Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 13 October 2025 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market opened last week on a subdued note, with overall activity remaining muted and turnover largely driven by selective trades. Buying interest was concentrated on the longer end of the curve, particularly in the 2034–2035 maturities, helping sustain healthy turnover levels despite the quiet tone. Yields held broadly steady, after picking up to elevated levels the week prior, across the curve, barring a further marginal uptick on the 2029 tenors.

Midweek sessions saw the market remain at a virtual standstill, apart from sporadic bouts of activity on selected maturities. Yields continued to hold broadly steady and consolidated around prevailing levels, as market participants adopted a wait-and-see mode amid the absence of strong directional cues. This underscored the broader tone of a lacklustre sentiment that characterized trading through the week.

As the week drew to a close, the market initially opened Friday on a sideways footing before renewed buying interest emerged during later trading hours, driving yields lower on the 2029 maturities. This change in direction was accompanied by a relatively marked increase in activity and transaction volumes.

Overall, the recovery in sentiment saw two-way quotes close the week lower on a week-on-week basis on the 2026-2029 sections, ahead of the Treasury Bond auction scheduled for the 13th of October.

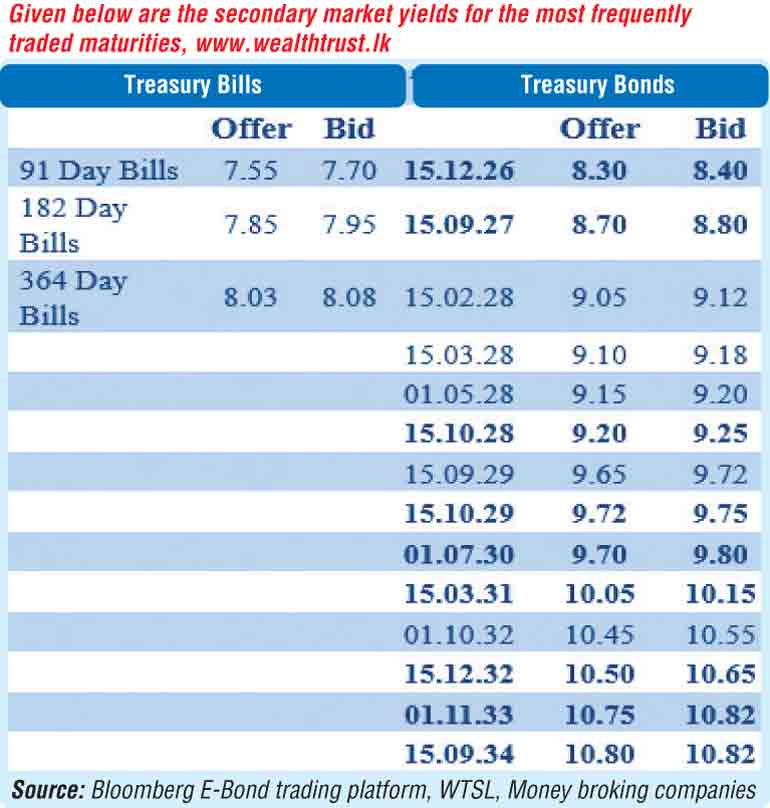

In terms of the weekly secondary bond market trade summary, during the week the 01.08.26 maturity was seen trading at the rate of 8.30% and the 01.05.27 maturity was seen trading at the rate of 8.76%. The 15.03.28 maturity was seen trading at 9.14% and 15.10.28 maturity was seen trading at the rate of 9.25%.

The 2029 tenors saw rates see-saw during the week, initially picking up and then dropping on renewed buying. The 15.09.29, 15.10.29 and 15.12.29 maturities saw rates decline from intraweek highs to lows of 9.76%-9.73%, 9.73%-9.67% and 9.75%-9.70% respectively.

The 01.07.30 maturity was observed trading at the rate of 9.78% during the week. Earlier in the week the relatively longer duration bonds - the 15.09.34 maturity traded at the rates of 10.82%-10.79% and 15.06.35 maturity within the range of 10.90%-10.87%.

The round of auctions will have a total offered amount of Rs 181.00 billion across three available maturities.

The auction will be comprised of:

nRs. 95 billion from a 1 July 2030 maturity bearing a coupon rate of 09.75%.

nRs. 45 billion from a 1 November 2033 maturity bearing a coupon rate of 09.00%.

nRs. 41 billion from a 1 July 2037 maturity bearing a coupon rate of 10.75%.

The settlement for the auction will be held on 15th October 2025.

For context, the previous round Treasury Bond auctions held on the 11 September which had a total offered amount of Rs 155 billion across three available maturities, went undersubscribed. The auctions raised only Rs. 116.161 billion or 74.94% out of the total offered amount in successful bids across both phases, despite total bids received exceeding the offered amount by 1.75 times. That marked the fifth consecutive bond auction to raise less than the offered amount. Maturity-wise the results were as follows:

The 01.07.30 maturity (9.75% coupon) maturity was issued at the weighted average rate of 9.76%. However, it failed to achieve the maturity-wise target offered amount of Rs 85 billion at the 1st phase in competitive bidding.

