Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 27 May 2025 02:19 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The Secondary Bond market kicked off the week with yields continuing to decline, supported by strong buying interest. This extended last week’s rally following the Central Bank of Sri Lanka’s decision to cut the Overnight Policy Rate by 25 basis points. Market activity and transaction volumes were seen at robust levels.

The Secondary Bond market kicked off the week with yields continuing to decline, supported by strong buying interest. This extended last week’s rally following the Central Bank of Sri Lanka’s decision to cut the Overnight Policy Rate by 25 basis points. Market activity and transaction volumes were seen at robust levels.

The 15.12.26 maturity traded down the range of 8.40%-8.36%. The 01.05.27 and 15.09.27 maturities were seen trading at the rates of 8.75% and 9.00%, respectively. The 15.02.28 maturity saw its yield decline down the range of 9.35%-9.27%. The 15.10.28 and 15.12.28 maturities were seen trading lower at 9.50% and 9.55%, respectively. The 15.09.29 and 15.12.29 maturities were seen trading down the ranges of intraday highs to lows of 9.95%-9.88% and 10.03%-9.90%, respectively. The yield on the 15.03.31 maturity was seen declining from 10.45% to trade at 10.30%. Similarly, the 15.12.32 maturity traded down the range of 10.50%-10.40%.

In addition, the details of the upcoming Rs. 200 billion Treasury bond auction scheduled to be held on 29 May (this Thursday) were announced. The auction will be comprised of:

The settlement for which will be held on 2 June.

The total secondary market Treasury bond/bill transacted volume for yesterday (26 May) was Rs. 25.48 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 7.74% and 7.75%, respectively.

The net liquidity surplus stood at Rs. 192.21 billion yesterday. An amount of Rs. 0.01 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 192.22 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex market

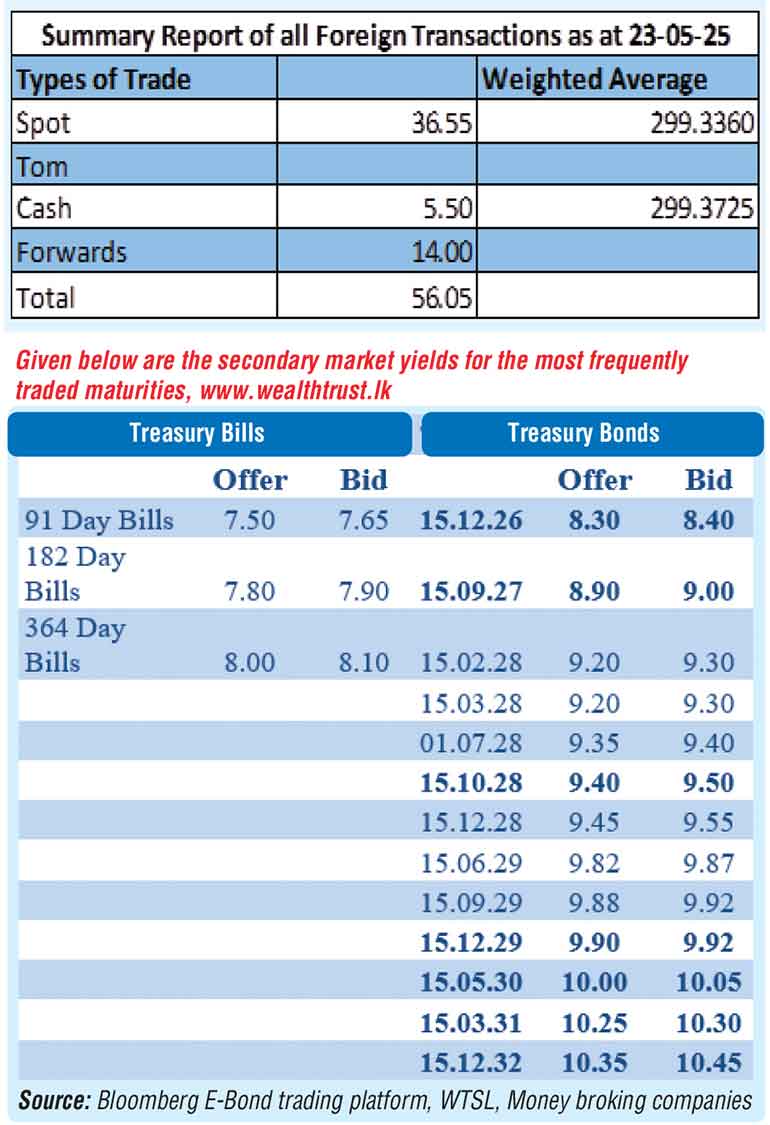

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating slightly to Rs. 299.70/299.90 as against 299.40/299.45 the previous day.

The total USD/LKR traded volume for 23 May was $ 56.05 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)