Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 29 October 2025 04:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market saw yields decline yesterday following news of an impressive fiscal outperformance for January–September 2025, exceeding several IMF benchmarks.

According to the Ministry of Finance’s Fiscal Review, the nominal budget deficit narrowed by 54.5% to Rs. 441.4 billion (from Rs. 970.0 billion a year earlier), driven largely by a 31.0% rise in Government revenue—including grants—to Rs. 3,834.9 billion (from Rs. 2,927.8 billion).

In addition, the primary surplus of the budget was Rs. 1.46 trillion by September, compared with a primary balance indicative target of Rs. 300 billion in the IMF program. Sri Lanka’s tax revenue (excluding grants) grew 32.5% to Rs. 3.56 trillion in the nine months to September, beating an International Monetary Fund program target, according to provisional data released by the nation’s finance ministry. The IMF program’s indicative target floor on Government revenues is Rs. 2.75 trillion for end-September.

This bullish momentum was supported by a Bloomberg report titled “Sri Lanka Inflation May Remain Below Target in 4Q, CenBank Says” which stated that Sri Lanka’s inflation is likely to remain below target in the fourth quarter of this year even as demand picks up, the central bank said in a report to the nation’s parliament.

The news sparked a rally with strong buying interest resulting in a surge in activity and transaction volumes. Rates were seen dropping on the back of renewed demand with a particular emphasis on 2028-2030 tenors. This marked a stark departure from the subdued market conditions seen in recent times. As a result, secondary Bond market two-way quotes were seen closing lower ahead of the upcoming Treasury Bills auction.

In terms of the secondary Bond market trade summary, the 15.03.28 maturity was seen trading at the rate of 9.17%. The 01.05.28 and 01.07.28 maturities were seen taken at 9.22% to 9.20% and down the range of 9.25%-9.23%. The 15.10.28 maturity dropped down the range of 9.30%-9.26%. Similarly, the 15.10.29 maturity was seen trading lower at the rate of 9.68%. The 15.05.30 and 01.07.30 maturities were seen trading at the rates of 9.74% and down the range of 9.78%-9.77%. The yield on the 01.07.32 maturity dropped down from an intraday high of 10.75% to a low of 10.73%.

Today’s scheduled weekly Treasury Bill auction will have on offer a total amount of Rs. 57 billion. This is comprised of Rs. 12.00 billion on the 91-day maturity, Rs. 30.00 billion on the 182-day and a further Rs. 15.00 billion on the 364-day maturity. This is well below the Treasury bill maturity in line with the scheduled auction (due on 31 October), which is estimated to be approximately Rs. 104.16 billion.

For context at the weekly Treasury bill auction held last Wednesday (8 October), the weighted average rates held largely steady, with a total amount of Rs. 39.62 billion accepted against a total offered amount of Rs. 70 billion. Accordingly, the weighted average rates of the 91-day, 182-day and 364-maturities stood at 7.52%, 7.89% and 8.02% respectively.

The total secondary market Treasury Bond/Bill transacted volume for 28 October of 2025 was Rs. 12.62 billion.

In money markets, the net liquidity surplus was recorded at Rs. 144.26 billion yesterday. An amount of Rs. 148.37 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 4.11 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on call money and repo were registered at 7.89% and 7.92% respectively.

Forex market

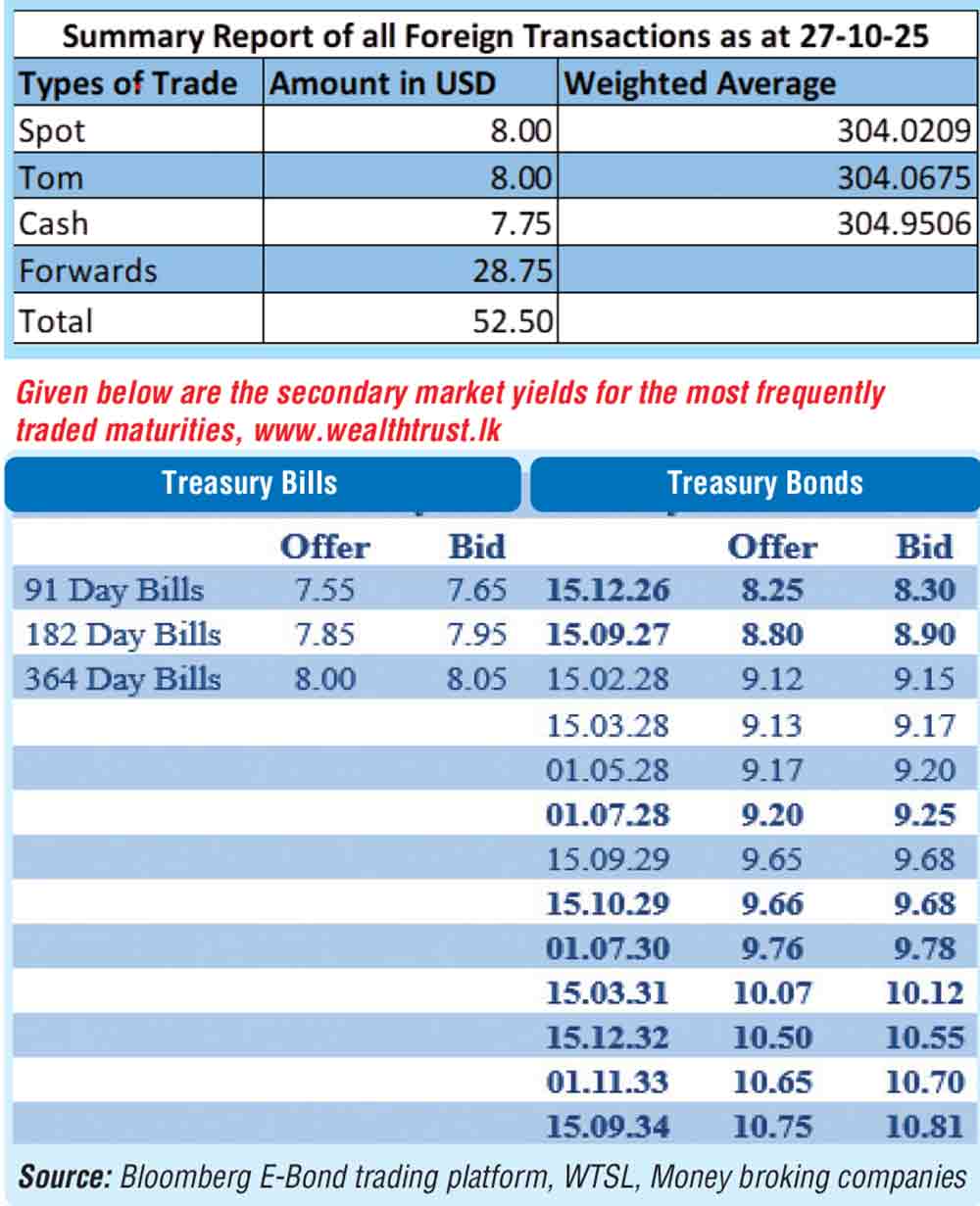

In the forex market, the USD/LKR rate on spot contracts closed stable Rs. 304.10/304.25 yesterday, unchanged against its previous day’s closing level.

The total USD/LKR traded volume for 27 October 2025 was $ 52.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)