Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 27 August 2025 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market continued to remain subdued for a second consecutive day, with activity and transaction volumes persisting at muted levels. Trading was limited to sparse deals concentrated on a few selected maturities, while overall volumes stayed thin. The market was seen at a virtual standstill for much of the day. Yields held broadly steady once again, as market participants largely stayed on the sidelines, maintaining a cautious wait-and-see approach in the absence of strong directional cues.

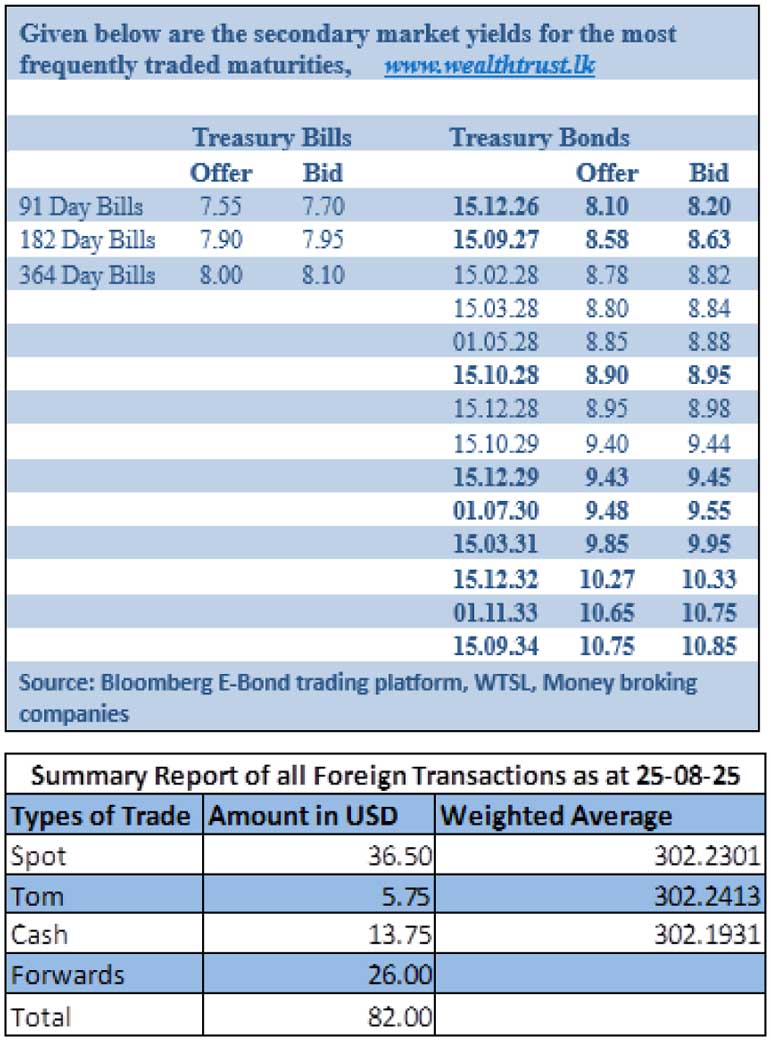

The 15.05.26 maturity was seen trading at the rates of 8.10%-8.05%. The 15.10.29 and 15.12.29 maturities were seen trading at the rates of 9.41%-9.45% collectively.

Meanwhile, in secondary market Bills February and March 2026 maturities were seen trading at the rates of 7.90% and 8.05%-8.01% respectively.

This is ahead of today’s Bill auction, where in total an amount of Rs. 82 billion will be on offer, an of Rs 3.50 billion over the previous week. The auction will be consisting of Rs. 15 billion on the 91-day, Rs. 32 billion on the 182-day and Rs. 35 billion on the 364-day maturities.

To recap, at the weekly Treasury Bill auction held last Wednesday (20/08/25), weighted average yields eased further albeit very marginally, marking the third straight week of declines on at least one tenor. The 91-day and 182-day maturities dipped by 1 basis point each to 7.59% and 7.89%, while the 364-day tenor held steady at 8.03%. The auction was fully subscribed for the third consecutive week, raising the total offered amount of Rs. 78.50 billion in the first phase through competitive bidding. Total bids received exceeded the offered amount by 1.97 times. Notably, the longer-tenor 364-day maturity raised more than the respective offered amount, while the 91-day and 182-day maturities raised less than their respective offered amounts.

The total secondary market Treasury Bond/Bill transacted volume for 25 August was Rs. 8.10 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.86% and 7.87%.

In the money market, the net liquidity surplus increased to Rs. 135.70 billion. An amount of Rs. 0.19 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 135.89 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day mostly unchanged at Rs. 302.25/302.33 as against Rs. 301.25/302.35 the previous day.

The total USD/LKR traded volume for 25 August was $ 82.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)