Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 26 January 2026 04:45 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market delivered a strong performance last week, with yields trending lower amid a marked improvement in system liquidity and a corresponding decline in money market rates. The positive momentum was sustained throughout, underpinned by steady, balance-sheet driven institutional demand.

The secondary Bond market delivered a strong performance last week, with yields trending lower amid a marked improvement in system liquidity and a corresponding decline in money market rates. The positive momentum was sustained throughout, underpinned by steady, balance-sheet driven institutional demand.

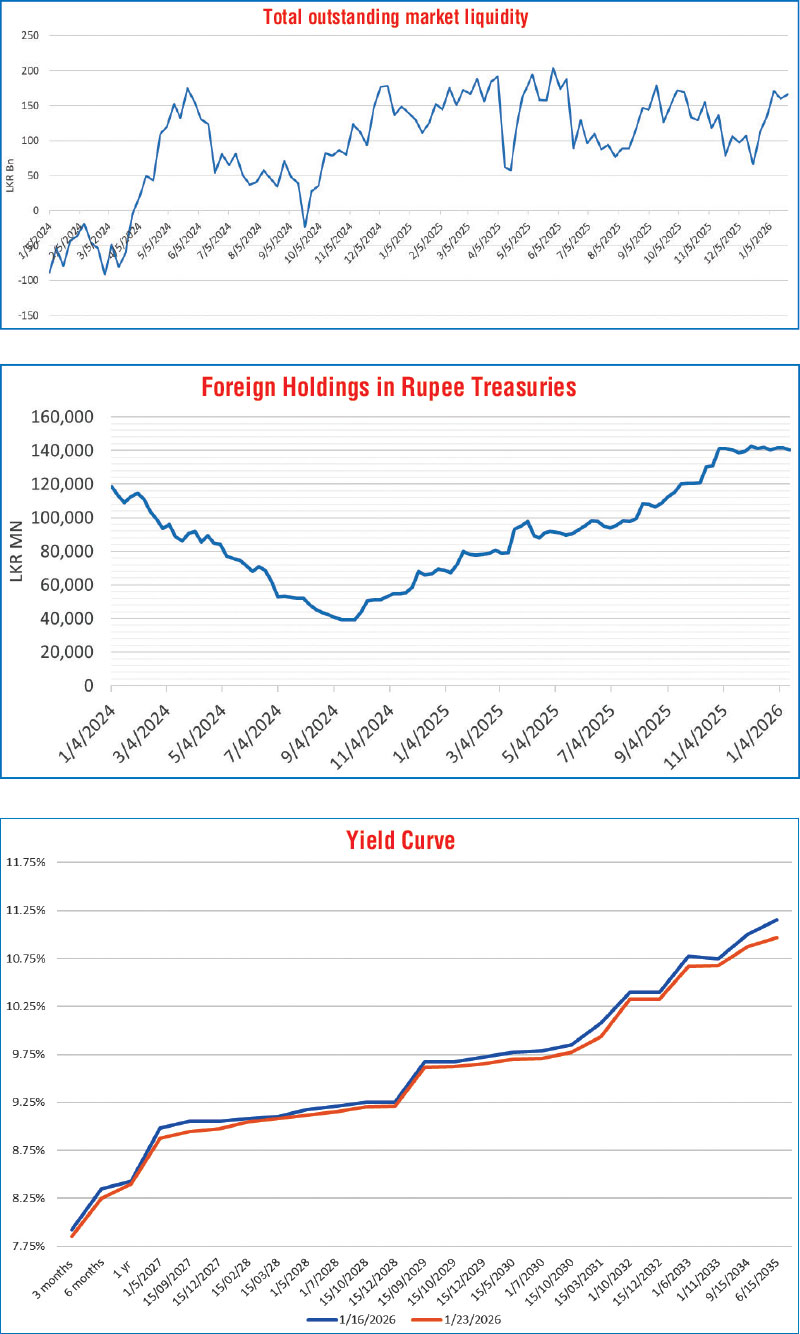

The overnight money market liquidity reached a six month high, exceeding Rs. 200 billion during the week and remained high throughout the week. The abundant liquidity environment translated into lower overnight call money and repo rates while the weekly T-Bill auction also witnessed a decline in rates, which helped anchor the short end of the yield curve, inducing a downward adjustment across the yield curve. Against this backdrop, Bond yields declined across key maturities, while market activity and transaction volumes remained consistently healthy.

Momentum strengthened further towards the latter part of the week, with aggressive buying pressure pushing yields lower. Market sentiment was additionally supported by policy-related optimism and positive external developments, reinforcing confidence in the prevailing rate environment and the medium-term outlook.

Overall, the week reflected a continued recovery in the secondary Bond market, driven by supportive liquidity conditions, easing rates, constructive policy signals, and a favourable external backdrop. As a result, the yield curve was observed registering a downward shift on a week-on-week basis.

