Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 18 August 2025 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Trading in the Secondary Bond market continued within a thin range during the week ending 15 August 2025. The volumes were moderate and concentrated in a few benchmarks.

Trading in the Secondary Bond market continued within a thin range during the week ending 15 August 2025. The volumes were moderate and concentrated in a few benchmarks.

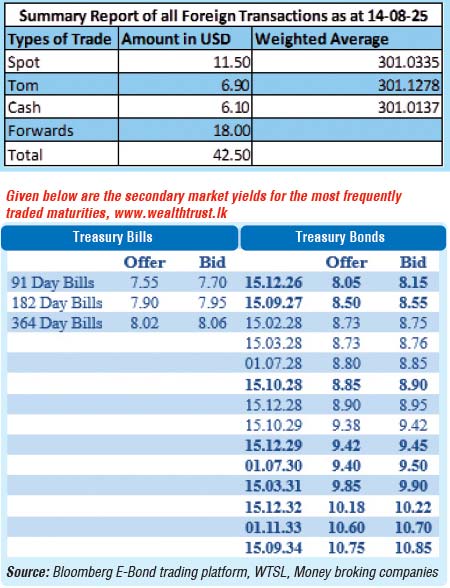

On the short end of the yield curve, the 01.05.27 and 15.09.27 maturities traded between 8.40%–8.35% and 8.50% respectively, while the 15.03.28, 01.05.28, and 01.07.28 maturities changed hands within 8.78%–8.75%, 8.80%, and 8.82% respectively. In the 2029 space, the 15.06.29 maturity traded at 9.30%-9.31%, while the 15.09.29 and 15.10.29 maturities ranged between 9.39%–9.35%, and the 15.12.29 maturity was active within 9.43%–9.39%. On the medium end of the curve, the 15.05.30 and 01.07.30 maturities were seen trading within 9.48%–9.45% and 9.45%–9.42% respectively. Further, the 15.03.31 maturity traded between 9.85%–9.80%, while the 15.12.32 maturity remained steady within 10.25%–10.20%.

To recap the Treasury Bond auctions last Tuesday (12 August) with a total offered amount of Rs. 65.00 billion across two available maturities, went undersubscribed. Maturity-wise the results were as follows:

The 01.01.32 maturity (8.00% coupon) was rejected at the 1st phase of the auction. This was despite bids received totalling Rs. 79.79 billion and exceeding the offered amount of Rs. 40.00 billion by 2.00 times. This marks the 1st instance since 12 September 2024 to see a particular maturity where all bids were rejected.

The 01.07.37 maturity (10.75% coupon) failed to raise the entire maturity-wise offered amount of Rs. 25.00 billion at the 1st phase, which prompted the opening of the 2nd phase. In total, 74.13% or Rs. 18.53 billion was raised in successful bids at a weighted average rate of 10.97%.

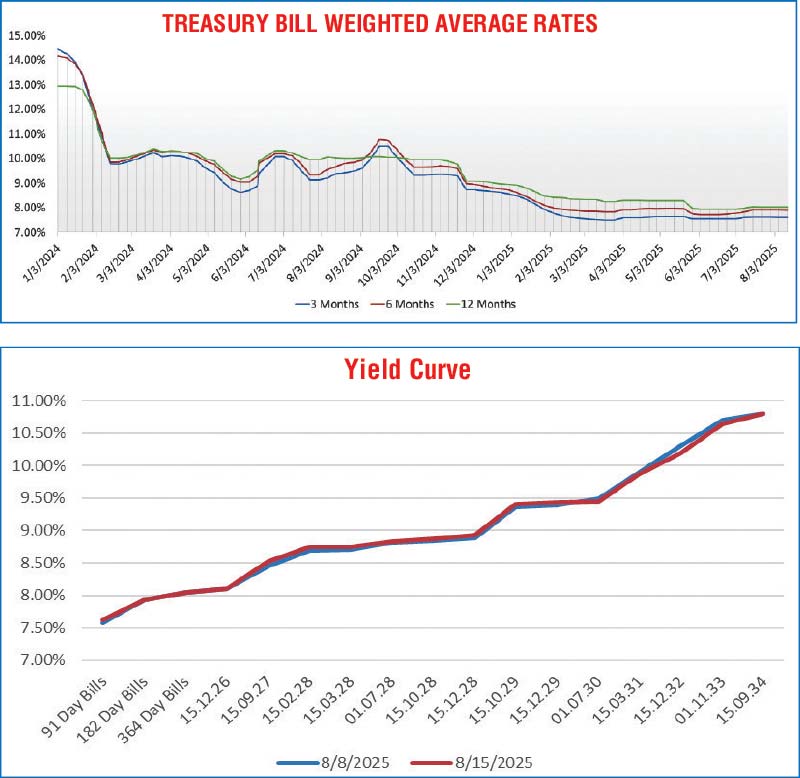

At the weekly Treasury Bill auction held last Wednesday, the weighted average yield rates dropped marginally. Accordingly, the weighted average rate on the 91-day tenor and the 182-day tenor registered declines of 01 basis point each to 7.60% and 7.90% respectively week-on-week. However, the 364-day tenor remained unchanged week-on-week at 8.03%. The auction raised the entire total offered amount of Rs. 103.50 billion at the 1st phase in competitive bidding. Total bids received exceeding the offered amount by 1.99 times. Notably, an additional amount of Rs. 10.35 million being the maximum aggregate amount offered was raised at phase II, out of the total market subscription of Rs. 14.34 billion.

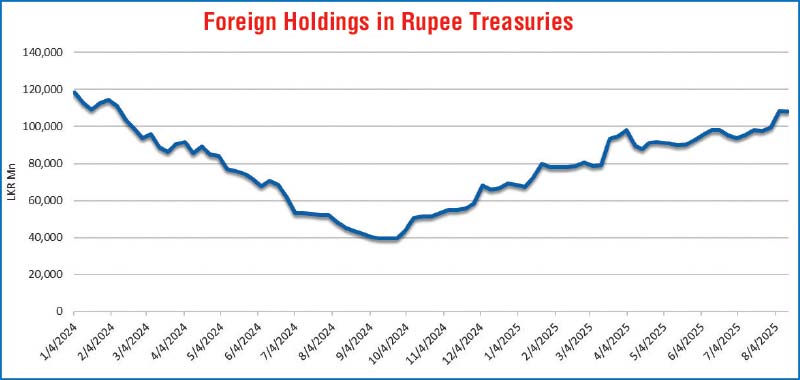

The foreign holding in Rupee Treasuries recorded a marginal net outflow, following two consecutive weeks of net inflows as at the week ending 14 August. As a result, the total holding reduced to Rs. 107.91 billion.

The daily secondary market Treasury Bond/Bill transacted volumes for the first three days of the week averaged at Rs. 11.32 billion.

In money market, the total outstanding liquidity surplus in the inter-bank money market held broadly steady to Rs. 88.33 billion as at the shortened week ending 7 August, 2025, from Rs. 88.52 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.85%-7.86% and 7.86% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at 15 August, 2025, unchanged against the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating to close the week at Rs. 300.90/301.05 as against the previous week’s closing level of Rs. 300.70/300.78, subsequent to trading at a high of Rs. 300.58 and a low of Rs. 301.39.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 67.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)