The 01.10.32 maturity (10.75% coupon) was issued at the weighted average rate of 10.45%. The entire maturity-wise offered amount of Rs 25 billion was raised at the 1st phase in competitive bidding. The longer tenor 15.06.35 maturity (10.70% coupon) was issued at the weighted average rate of 10.96%. The entire maturity-wise offered amount of Rs 45 billion was raised at the 1st phase in competitive bidding.

Meanwhile, at the weekly Treasury bill auction held last Wednesday (08th October), the weighted average rates held largely steady, with the exception of the 91-day maturity which registered a further drop of 01-basis point.

The 182-day and 364-day tenors remained unchanged at 7.89% and 8.02% respectively. This marks the 12th week where T-Bill rates have stayed broadly anchored around prevailing levels. Nevertheless, the auction went undersubscribed. Only 57.10% or Rs 19.13 billion out of the Rs 33.5 billion targeted offered amount was raised. This was despite the bids received to offered amount ratio standing at 1.59 times

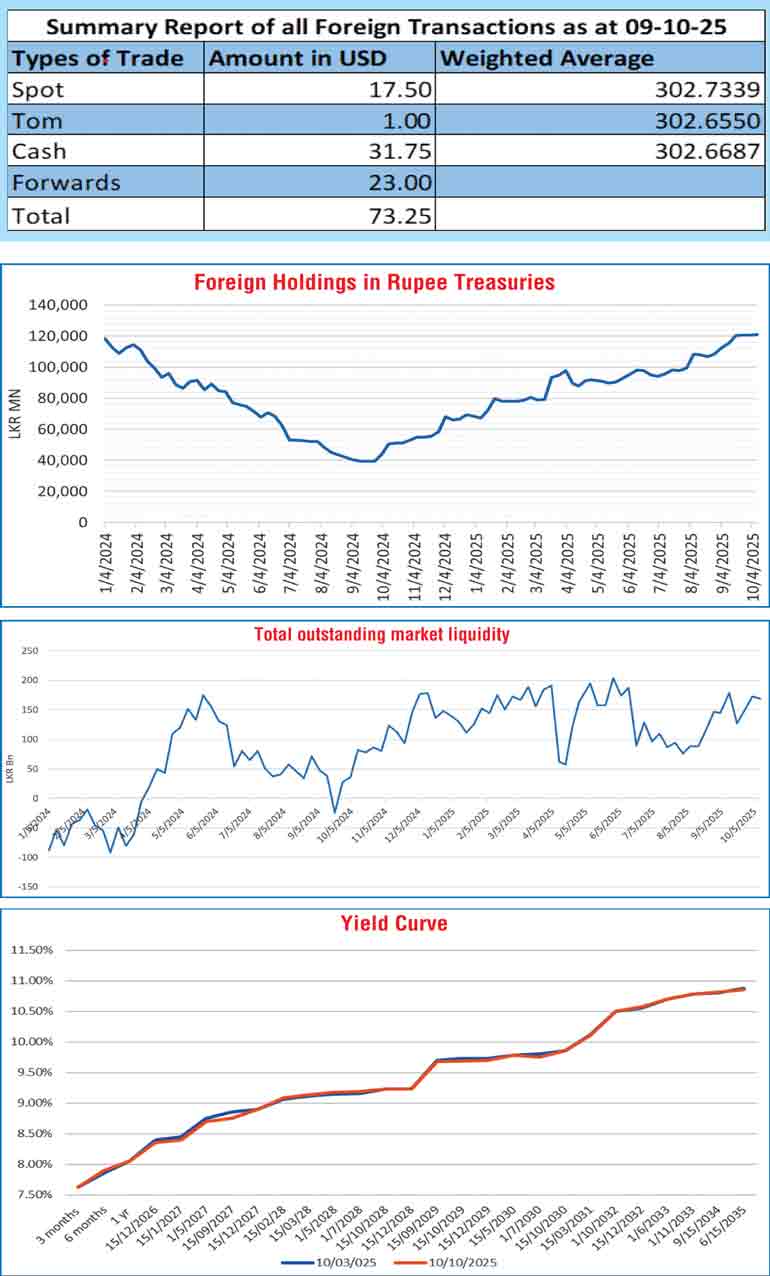

Foreign holdings of rupee-denominated Government securities increased marginally last week, recording a net inflow of Rs. 325 million during the week ending 7 October, reversing a marginal dip the prior week. The previous week recorded a very marginal net outflow, which briefly interrupted a five-week streak of inflows preceding that. As a result, total foreign holdings rose to Rs. 120.92 billion by the end of the week. In the money market, the total outstanding liquidity surplus in the inter-bank money market dipped marginally to Rs. 169.15 billion as at the week ending 10 October, 2025, from Rs. 173.36 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the ranges of 7.87% and 7.88%-7.89% respectively while the Central Bank of Sri Lanka (CBSL) holding of Government securities was registered at Rs. 2,508.92 billion as at 10 October, unchanged against the previous week’s closing level.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 10.07 billion.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating marginally to Rs. 302.60/302.68 as against the previous week’s closing level of Rs. 302.45/302.50. However, this was subsequent to trading at a high of Rs. 302.44 and a low of Rs. 302.80.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 120.28 million.

(References:

Central Bank of

Sri Lanka, Bloomberg E-Bond trading

platform, Money

broking companies)