Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 11 February 2026 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market sustained its positive tone yesterday, building on the previous session’s momentum, as yields continued to edge lower across key maturities. Trading interest remained predominantly skewed towards the belly-to-long end of the curve, with strong demand observed for tenors between 2029 and 2037, exerting further downward pressure on yields.

Meanwhile, the short end of the curve remained largely range-bound, resulting in continued consolidation at the front end. Overall market activity remained strong, with transaction volumes recorded at robust levels.

Accordingly, the 01.08.26 maturity traded at the rate of 8.10%. The 01.05.27 maturity traded at the rate of 8.50%. The 15.03.28, 01.05.28, 15.10.28 and 15.12.28 maturities were seen trading at the rates of 8.98%, 9.00%, 9.10%-9.07% and 9.12%. The 15.06.29 and 15.10.29 maturities were seen trading at the rates of 9.45%-9.42% and 9.50% respectively.

The 01.03.30 maturity traded within the range of 9.65%-9.60% and the 01.07.30 maturity at the rate of 9.65%. The 15.03.31 maturity traded down the range of 9.85%-9.80%. The 01.10.32 maturity traded at the rate of 10.15%. The 01.06.33 maturity traded at the rate of 10.50%. The 15.06.34 maturity traded within the range of 10.66%-10.65%. The 15.06.35 maturity traded lower at the rate of 10.75%. The 01.07.37 maturity traded at the rate of 10.95%.

The weekly Treasury Bill auction scheduled for today (11) will have on offer a total amount of Rs. 90 billion. The auction will be comprising of Rs. 20 billion in 91-day bills, Rs. 50 billion in 182-day bills, and Rs. 20 billion in 364-day bills. The offered amount is below the maturing volume, which is estimated at around Rs. 91.50 billion.

For context, the weekly Treasury bill auction held last Tuesday (3), registered a positive outcome and saw yields continue to trend downwards. Accordingly, weighted average rates registered declines across all maturities for the third consecutive week. The rate on 91-day bill declined 4 basis points to 7.80%, while the rate on the 182-day bill dropped 9 basis points to 8.17%. The 364-day bill saw its yield ease by 3 basis points to 8.33%. However, the auction was undersubscribed, raising only Rs. 89.82 billion or 74.85% out of the Rs. 120 billion offered at the first phase in competitive bidding.

Nevertheless, demand extended to the second phase where Rs. 42.18 billion was raised, out of the total market subscription of a staggering Rs. 158.88 billion. Accordingly, the aggregate accepted amount of the issuance was Rs. 132,000 million – not only bridging the shortfall at the first phase, but also raising an additional 10% on top.

The total secondary market Treasury Bond/Bill transacted volume for 9 February was Rs. 26.87 billion.

In money markets, the net liquidity surplus remained elevated and was recorded at Rs. 282.22 billion yesterday. An amount of Rs. 282.62 billion was deposited at Central Banks SDFR (Standing Deposit Facility Rate) of 7.25% as against an amount of Rs. 0.40 billion withdrawn from the Central Banks SDFR (Standing Deposit Facility Rate) of 8.25%.

The weighted average rates on overnight call money and Repo stood at 7.68% and 7.72% respectively.

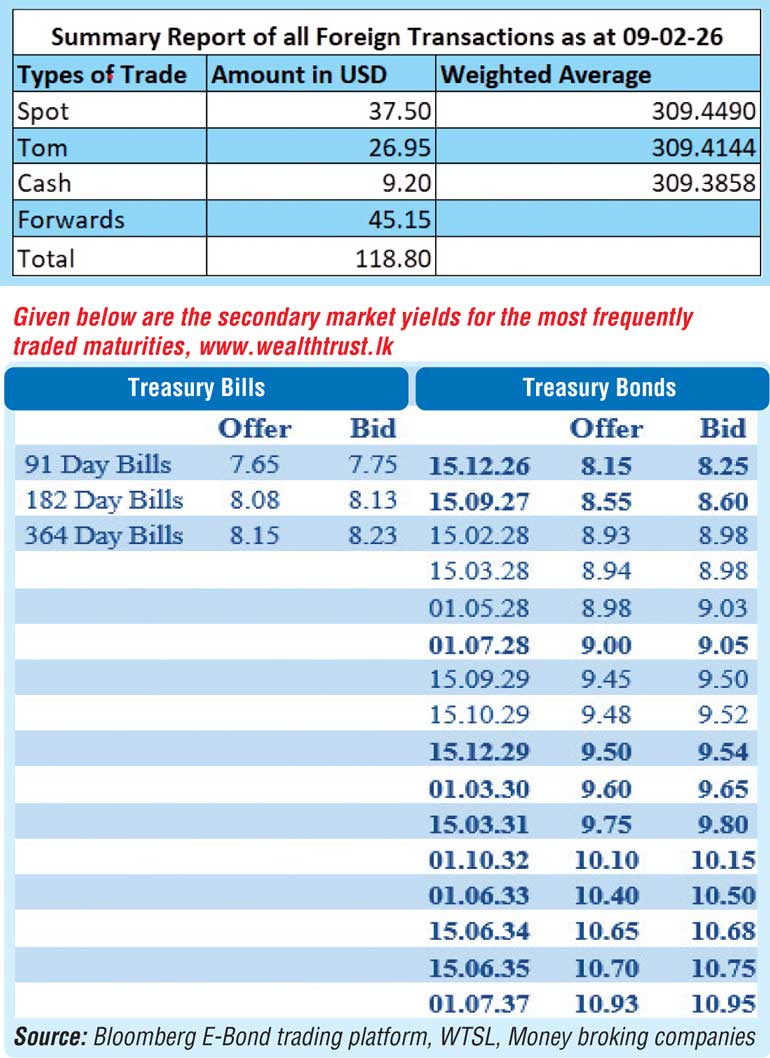

Forex Market

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day at Rs. 309.40/309.45 as against its previous day’s closing level of

Rs. 309.43/309.50.

The total USD/LKR traded volume for 9 February 2026 was

$ 118.80 million.

(References: Public Debt Management Office - Ministry of Finance, Central Bank of Sri Lanka, Bloomberg E-Bond Trading Platform, Money Broking Companies)