Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 8 December 2025 03:18 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market last week started off slowly and activity remained relatively subdued, as market participants adopted a wait and see approach amidst the aftermath of Cyclone Ditwah.

The secondary Bond market last week started off slowly and activity remained relatively subdued, as market participants adopted a wait and see approach amidst the aftermath of Cyclone Ditwah.

However, transaction volumes were seen at healthy levels boosted by several block transactions. Yields were seen drifting higher particularly on the short to belly end of the yield curve, specifically 2026 to 2033 tenors.

Nevertheless, the long end of the yield curve; the tenors 2034 and beyond, held intact as concentrated buying interest was observed. In conclusion, secondary Bond market closing two-way quotes reflected mixed movement and as a result the yield curve was observed flattening.

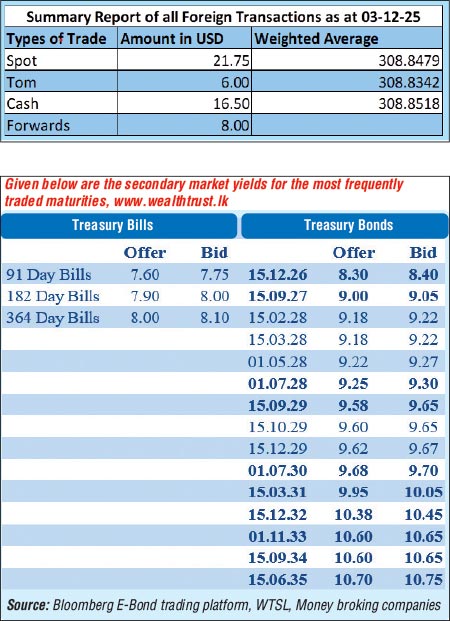

During the week, the 01.08.26 traded at the rate of 8.45% and the 15.09.27 maturity traded at 9.00%. The 15.02.28 and 15.03.28 traded at 9.20% each, while the 01.05.28 traded at 9.25%. The 15.06.29 traded at 9.55%, the 15.10.29 traded within 9.60%–9.65%, and the 15.12.29 traded within 9.65%–9.70%. The 01.07.30 changed hands within 9.68%–9.70%.

The 15.03.31 traded within the range of 9.99%-10.07% and the 15.05.31 within range of 10.20%–10.30%. The 15.12.32 traded at 10.35%. The 01.06.33 changed hands within 10.50%–10.55% and the 01.11.33 within the range of 10.50%–10.67%. The 15.09.34 traded at 10.65% whiles the 15.06.35 at 10.72%.

At the weekly Treasury Bill auction held last Wednesday (2 December) the weighted average rates held steady. Accordingly, the yields on the, the 182-day and the 364-day

tenors were recorded unchanged at 7.91% and 8.03%. However, the 91-day tenor recorded a very marginal drop of 01 basis point to 7.51%.

This marks the 20th week where T-Bill rates have stayed broadly anchored around prevailing levels. Nevertheless, the auction was undersubscribed despite the bids received to offered amount ratio standing at 1.81 times.

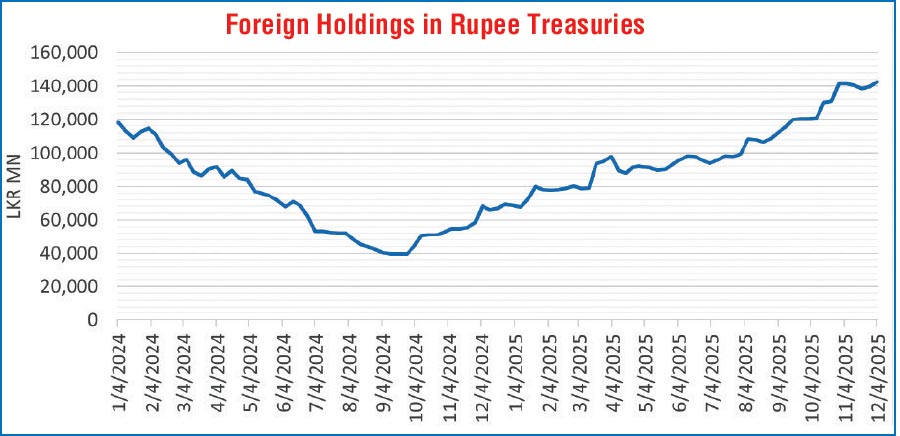

The foreign holdings of rupee-denominated Government securities continued their upward trajectory last week, recording a net inflow for the second consecutive week, amounting to Rs. 2.92 billion — a 2.00% week-on-week increase. Consequently, total holdings rose to Rs. 142.45 billion reaching the highest value in 2 years (since November 2023).

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 9.23 billion.

In the money market, the total outstanding liquidity surplus in the inter-bank money market reduced to Rs. 96.90 billion as at the week ending 5 December, 2025, from Rs. 105.80 billion recorded the previous week.

The weighted average interest rates on call money and repo were recorded within the ranges of 7.94%-7.95% and 7.96%-7.97% respectively while the Central Bank of Sri Lanka’s (CBSL) holding of Government securities was registered at Rs. 2,508.92 billion as at 5 December, unchanged against the previous week’s closing level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week depreciating to Rs. 308.55/308.65 as against the previous week’s closing level of Rs. 308.05/308.20. This was subsequent to trading at a high of Rs. 308.20 and a low of Rs. 309.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 46.4 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)