Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 9 December 2025 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market opened the new trading week on a dull note, with activity remaining subdued as participants took a cautious stance. Traders were seen digesting the news of potential increased post-cyclone fiscal spending against the likelihood of increased IMF support. Yields were seen holding broadly steady as market sentiment tilted defensive.

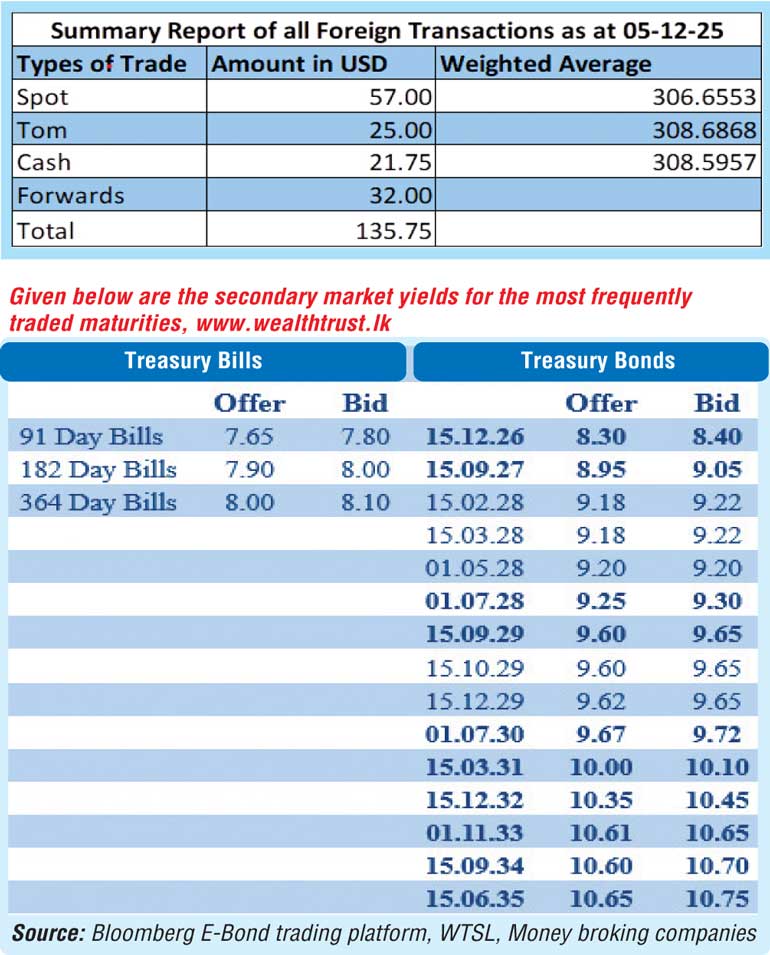

In terms of the secondary Bond market trade summary limited trades were observed on selected tenor. The 15.02.28 and 01.05.28 maturities were seen trading at the rate of 9.20% and 9.23% respectively. The 15.12.28 maturity was observed trading at the rate of 9.35%. The 15.10.29 and 15.12.32 maturities were seen changing hands at the rates of 9.63% and 10.37% respectively.

The total secondary market Treasury Bond/Bill transacted volume for 5 December 2025 was Rs. 4.30 billion.

In money markets, the net liquidity surplus decreased further to Rs. 85.67 billion. An amount of Rs. 92.27 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 6.60 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on call money and repo were registered at 7.95% and 7.98% respectively.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day steady at Rs. 308.63/308.68 as against Rs. 308.55/308.65 the previous day.

The total USD/LKR traded volume for 5 December was $ 135.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)