Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 16 September 2025 04:28 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market yesterday started off the new trading week on a dull note, with activity and transaction volumes at subdued levels. Very limited trades were observed on relatively thin volumes. Yields were seen holding broadly steady. Market participants opted to stick to the sidelines, adopting a wait and see approach ahead of the upcoming Fed (US) Monetary Policy Announcement due tomorrow (17).

It has been widely reported that market pundits expect the US Federal Reserve to cut interest rates at its upcoming policy meeting, citing signs of a cooling labor market. According to the CME Fed Watch tool, which tracks market expectations for Fed policy shifts, there is a 95% probability of a 25-basis point reduction. Morgan Stanley and Deutsche Bank expect the US Federal Reserve to deliver interest rate cuts at all its three meetings this year, in September, October and December.

In secondary Bonds market, the 15.12.29 maturity was observed trading at the rate of 9.55%.

In secondary market Bills, trades were observed on November 2025 bills at the rate of 7.79%.

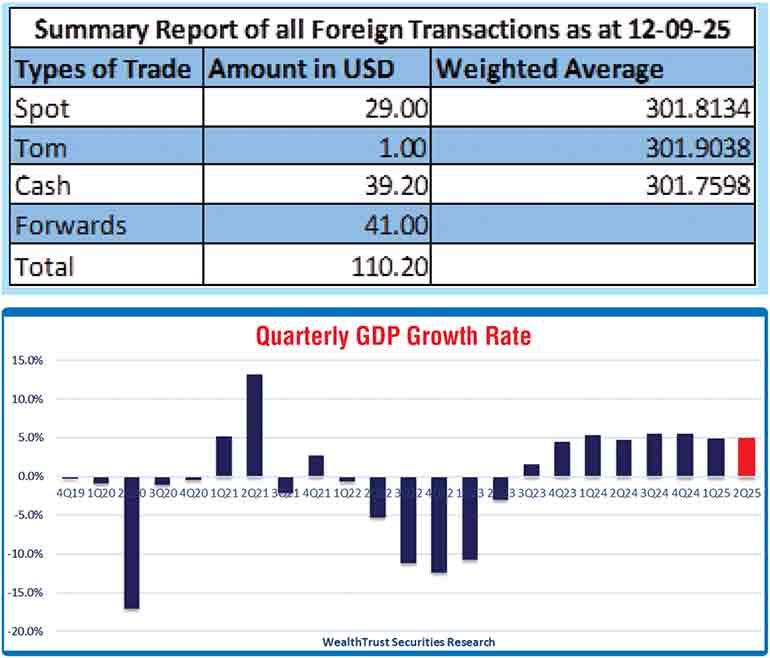

Meanwhile, Sri Lanka’s economy grew 4.9% year-on-year in Q2 2025, according to the Department of Census and Statistics. This was above the Bloomberg consensus estimate of 4.8%, based on forecasts from six economists that ranged between 3.4% and 5.7%.

The total secondary market Treasury Bond/Bill transacted volume for 12 September was Rs. 7.84 billion.

The net liquidity surplus was recorded at Rs. 147.91 billion yesterday. An amount of Rs. 4.10 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 152.01 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

The weighted average rates on call money and repo were registered at 7.86% and 7.87% respectively.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating Rs. 302.10/302.17 as against

Rs. 301.90/301.95 the previous day.

The total USD/LKR traded volume for 12 September was $ 110.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)