Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 22 July 2025 01:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Bond market kicked off the week on a quiet note, with yields holding broadly steady as trading remained range-bound. Market participants largely stayed on the sidelines, keeping the market in a consolidation phase ahead of the upcoming the 4th Monetary Policy Review for 2025, scheduled to be announced on Wednesday (23 July) at 7:30 a.m.

The Secondary Bond market kicked off the week on a quiet note, with yields holding broadly steady as trading remained range-bound. Market participants largely stayed on the sidelines, keeping the market in a consolidation phase ahead of the upcoming the 4th Monetary Policy Review for 2025, scheduled to be announced on Wednesday (23 July) at 7:30 a.m.

To recap: At the 3rd Monetary Policy Review for 2025 announced on 22 May, the Central Bank of Sri Lanka (CBSL) decided to cut the Overnight Policy Rate by 25 basis points to 7.75%. This marked the first cut since the OPR was introduced in November 2024. In addition, the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR), which are linked to OPR with pre-determined margins of ± 50 basis points, were also revised downwards by 25 basis points to 7.25% and 8.25%, respectively. However, the statutory reserve rate was left unchanged at 2.00%.

On the inflation front, the National Consumer Price Index - NCPI (Base: 2021=100) or National inflation for the month of May 2025 was recorded at + 0.30% on its point to point as against + 0.60% recorded in April 2025, while the annual average inflation was recorded at -0.90%.

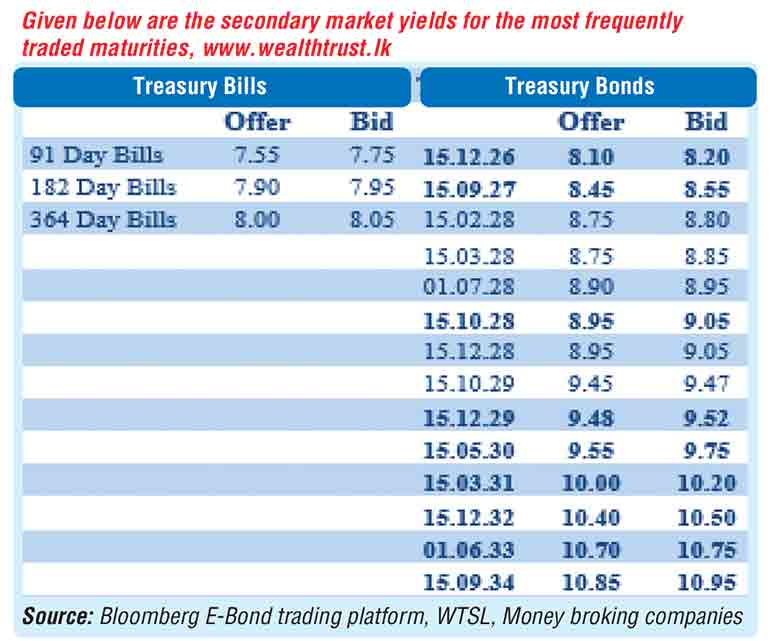

In Secondary Bonds market, limited trades were seen on the 15.10.28, 15.09.29 and 15.10.29 maturities at levels of 9.00% to 9.01%, 9.45% and 9.46% respectively.

In Secondary Bonds market, limited trades were seen on the 15.10.28, 15.09.29 and 15.10.29 maturities at levels of 9.00% to 9.01%, 9.45% and 9.46% respectively.

However, secondary market bills saw decent action. The September, October and November 2025 maturities were seen trading at the rates of 7.55%, 7.63% and 7.78% respectively. January 2026 bills traded at the rate of 7.90%.

The total secondary market Treasury Bond/Bill transacted volume for 18 July was Rs. 12.67 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.79% and 7.81% respectively.

The net liquidity surplus was recorded at Rs. 103.93 billion yesterday. An amount of Rs. 0.16 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 104.08 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex Market

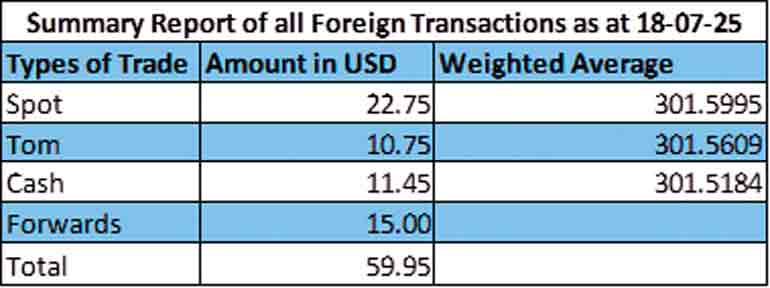

In the Forex market, the USD/LKR rate on spot contracts closed the day at broadly steady at Rs. 301.75/301.85 as against 301.65/301.85 the previous day.

The total USD/LKR traded volume for 18 July was $ 59.95 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)