Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 26 November 2025 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday mirrored the subdued sentiment observed at the start of the week, with investors continuing to maintain a cautious wait-and-see approach ahead of the sixth and Final Monetary Policy Announcement for 2025.

Trading activity was observed in a sideways pattern, with yields broadly holding steady and fluctuating within a tight range, reflecting continued consolidation at prevailing levels across most of the yield curve. However, rates were seen drifting higher on selected tenors.

The overall turnover was supported once again by the execution of several block-sized trades, which contributed to moderate total volumes for the day.

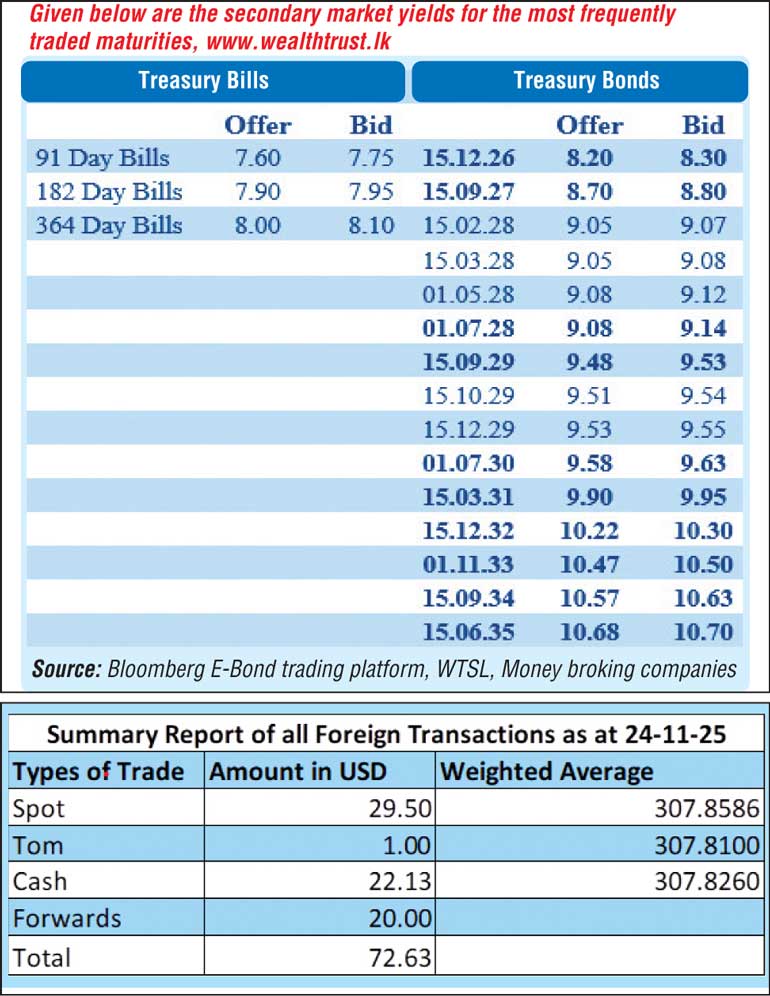

In terms of the secondary Bond market trade summary, the 15.01.27 maturity changed hands at the rate of 8.30%. The 15.02.28 and 15.03.28 maturities were seen trading at the rate 9.05% each. The 01.05.28 and 15.12.28 maturities were seen trading at the rates of 9.10% and 9.15% respectively. The 15.10.29 and 15.12.29 maturities were seen trading within the range of 9.52%-9.54% collectively. The 15.09.34 maturity was seen trading at the rate of 10.60% and the 15.06.35 maturity within the range of 10.69%-10.70%.

The Monetary Policy Review No. 06 for 2025 (the final announcement for 2025) is due to be announced today at 7.30 a.m.

To recap: At the 05th Monetary Policy Review for 2025 announced in September, the Central Bank of Sri Lanka (CBSL) decided to hold the Overnight Policy Rate at 7.75%. This marked the second consecutive monetary policy decision to keep rates on hold. The Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR), which are linked to OPR with pre-determined margins of ± 50 basis points, also remained unchanged at 7.25% and 8.25%, respectively. The statutory reserve rate was left unchanged at 2.00%.

In an article titled ‘SRI LANKA PREVIEW: Central Bank Is Set to Keep Rates on Hold’ Bloomberg Economics opined that The Central Bank of Sri Lanka is likely to hold rates at 7.75% for a third straight meeting. The article cited the following reasons for this outcome as per their view:

accelerated

This will be followed by today’s scheduled weekly Treasury Bill auction. The auction will have on offer a total amount of Rs. 86.50 billion. The auction will be comprising of Rs. 16.00 billion in 91-day Bills, Rs. 40.00 billion in 182-day Bills, and Rs. 30.50 billion in 364-day Bills. This marks the fifth consecutive auction where the offered amount is considerably below the maturing volume, which is estimated at around Rs. 97.95 billion.

For context, at the weekly Treasury Bill auction held last Wednesday (19th November) the weighted average rates remained broadly steady, with the yields on the 91-day and the 182-day tenors remaining unchanged at 7.52% and 7.91% respectively. However, the 364-day tenor registered a marginal decrease of 01 basis point to 8.03%. This marks the 18th week where T-Bill rates have stayed broadly anchored around prevailing levels. However, the auction was undersubscribed, raising only 73.40% or Rs 63.12 billion out of the Rs 86.00 billion offered. This marks the third consecutive auction to undersubscribed whiles the bids received to offered amount ratio stood at 1.95 times.

The total secondary market Treasury Bond/Bill transacted volume for 24 November was Rs. 5.17 billion.

In money markets, the net liquidity surplus was recorded at Rs. 79.28 billion yesterday. An amount of Rs. 82.15 billion was deposited at Central Banks SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 2.87 billion was withdrawn from the Central Banks SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on call money and repo were registered at 7.95% and 7.96% respectively.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day broadly steady at Rs. 307.90/308.00 as against Rs. 307.80/307.90 the previous day.

The total USD/LKR traded volume for 24 November was $ 72.63 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)