In terms of the secondary Bond market trade summary: During the week, the 15.05.26 maturity traded down the range of 8.35%–8.30%. The 01.05.27 maturity traded within 8.95%–8.90%, while the 15.09.27 maturity traded within 8.95%–8.93%.

Moving into the 2028 tenors, the 15.02.28 maturity traded at 9.05%, while the 15.03.28 maturity traded down from 9.10% to 9.06%. The 01.05.28 maturity traded down the range of 9.15%–9.11%, while the 01.07.28 maturity traded at 9.15%. The 01.09.28 maturity traded at 9.18%, while the 15.10.28 maturity traded at 9.20%. The 15.12.28 maturity traded within 9.22%–9.20%.

Further along the curve, the 15.06.29 maturity traded down the range of 9.60%–9.55%. The 15.09.29 maturity traded down the range of 9.68%–9.60%, while the 15.10.29 maturity traded within 9.65%–9.60%. The 15.12.29 maturity traded within 9.68%–9.62%.

On the medium-to-long end, the 01.03.30 maturity traded down the range of 9.76%–9.70%, while the 01.07.30 maturity traded within 9.72%–9.70%. The 15.03.31 maturity traded down the range of 10.10%–9.95%. The 01.10.32 maturity traded down the range of 10.30%–10.27%. The 01.06.33 maturity traded down the range of 10.75%–10.65%, while the 01.11.33 maturity traded at 10.70%. At the long end, the 15.06.35 maturity traded down the range of 11.15%–10.98%, supported by block buying and sizeable transaction volumes.

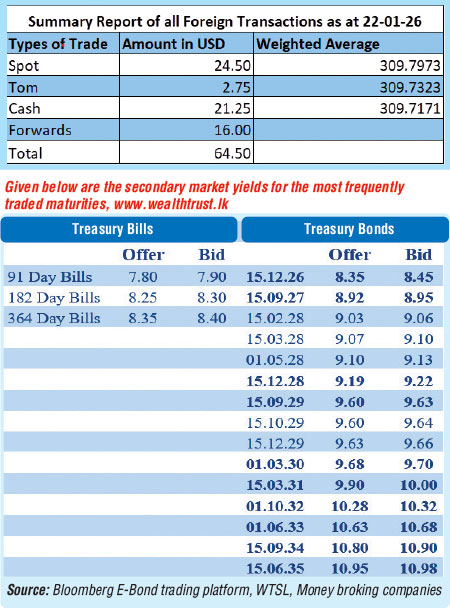

At the weekly Treasury Bill auction held last Wednesday (21), weighted average yields declined across all maturities, reversing the upward trend seen over the previous four consecutive weeks. The weighted average yield on the 91-day Bill eased by 2 basis points to 7.93%, while the 182-day Bill recorded a sharper decline of 8 basis points to 8.36%. Meanwhile, the 364-day Bill edged down marginally by 1 basis point to 8.47%.

Despite the auction being marginally undersubscribed at the first phase, investor appetite remained strong, with total bids reaching 2.81 times the offered volume. The Public Debt Management Office raised Rs. 112.48 billion, representing 89.99% of the Rs. 125 billion on offer during competitive bidding. Notably, the full acceptance of the offered amounts in both the 91-day and 182-day maturities highlighted robust demand at the short end of the curve. Subsequently, strong demand was also observed at Phase 2, where Rs. 25.02 billion was raised across all three tenors out of a total market subscription of Rs. 116.41 billion, reflecting a heavily oversubscribed Phase 2 issuance. As a result, the total accepted amount across both phases reached Rs. 137,500 million.

Meanwhile, the foreign holdings of rupee-denominated Government Securities recorded a net outflow for the second consecutive week, amounting to Rs. 550 million. Consequently, the total holdings reduced to Rs. 139.93 billion during the week ending 22 January.

The daily secondary market Treasury Bond/Bill transacted volumes for the first three days of the week averaged at Rs. 31.90 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank market stood at Rs. 166.13 billion as at the week ending 23 January 2026, increasing from Rs. 160.19 billion recorded the previous week. Notably, during the week, liquidity conditions strengthened significantly — on Tuesday, the liquidity surplus rose to a near six-month high of Rs. 200.77 billion, pushing the average daily overnight liquidity surplus for the week up to Rs. 181.92 billion.

Meanwhile, the weighted average interest rates on call money and repo were recorded at 7.76% and 7.77%, respectively, at the close of the week ending 23 January, down from 7.94% and 7.97% in the previous week. This marks a notable decline from the recent highs observed toward the end of December, when Call Money and Repo rates were recorded at 8.04% and 8.06%, respectively.

The Central Bank of Sri Lanka’s (CBSL) holdings of Government securities stood at Rs. 2,508.92 billion as at 23 January, remaining unchanged from the previous week’s closing level.

Forex market

In the forex market, the USD/LKR rate on spot contracts was seen closing the week broadly steady at Rs. 309.76/309.80 as against the previous week’s closing level of Rs. 309.70/309.80. This was subsequent to trading at a high of Rs. 309.55 and a low of Rs. 309.85.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 72.47 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)