Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 10 November 2025 03:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

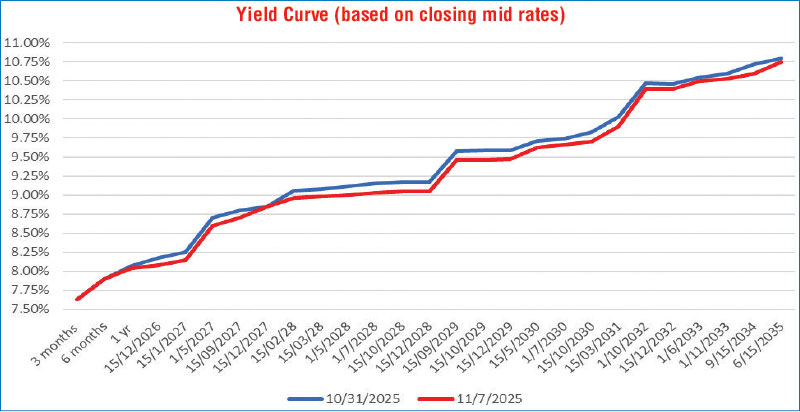

The secondary Government securities market commenced last week on a positive note, extending the momentum from the prior week’s rally. The surge in demand drove yields sharply lower, particularly across the 2026–2030 maturities, resulting in a further downward shift in the overall yield curve amid robust activity and volume levels.

The secondary Government securities market commenced last week on a positive note, extending the momentum from the prior week’s rally. The surge in demand drove yields sharply lower, particularly across the 2026–2030 maturities, resulting in a further downward shift in the overall yield curve amid robust activity and volume levels.

On Tuesday, the market consolidated at lower yield levels, with rates holding steady following the previous session’s decline. Trading activity and transaction volumes remained healthy, and several block trades were executed, indicating sustained investor interest at prevailing yields.

Following the midweek holiday, Thursday saw a fresh wave of buying interest, driving yields lower once again. Market activity remained vibrant.

By Friday, the week’s trend intensified, with aggressive buying interest prompting a further drop in yields. Trading volumes were seen at heightened levels, with a number of block transactions—particularly in the 2028–2033 segment, where yields recorded notable additional declines. As a result, the week concluded with secondary bond market two-way quotes and the yield curve closing lower on a week-on-week basis as the market remained positive for the second consecutive week.

The bullish market sentiment was supported by favourable developments as expressed during the 2026 Budget reading. The Budget statements outlined continued macro-fiscal discipline, resulting in policy continuity which has already resulted in actual fiscal over-performance in the year 2025.

The reading further indicated economic growth projected at 4-5%, Government revenue expected to exceed 15.4% of GDP and Government expenditure expected to be maintained at 20.5% of GDP for 2026. This is projected to result in a primary Budget balance of 2.5% and the Budget deficit maintained at 5.1% of GDP for 2026. Another positive development shared during the reading was the news Sri Lanka is expecting to restructure the defaulted debt of the national carrier by December.

In terms of the secondary bond market trade summary, the 15.05.26, 01.08.26, and 15.12.26 maturities were seen trading at the levels of 8.05%–8.00%, 8.05%, and 8.10% respectively.

Among the 2028 maturities, the 01.05.28 maturity was seen trading down the range of 9.15%–9.00%. The 01.07.28 maturity saw its yield decline from an intra-week high of 9.17% to a low of 9.00%. The 15.10.28 and 15.12.28 maturities were seen trading at lows of 9.05% each at the close of the week. Moving to the 2029 maturities, heavy buying interest was witnessed, resulting in yields dropping considerably during the week. The 15.06.29 maturity traded down the range of 9.55%–9.37%, while the 15.09.29, 15.10.29, and 15.12.29 maturities dropped from intraweek highs to lows of 9.55%–9.43%, 9.56%–9.45%, and 9.58%–9.46% respectively.

The 2030 maturities too saw robust demand, with the 15.05.30 and 01.07.30 maturities trading down the ranges of 9.78%–9.62% and 9.75%–9.63% respectively. The 2031 maturity, the 15.03.31 was seen trading down the range of 10.00%-9.90%. On the longer end, the 01.07.32 and 15.12.32 maturities traded lower at levels of 10.51% and within the range of 10.45%–10.40% respectively. The 01.11.33 maturity saw its yield decline down the range of 10.62%–10.55%, while the 15.09.34 maturity traded at the rate of 10.70%.

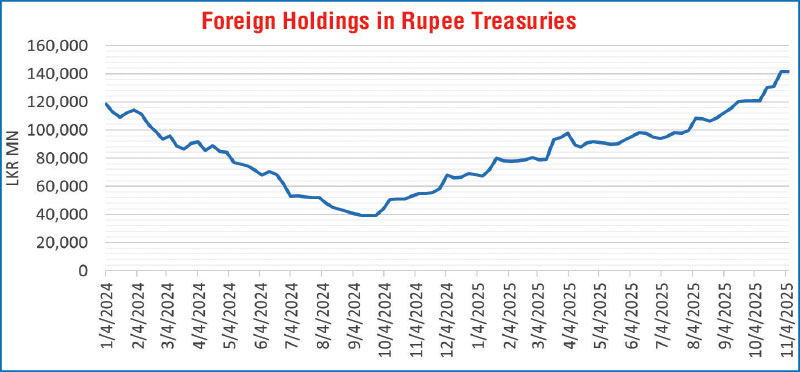

The foreign holdings of rupee-denominated Government securities held static last week, remaining unchanged at Rs. 141.32 billion as at the close of the week ending 6 November.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 13.99 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market reduced to Rs. 118.29 billion as at the week ending 7 November, from Rs. 155.05 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.90%-7.94% and 7.96%-7.97% respectively while the Central Bank of Sri Lanka's (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 7 November, unchanged against the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 304.80/304.90 as against the previous week’s closing level of Rs. 304.35/304.45. This was subsequent to trading at a high of Rs. 304.50 and a low of Rs. 305.15.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 119.7 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)