Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 12 November 2025 02:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday overall saw yields consolidate at the lower levels established by the recent rally. Sideways trading action was seen in a narrow band, while activity and transaction volumes remained at healthy levels. Market participants were seen switching into a wait-and-see mode ahead of the upcoming back-to-back Treasury Bill and Bond auctions.

The secondary Bond market yesterday overall saw yields consolidate at the lower levels established by the recent rally. Sideways trading action was seen in a narrow band, while activity and transaction volumes remained at healthy levels. Market participants were seen switching into a wait-and-see mode ahead of the upcoming back-to-back Treasury Bill and Bond auctions.

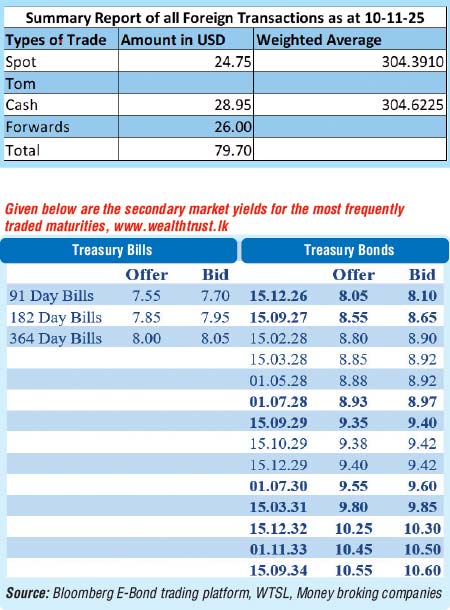

In terms of the secondary bond market trade summary, the 01.05.27 maturity was seen trading at the rate of 8.50%. The 01.05.28, 01.07.28 and 15.10.28 maturities were seen trading at the rates of 8.90%, 8.98%-8.94% and 8.99% respectively. The 15.06.29, 15.09.29, 15.10.29 and 15.12.29 maturities were seen trading at the rates of 9.34%-9.33%, 9.39% and 9.40% and 9.42% respectively. The 15.05.30 and 01.07.30 maturities were seen trading at the rates of 9.55%, 9.60%-9.56% respectively. The 15.09.34 maturity was seen trading at the rates of 10.56%-10.55%.

Today’s scheduled weekly Treasury Bill auction will have on offer a total amount of Rs. 77 billion. The auction will be comprising of Rs. 10 billion in 91-day bills, Rs. 30 billion in 182-day bills, and Rs. 37 billion in 364-day bills. This marks the third consecutive auction where the offered amount is considerably below the maturing volume, which is estimated at around Rs. 104.28 billion.

For context, at the weekly Treasury bill auction held last Tuesday the weighted average rates remained unchanged, with the yields on the 91-day tenor staying at 7.52%, the 182-day remaining at 7.90% and the 364-day at 8.04% respectively. This marked the 16th week where T-Bill rates have stayed broadly anchored around prevailing levels. However, the auction was undersubscribed, raising only 86.40% or Rs. 66.96 billion out of the Rs. 77.50 billion offered. The bids received to offered amount ratio stood at 1.68 times.

The total secondary market Treasury Bond/Bill transacted volume for 10 November was Rs. 13.01 billion.

In money markets, the net liquidity surplus was recorded at Rs. 145.28 billion yesterday, deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%.

The weighted average rates on call money and repo were registered at 7.93% and 7.96% respectively.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating marginally to Rs. 304.20/304.35 as against Rs. 304.15/304.20 the previous day.

The total USD/LKR traded volume for 10 November was $ 79.70 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)