Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 31 October 2025 00:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday initially experienced marginal selling pressure on the back of profit-taking following the recent rally. However, this was quickly absorbed by strong buying interest kicking in, as any attractive offers were quickly snapped up by traders. Market sentiment remained enthusiastic, buoyed by the announcement that the US Fed had cut its monetary policy rates by a further 25 basis points. As a result, yields were seen consolidating at the newly established levels, and secondary market two-way quotes held firm by the close of the day. Activity and transaction volumes continued to be seen at healthy levels, albeit tapering off towards the end of the day.

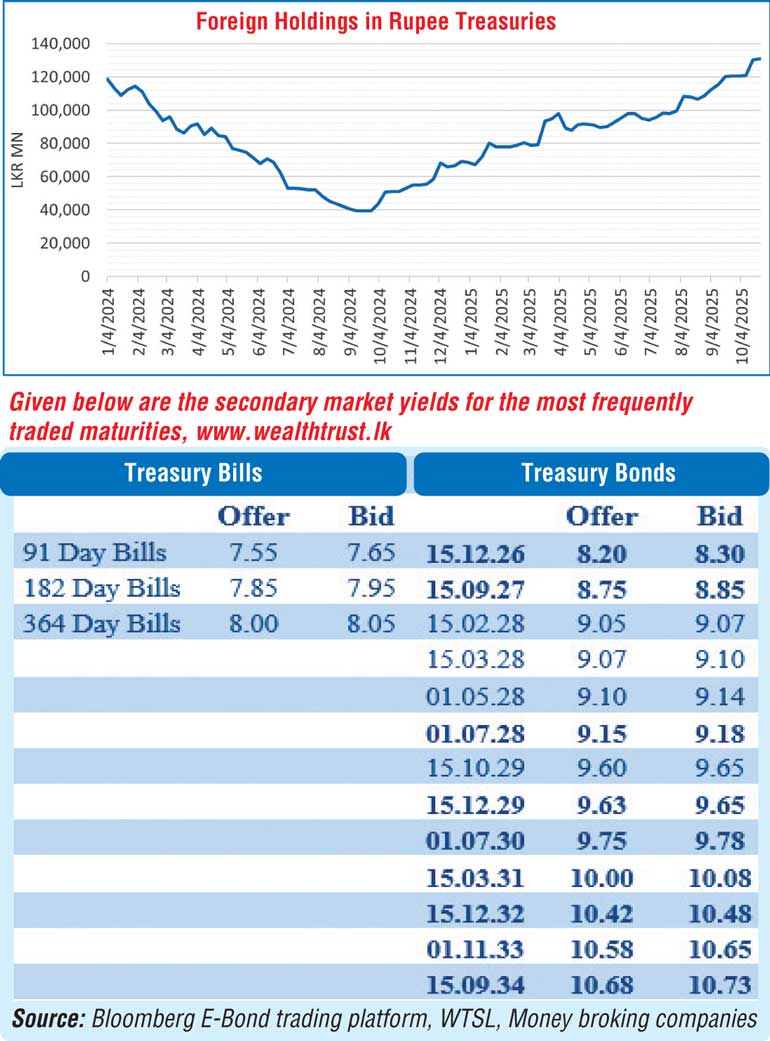

In terms of the secondary bond market trade summary, the 15.02.28 and 15.03.28 maturities were seen trading at the rates of 9.07% and 9.10%-9.09% respectively. The 01.05.28, 15.10.28 and 15.12.28 maturities traded at the rates of 9.13%-9.12%, 9.20% and 9.25% respectively. The 15.10.29 and 15.12.29 maturities were seen changing hands at the rates of 9.62% and 9.63% respectively. The 01.07.30 maturity traded at the rate of 9.77% and the 15.10.30 at 9.80%. The 01.11.33 maturity traded at the rate of 10.60%.

By a 10-2 vote, the US central bank’s Federal Open Market Committee lowered its benchmark overnight borrowing rate to a range of 3.75%-4%, marking the second straight cut at its October Meeting. In addition to the rate move, the Fed announced that it would be ending the reduction of its aggregate securities holdings – a process known as quantitative tightening – on 1 December. Further the CME Group’s Fedwatch Tool indicated an approximately 70% probability of a further rate cut in December.

For context, these developments come against the backdrop of a U-shaped recovery in foreign holdings of rupee-denominated Government securities. As of last week (23 October 2025), total foreign holdings in Government Securities had risen to Rs. 130.96 billion, the highest level in nearly two years since mid-November 2023. This trend underscores a robust rebound in foreign investor appetite for domestic Treasury bills and bonds, up 233% from a low of Rs. 39.38 billion recorded in September 2024.

The total secondary market Treasury Bond/Bill transacted volume for 29 October of 2025 was Rs. 29.35 billion.

In money markets, the net liquidity surplus was recorded at Rs. 153.72 billion yesterday. An amount of Rs. 154.52 billion was deposited at Central Banks SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 0.80 billion was withdrawn from the Central Banks SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on call money and repo were registered at 7.89% and 7.92% respectively.

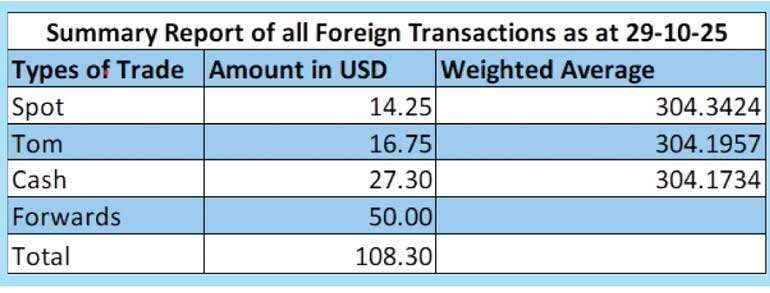

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts closed appreciating slightly Rs. 304.35/304.45 yesterday as against its previous day’s closing level of 304.40/304.55.

The total USD/LKR traded volume for 29 October 2025 was $ 108.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)