Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 17 November 2025 00:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securitas

The secondary Bond market last week started off and maintained a broadly positive tone throughout the week, supported initially by strong bullish momentum and the announcement of a $ 100 million ADB financing package aimed at strengthening Sri Lanka’s macroeconomic stability.

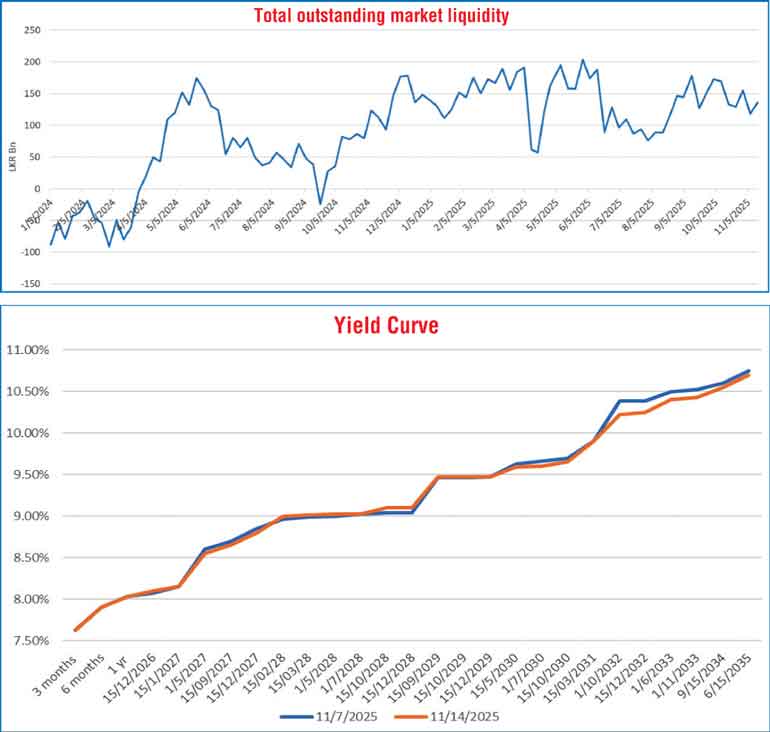

Early in the week, robust buying interest drove yields lower across the curve, particularly in the 2028–2033 maturities. As the week progressed, yields largely consolidated at these lower levels, with activity and transaction volumes remaining healthy. Subsequently, market sentiment shifted to a cautious, wait-and-see mode ahead of back-to-back Treasury Bill and Bond auctions, resulting in mostly sideways trading within narrow bands.

Mid- to late-week trading saw yields fluctuate modestly, with brief upward adjustments followed by renewed interest. By Friday, the market experienced selling pressure as profit-taking kicked in, which caused short-end yields to edge up to close the week steady.

However, the longer end of the yield curve (2030 tenors and beyond) closed notably lower week-on-week. This resulted in a flattening of the yield curve and a downward shift on the long end. This showcased increased appetite for longer tenors among market participants.

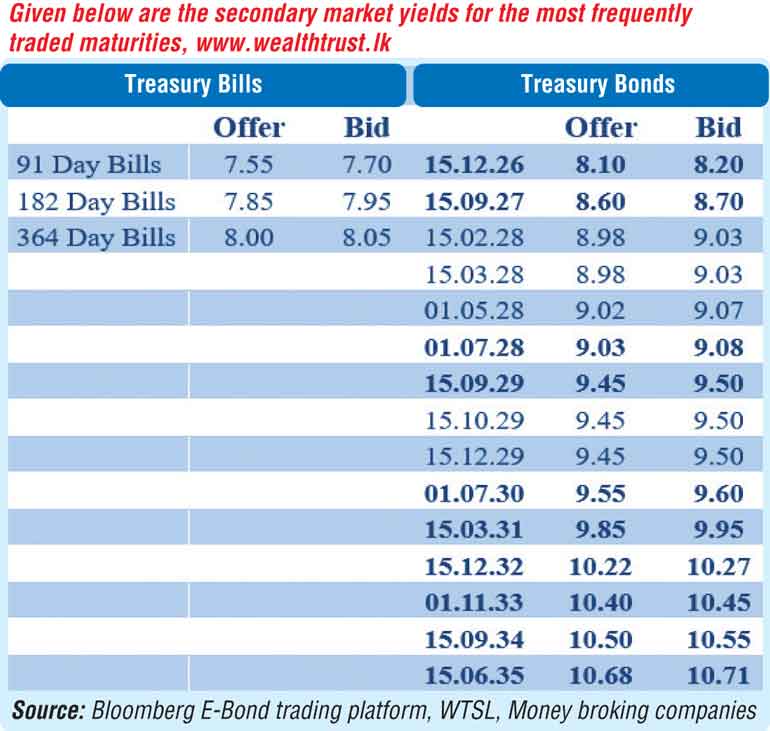

In terms of the secondary bond market trade summary, the 15.12.26 maturity was seen trading at 8.12%, while the 01.05.27 maturity traded between 8.56%-8.50% during the week. Among the 2028 maturities, the 15.02.28 and 15.03.28 maturities were seen trading rates of 8.90% and 9.00%–8.90% respectively, while the 01.05.28 maturity traded between 8.93%–8.95%. The 01.07.28 and 15.10.28 maturities were seen trading within 9.00%–8.94% and 9.07%–8.99% respectively.

