Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 2 June 2025 03:47 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The Secondary Bond market rallied last week, with yields declining on the back of strong buying interest. This bullish momentum was driven by the Central Bank of Sri Lanka’s decision to reduce the Overnight Policy Rate by 25 basis points the previous week. The rally continued through most of the week, though some profit-taking towards the end led to a slight reversal in sentiment. Nevertheless, secondary market two-way quotes ended the week significantly lower. Market activity remained robust, with healthy transaction volumes and several notable block trades being recorded.

The Secondary Bond market rallied last week, with yields declining on the back of strong buying interest. This bullish momentum was driven by the Central Bank of Sri Lanka’s decision to reduce the Overnight Policy Rate by 25 basis points the previous week. The rally continued through most of the week, though some profit-taking towards the end led to a slight reversal in sentiment. Nevertheless, secondary market two-way quotes ended the week significantly lower. Market activity remained robust, with healthy transaction volumes and several notable block trades being recorded.

The downward rally in yields was further supported by the significant rise in prevailing liquidity surplus in the money market, as the overall liquidity surplus was seen increasing to Rs. 203.79 billion by the end of the week against its previous weeks Rs. 157.78 billion. In addition, the drop on the 364-day bill weighted average by 31 basis points at the weekly Treasury Bill auction added further impetus to the downward rally in bond yields.

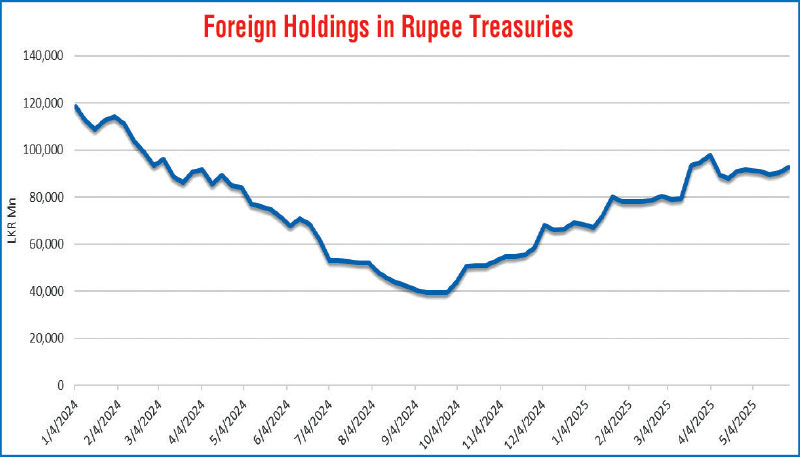

Furthermore, the foreign holding in Rupee Treasuries recorded a net inflow for the second consecutive week, amounting to Rs. 2.49 billion and as a result the total holding increased to Rs. 92.71 billion as at 29 May.

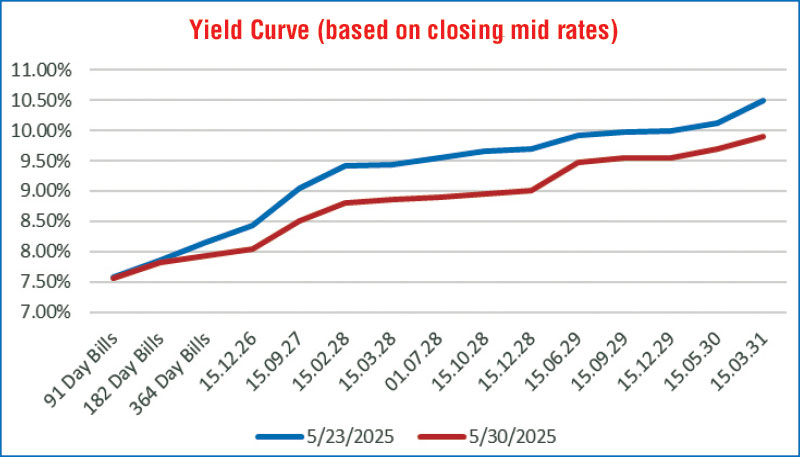

In Secondary Bond market, the 01.05.27 and 15.09.27 maturities were seen trading down from intraweek highs to lows of 8.75%-8.25% and 9.00%-8.45 respectively. The 01.07.28 auction maturity saw its yields decline from an intraweek high of 9.50% down to trade at a low of 8.80% post auction, however closed the week back up at 8.90% as profit taking set in at the end of the week. Similarly, the popular 15.12.29 maturity was seen trading down the range of intraweek highs to lows of 10.03%-9.35%, before rebounding to trade at the rate of 9.60% as profit taking kicked in. The yield on the 15.03.31 maturity was seen declining from 10.45% to trade at 9.80%.

