Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 21 August 2025 04:26 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

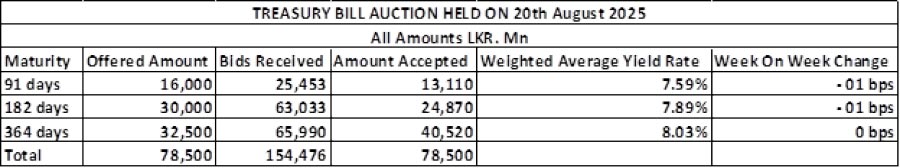

The weighted averages at yesterday’s weekly Treasury Bill auction continued to trickle lower on one or two maturities for a third consecutive week. The total offered amount of Rs. 78.5 billion was successfully accepted, also for the third consecutive week as well.

The weighted averages at yesterday’s weekly Treasury Bill auction continued to trickle lower on one or two maturities for a third consecutive week. The total offered amount of Rs. 78.5 billion was successfully accepted, also for the third consecutive week as well.

The weighted average rate on the 91-day tenor and the 182-day tenor registered declines of 01 basis point each to 7.59% and 7.89% respectively week-on-week. However, the 364-day tenor remained unchanged week-on-week at 8.03%.

Notably, the longer-tenor 364-day maturity raised more than the respective offered amount, while the 91-day and 182-day maturities raised less than their respective offered amounts.

The Phase II subscription for all three maturities is now open until 3 p.m. of business day prior to settlement date (i.e., 21.08.2025) at the WAYRs determined for the said ISINs at the auction.

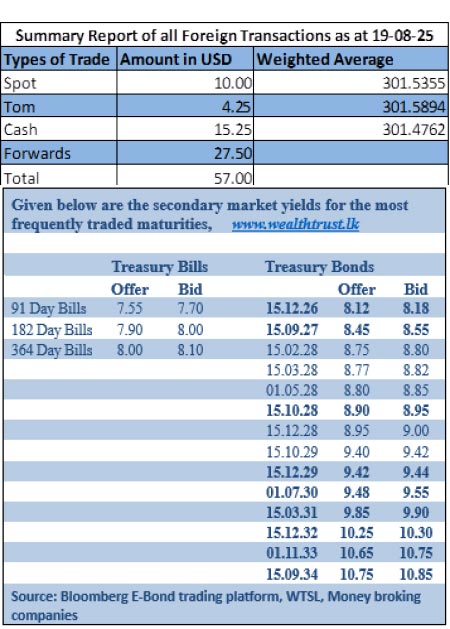

Meanwhile, the Secondary Bond market yesterday saw several large block trades drive sizeable transaction volumes with yields increasing marginally. However, renewed buying interest at the elevated levels curtailed any further movement.

The 01.08.26 maturity traded at the rates of 8.05%-8.10%. The 15.03.28 and 01.05.28 traded at the rates of 8.80%-8.82% and 8.84% respectively. The 01.07.28 maturity traded at the rate of 8.88%. The 15.09.29 and 01.11.33 maturities traded at the rate of 9.40% and 10.70% respectively.

In the Secondary Bills market, trades were observed in December 2025 bills at yields of 7.72%-7.70%, followed by February 2026 maturities at 7.97%, and March 2026 bills at 8.04%-8.01%.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.86% each.

The net liquidity surplus was recorded at Rs. 105.85 billion yesterday. An amount of Rs. 15.56 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.25%, while an amount of Rs. 121.41 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.25%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts to closed at Rs. 301.70/301.80 as against its previous day’s closing level of Rs. 301.55/301.70.

The total USD/LKR traded volume for 19 August was $ 57.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)