Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 4 November 2025 04:53 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

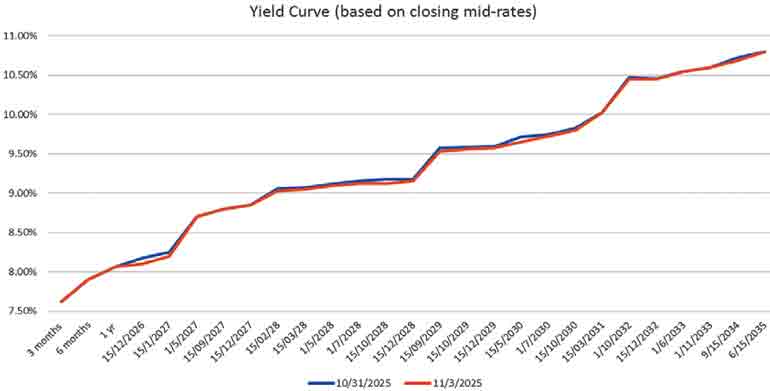

The secondary Bond market yesterday kicked off the new trading week on a positive note carrying over the bullish momentum from last week’s rally.

The market sentiment was supported by news that the foreign holdings of Sri Lankan rupee Government securities rose by Rs. 10.36 billion during the previous week - ending 30 October. This marked the largest inflow in 32 weeks and the fourth consecutive gain.

As a result, total holdings reached Rs. 141.32 billion, the highest in two years, reflecting a 259% surge from September 2024 lows. The market extended the rally and saw strong buying interest push yields lower.

Activity and transaction volumes were seen at robust levels. The demand was concentrated on 2026-2030 tenors, which saw the bulk of the action and the decline in rates. In conclusion, secondary market two-way quotes were seen closing lower, resulting in a further downward shift of the yield curve.

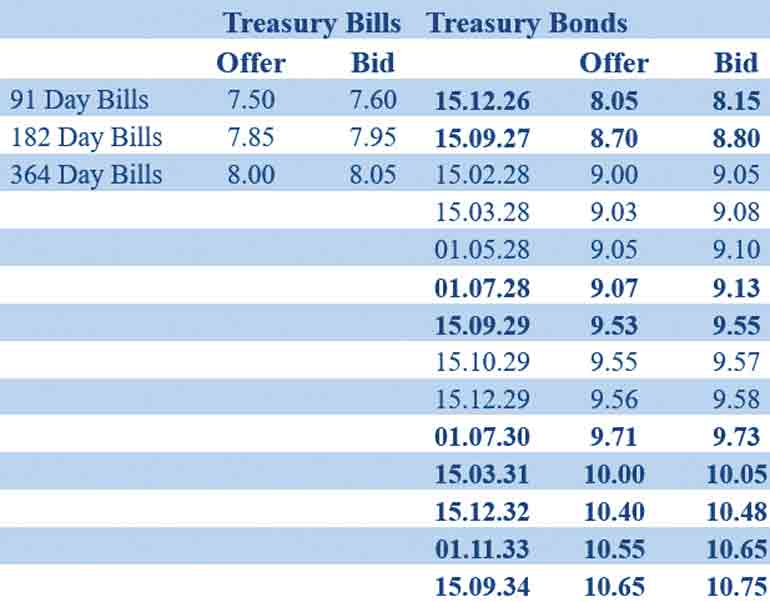

In terms of the secondary Bond market trade summary, the 15.12.26 maturity was seen taken at 8.10%. The 15.03.28 and 01.05.28 maturities were seen at the trading at the rate of 9.05% and down the range of 9.15%-9.10% respectively.

The 01.07.28, 01.09.28 and 15.10.28 maturities were seen trading at the rates of 9.15%, 9.15% and down the range of 9.17%-9.15% respectively. The 15.06.29 and 15.09.29 maturities were seen trading lower at the rates of 9.50% and down the range of 9.55%-9.53% respectively.

The 15.10.29 and 15.12.29 traded down the ranges of 9.57%-9.55% and at the rates of 9.58% respectively. The 01.07.30 maturity saw its yield decline from an intraday high to a low of 9.75%-9.72%. The 15.03.31 maturity traded at the rate of 10% and the 01.11.33 at the rate of 10.60%. The 15.09.34 maturity traded at the rate of 10.70%.

Today’s scheduled weekly Treasury Bill auction will have on offer a total amount of Rs. 57 billion. The auction will be comprising of Rs. 7.50 billion in 91-day bills, Rs. 30 billion in 182-day bills, and Rs. 40 billion in 364-day bills. This marks the second consecutive auction where the offered amount is considerably below the maturing volume, which is estimated at around Rs. 106.40 billion.

This continued undersupply of Treasury Bills at primary auctions was also seen spurring the secondary Bond market.

For context, the weekly Treasury Bill auction held last Wednesday (29th October) was fully subscribed, successfully raising the entire Rs 57 billion on offer.

The bids received to offered amount ratio stood at 2.21 times. This marked the first auction to be fully subscribed in four weeks.

The weighted average rates held largely steady, with the yield on the 91-day tenor remaining unchanged at 7.52%. However, the 182-day and 364-day tenors registered marginal increases of 01 basis point to 7.90% and 02 basis points to 8.04% respectively.

The total secondary market Treasury Bond/Bill transacted volume for 31 October was Rs. 6.35 billion.

In money markets, the net liquidity surplus was recorded at Rs. 105.18 billion yesterday. An amount of Rs. 139.49 billion was deposited at Central Banks SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 34.32 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on call money and repo were registered at 7.90% and 7.97% respectively.

Forex Market

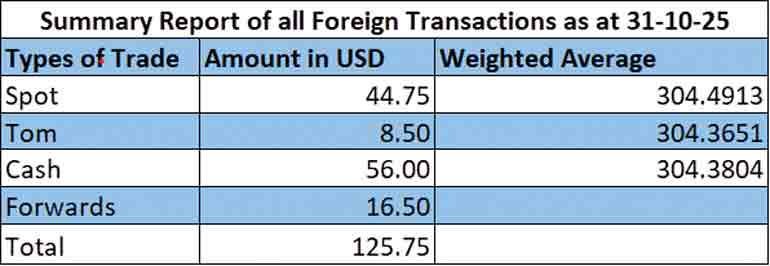

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating marginally to Rs. 304.45/304.55 as against

Rs. 304.35/304.45 the previous day.

The total USD/LKR traded volume for 31 October was $ 125.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)