As a result, the yield curve was seen shifting lower.

The back-to-back primary auctions reflected the monetary policy rate cut and the ensuing bull run in the secondary market.

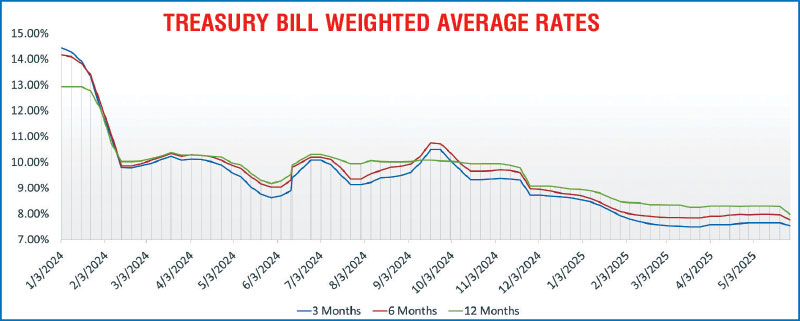

The weekly Treasury Bill auction conducted last Wednesday (28 May) was fully subscribed. The entire Rs. 162.50 billion on offer successfully raised in the first phase in competitive bidding. The total bids received exceeded the offered amount by 2.31 times. This marked the first auction since the Central Bank of Sri Lanka slashed the Overnight Policy Rate by 25 basis points. Accordingly, the weighted average yield rate on the 91-day tenor declined by 10 basis points to 7.55%, the 182-day tenor by 20 basis points to 7.77% and the 364-day tenor by 31 basis points to 7.98%. An additional amount of Rs. 16.25 billion, being the maximum aggregate amount offered was raised at the second phase.

The Treasury Bond auctions held last Thursday – 29 May, concluded on a resoundingly bullish note, with the full Rs. 200.00 billion on offer successfully raised at the first phase in competitive bidding. Total bids exceeding the offer by 2.65 times – an impressive outcome given the scale of the auction.

The 01.07.28 maturity (09.00% coupon) raised the entire maturity-wise offered amount of Rs. 40.00 billion in the first phase at a weighted average yield of 8.85%. For reference this was well below its secondary market two-way quote of 8.93%/8.97% just prior to the auction.

The 15.12.29 maturity (11.00% coupon) raised the entire maturity-wise offered amount of Rs. 80.00 billion at a yield of 9.47%. This was in line with market expectations as the maturity was seen quoted at the rate of 9.40/9.50% just prior to the auction.

Similarly, the 15.09.34 maturity (10.25% coupon) also raised the entire maturity-wise offered amount of Rs. 80.00 billion at a yield of 10.46%. A remarkable outcome with a relatively narrow term spread over a 15.12.32 maturity which was quoted at the rate of 10.00%/10.15% just prior to the auction.

The demand extended to the direct issuance window, with Rs. 20.00 billion, being the maximum amount offered, raised out of the total market subscription of Rs. 54.27 billion.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 55.63 billion.

In money market, the weighted average interest rates on call money and repo were recorded within the ranges of 7.74%-7.75% and 7.75%-7.76% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,509.42 billion as at 30 May, unchanged from the previous week’s closing level.

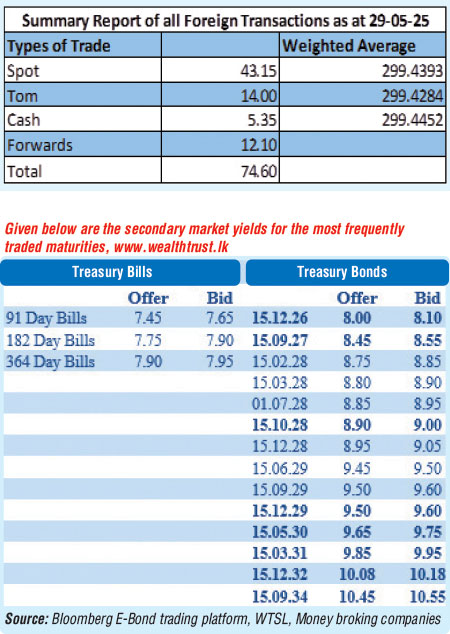

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating marginally, to close the week at Rs. 299.50/299.60 as against the previous week’s closing level of Rs. 299.40/299.45 and subsequent to trading at a high of Rs. 299.30 and a low of Rs. 300.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 101.14 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)