Moving on to the 2029 maturities, the 15.06.29 maturity traded within 9.35%–9.33%, while the 15.09.29, 15.10.29, and 15.12.29 maturities were seen trading between 9.48%–9.39%, 9.48%–9.40%, and 9.45%–9.40% respectively. The 15.05.30 and 01.07.30 maturities were seen trading between 9.63%–9.55% and 9.60%–9.54% respectively, while the 15.03.31 maturity traded within the range of 9.90%–9.79%.

On the longer end, the 01.07.32, 01.10.32 and 15.12.32 maturities were seen trading from highs of 10.40%, 10.30% and 10.35% respectively to lows of 10.25%, 10.18%, and 10.20%. The 01.11.33 maturity traded from highs of 10.53% to lows of 10.40%, while the 01.06.33 maturity traded within a narrow band of 10.42%–10.40%. The 15.09.34 maturity was seen trading at levels of 10.56%–10.55%.

At the weekly Treasury bill auction held last Wednesday (12 November) the weighted average rates remained broadly steady, with the yields on the 91-day and the 364-day tenors remaining unchanged at 7.52% and 8.04% respectively. However, the 182-day tenor registered a marginal increase of 01 basis point to 7.91%.

This marks the 17th week where T-Bill rates have stayed broadly anchored around prevailing levels. However, the auction was undersubscribed, raising only 56.25% or Rs 43.31 billion out of the Rs 77 billion offered. This marks the second consecutive auction to undersubscribed. The bids received to offered amount ratio stood at 1.44 times.

This was followed by a round of Treasury Bond auctions held last Thursday (13 November) offering Rs 80 billion across two maturities. Both maturities were fully accepted at the first phase in competitive bidding, with total bids exceeding the offer by 2.73 times. This marked the first successful full uptake in seven consecutive auctions and reflected the strong bullish sentiment following recent secondary market rallies.

The 01.07.30 maturity (9.75% coupon) was issued at a weighted average rate of 9.56%. For context, this was down from 9.80% at last month’s auction when this maturity was previously issued and in line with pre-auction market quotes. The 15.06.35 maturity (10.70% coupon) cleared at 10.69%, showing a notably narrow term premium relative to the 15.09.34 maturity which was actively quoted at 10.55%/10.60% at the time of the auction.

The demand for bonds extended to the Direct Issuance Window where Rs. 8 billion (10% of the aggregate amount offered at the 1st phase) being the maximum amount offered was raised out of a total market subscription of Rs. 10.72 billion.

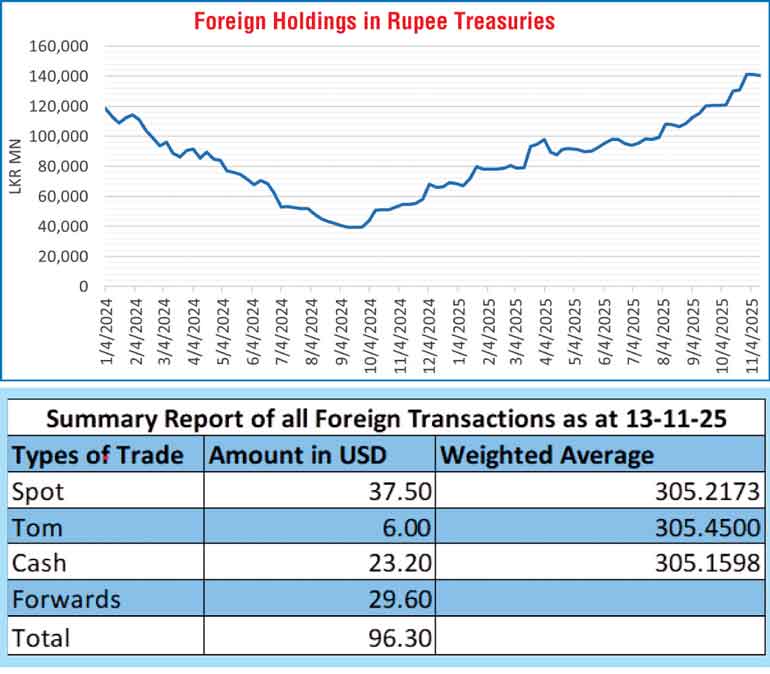

The foreign holdings of rupee-denominated Government securities recorded a net outflow amounting to Rs. 920 million last week and as a result the total holdings dropped to Rs. 140.40 billion as at the close of the week ending 13 November.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 22.09 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market increased to Rs. 136.12 billion as at the week ending 14 November, 2025, from Rs. 118.29 billion recorded the previous week.

The weighted average interest rates on call money and repo were recorded within the ranges of 7.90%-7.94% and 7.95%-7.96% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,508.92 billion as at the November 14th, 2025, unchanged against the previous week’s closing level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 306.90/307.20 as against the previous week’s closing level of Rs. 304.80/304.90. This was subsequent to trading at a high of Rs. 304 and a low of Rs. 307.05.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 91.42 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)