Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 30 September 2025 01:28 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday started off the new trading week on a dull note, with activity and transaction volumes at subdued levels. Very limited trades were observed on relatively thin volumes. Yields were seen holding broadly steady. Market participants were reserved amid the absence of strong directional cues and opted to stick to the sidelines, adopting a wait and see approach the ahead of September CCPI Data.

Bloomberg Economics (BE) in an article titled “SRI LANKA PREVIEW: Inflation Likely Surged on Rising Food Costs” opined that Sri Lanka’s inflation probably picked up in September as higher food prices outweighed a cut in fuel prices. It went on to project that Consumer prices likely rose 2.5% year on year in September, compared to a gain of 1.2% in the prior month. The report stated that food prices likely increased 4.7% year on year, following a

gain of 2% in August, based on available weekly retail prices. BE noted that the government reduced petrol prices by Rs. 6 per litre to Rs. 299 in September. It went on to say that core inflation probably remained unchanged at 2% year on year from the prior month and expected it to gain pace ahead as demand is strengthening. The report further estimated that price gains will average around 0.2% in 2025, down from 1.3% in 2024 and far below 20.5% in 2023. The data is due today (30).

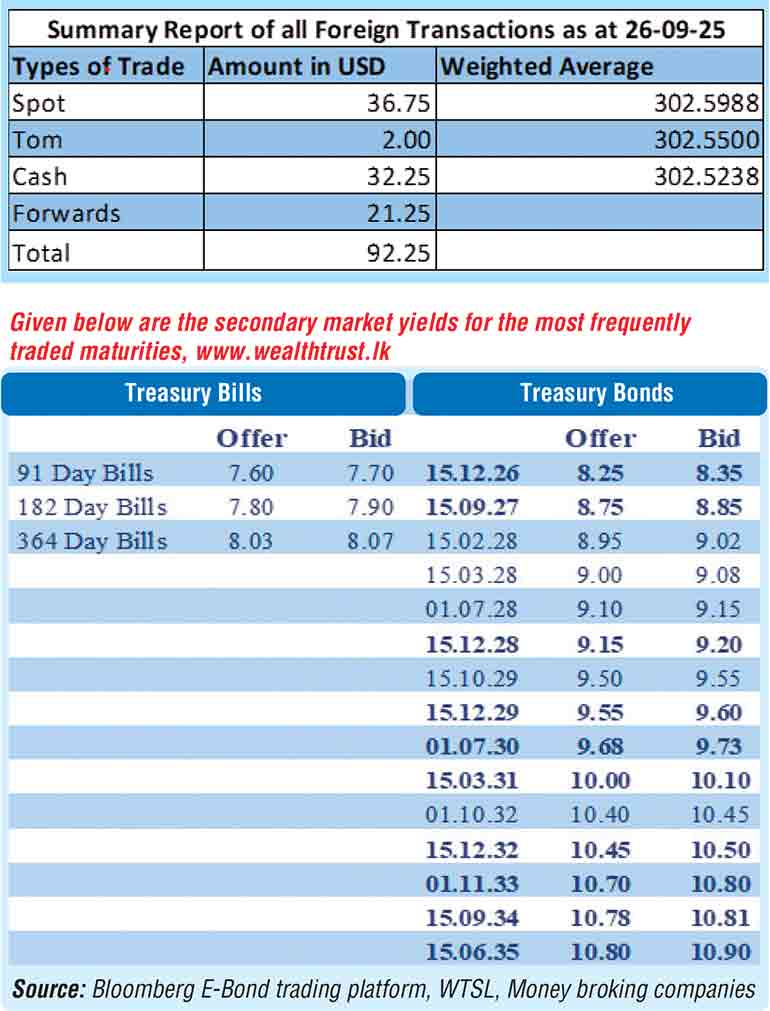

In the secondary Bond market, the 01.06.26 maturity was traded at 8.25%, the 15.01.28 maturity at 9.00%, and the 01.07.30 maturity at 9.70%.

In secondary market Bills, trades were observed on January and August/September 2026 maturities were seen trading at the rates of 7.80% and 8.00%-8.01%.

The total secondary market Treasury Bond/Bill transacted volume for 26 September was Rs. 1.64 billion.

In money markets, the net liquidity surplus was recorded at Rs. 170.90 billion yesterday. An amount of Rs. 0.10 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 171.00 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 7.25%.

The weighted average rates on call money and repo were registered at 7.86% and 7.88% respectively.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating slightly to Rs. 302.55/302.60 as against Rs. 302.50/302.55 the previous day.

The total USD/LKR traded volume for 26 September was $ 92.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)