Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 30 October 2025 05:17 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

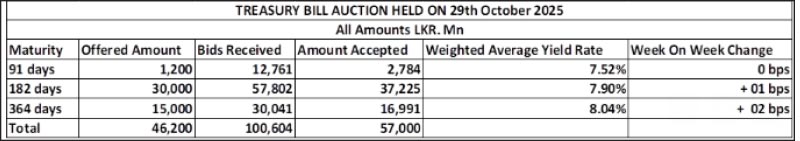

The weekly Treasury Bill auction was fully subscribed, successfully raising the entire Rs. 57 billion on offer. The bids received-to-offered amount ratio standing at 2.21 times. This marked the first auction to be fully subscribed in four weeks.

The weekly Treasury Bill auction was fully subscribed, successfully raising the entire Rs. 57 billion on offer. The bids received-to-offered amount ratio standing at 2.21 times. This marked the first auction to be fully subscribed in four weeks.

The weighted average rates held largely steady, with the yield on the 91-day tenor remaining unchanged at 7.52%. However, the 182-day and 364-day tenors registered marginal increases of 01 basis point to 7.90% and 02 basis points to 8.04% respectively. This marks the 15th week where T-Bill rates have stayed broadly anchored around prevailing levels.

The Phase II of subscription on for across all three tenors is now open until 3.00 pm of business day prior to settlement date (i.e., 30.10.2025) at the WAYRs determined for the said ISINs at the auction. See graph for details of the auction (Phase 1).

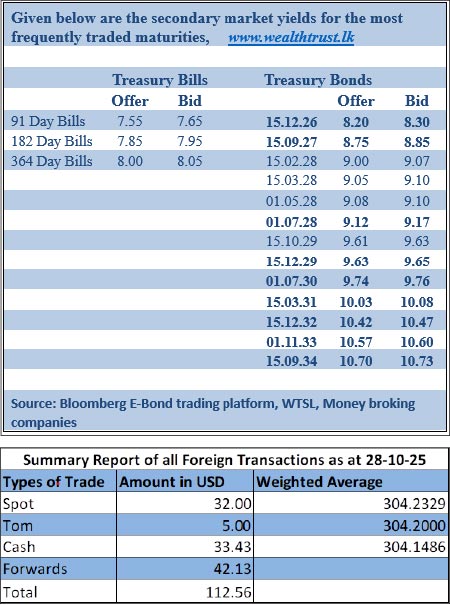

The secondary Bond market yesterday rallied for a second straight session, carrying over the bullish momentum from the previous day. This was spurred by the news of Sri Lanka’s outperformance in terms of all key fiscal metrics for the first three quarters of 2025, exceeding multiple IMF benchmarks.

The market opened with strong buying interest resulting in a further surge in activity and increased transaction volumes. Rates were seen dropping considerably on the back of robust demand seen across the yield curve.

A particular emphasis was placed on 2032 and other relatively longer tenor maturities which saw yields decline in the neighbourhood of 10 basis points. As a result, the secondary Bond market two-way quotes were seen closing the day lower.

In terms of the Secondary Bond market trade summary, the 15.03.28 maturity was seen trading down the range of 9.15%-9.10%. The 01.05.28 and 01.07.28 maturities were seen trading lower at the rates of 9.10% and 9.20% respectively.

The 15.06.29 maturity saw its yield decline from an intraday high of 9.60% to a low of 9.55%. The 15.10.29 and 15.12.29 maturities were seen trading down the ranges of 9.66%-9.61% and 9.63%-9.61% respectively.

The 15.05.30 maturity was seen trading at the rate of 9.73% and the 01.07.30 maturity was taken from 9.77% down to a low of 9.75%. The 15.12.32 maturity saw heavy action, with rates nose-diving from an intraday high of 10.58% to a low of 10.45%.

Similarly, the 01.11.33 maturity traded down from an intraday high of 10.63% to a low of 10.57%. The 15.09.34 maturity was seen trading down the range of 10.75% to 10.70%.

In the secondary Bills market, trades were observed on January, March/April/May, July and August 2026 maturities at the rates of 7.70%-7.65%, 7.92%-7.90%, 7.95% and 8.03% respectively prior to the conclusion of the T-Bill auction.

The total secondary market Treasury Bond/Bill transacted volume for 28 October was Rs. 15.60 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.89% and 7.93% respectively.

In money markets, the net liquidity surplus was recorded at Rs. 154.84 billion yesterday. An amount of Rs. 155.63 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 0.79 billion was withdrawn from the Central Banks SLFR (Standard Lending Facility Rate) of 8.25%.

Forex market

In the forex market, the USD/LKR rate on spot contracts to closed depreciating to 304.40/304.55 as against its previous day’s closing level of Rs. 304.10/304.25.

The total USD/LKR traded volume for 28 October 2025 was $ 112.56 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)