Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 26 June 2025 00:08 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

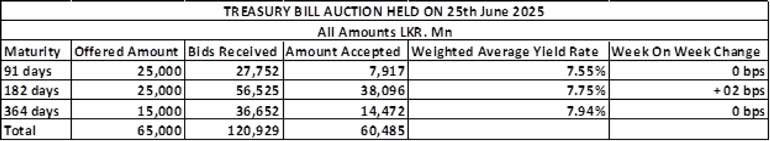

The weekly Treasury Bill auction conducted yesterday went undersubscribed for a second consecutive week as only an amount of Rs. 60.49 billion or 93.05% of the total offered volume of Rs. 65.00 billion was accepted in successful bids. The total bids received exceeded the offered amount by 1.86 times.

The weekly Treasury Bill auction conducted yesterday went undersubscribed for a second consecutive week as only an amount of Rs. 60.49 billion or 93.05% of the total offered volume of Rs. 65.00 billion was accepted in successful bids. The total bids received exceeded the offered amount by 1.86 times.

Interestingly, the weighted average yield rate on the 182-day tenor increased by 02 basis point to 7.73%. However, the weighted average yield rate on the 91-day tenor and 364-day tenors remained steady at 7.55% and 7.94% respectively.

The Phase II subscription for the 91-day and 364-day tenors is now open until 3 pm of business day prior to settlement date (i.e., 26.06.2025) at the WAYRs determined for the said ISINs at the auction.

The Phase II subscription for the 91-day and 364-day tenors is now open until 3 pm of business day prior to settlement date (i.e., 26.06.2025) at the WAYRs determined for the said ISINs at the auction.

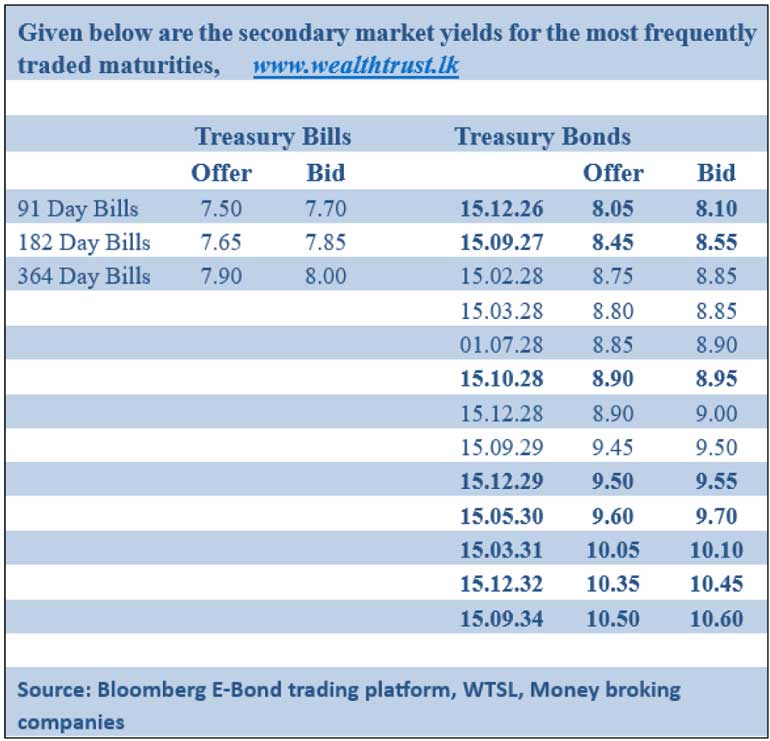

Meanwhile, the Secondary Bond market saw yields continue to decline, marking a significant recovery from the highs seen earlier in the week as the Israel-Iran truce continued to hold. Market activity and transaction volumes were observed healthy levels.

The 01.08.26 and 15.12.26 maturities traded at the rates of 8.02% and 8.10% respectively. The 15.10.27 maturity traded at the rate of 8.60%. The 15.03.28 and 01.05.28, 01.09.28 and 15.10.28 maturities were seen trading at the rates of 8.82%, 8.95%-8.85%, 8.91% and 8.93% to 8.95% respectively. The 15.09.29 and 15.12.29 maturities traded down the ranges of 9.52%-9.47% and 9.55%-9.52% respectively. The 01.07.32 maturity traded within the range of 10.55%-10.60%.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.74% and 7.75% respectively, while the net liquidity surplus stood at Rs. 116.56 billion.

Forex market

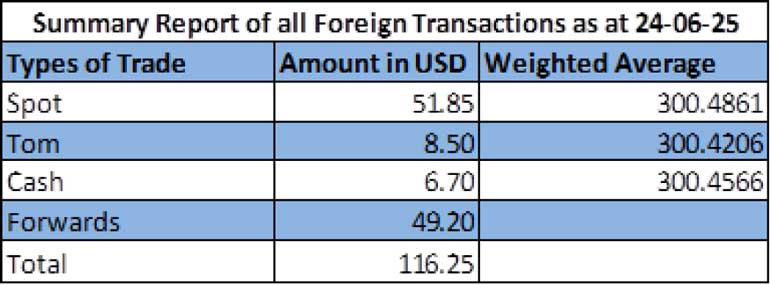

In the Forex market, the USD/LKR rate on spot contracts appreciated further to close Rs. 300.05/300.15 as against its previous day’s closing level of Rs. 300.50/300.60.

The total USD/LKR traded volume for 24 June was $ 116.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)