–9.00%.

Further along the curve, the 15.06.29 maturity traded down the range of 9.52%–9.40%, while the 15.09.29 maturity traded at 9.51%-9.45%. The 15.10.29 maturity traded down from an intraweek high of 9.63% to a low of 9.45% and the 15.12.29 from high of 9.65% to a low of 9.45%. The 01.07.30 maturity traded down the range of 9.70%-9.60%.

On the longer end, the 15.03.31 maturity traded down the range of 10.00%–9.95%. The 15.12.32 maturity traded down from an intraweek high of 10.37% to a low of 10.25%. Meanwhile, the 01.06.33 maturity traded down the range of 10.60%–10.38%, and the 01.11.33 maturity traded down the range of 10.60%–10.40%

At the weekly Treasury Bill auction held last Wednesday (10 December) the weighted average yields remained unchanged. Accordingly, the 91-day, 182-day and 364-day tenors were recorded at 7.51%, 7.91% and 8.03%, respectively. This marks the 21st consecutive week in which Treasury Bill yields have remained broadly anchored at prevailing levels. The auction was fully subscribed, with the entire Rs. 48 billion on offer successfully raised. Notably, this represents the first full subscription in six consecutive auctions. Total bids received amounted to 2.19 times the accepted amount, reflecting healthy investor demand.

The Treasury Bond auctions held last Thursday (11 December) too recorded strong outcomes as the longer-dated maturities were fully subscribed at the first phase, with yields accepted well within their respective pre-auction rate bands.

Maturity-wise auction results are summarized below:

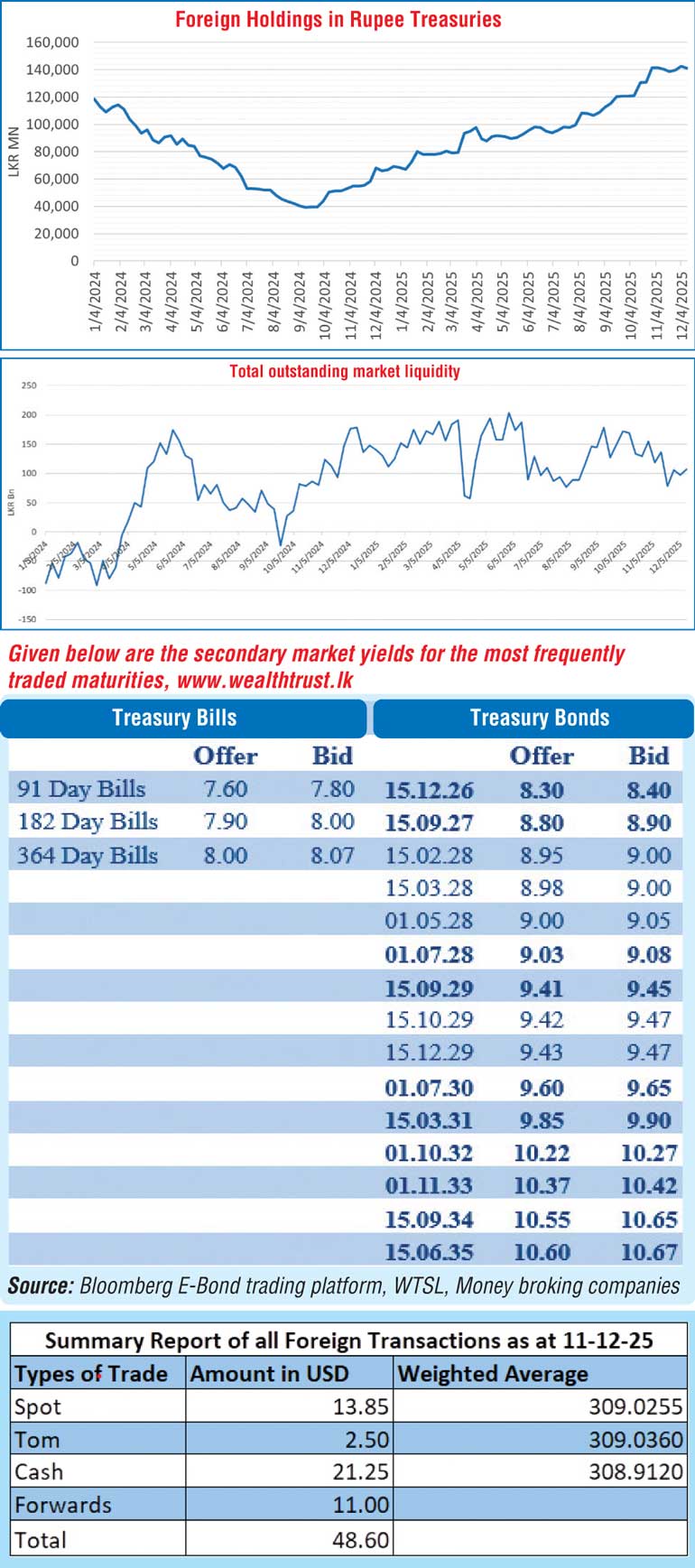

The foreign holdings of rupee-denominated Government securities recorded a net foreign outflow, amounting to Rs. 1.22 billion. Consequently, total holdings decreased to Rs. 141.23 billion.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 9.67 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 106.77 billion as at the week ending 12 December, 2025, from Rs. 96.90 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.94%-7.96% and 7.98%-8.01% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 12 December, unchanged against the previous week’s closing level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 309.05/309.15 as against the previous week’s closing level of Rs. 308.55/308.65. This was subsequent to trading at a high of Rs. 308.60 and a low of Rs. 309.35.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 61.18 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)