Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 1 August 2025 00:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Colombo Consumer Price Index (CCPI; Base 2021=100) for the month of July was recorded at a negative of 0.3% or -0.3% on its point to point, continuing its deflation for an 11th consecutive month. However, it was seen increasing against its previous month’s figure of -0.6%. The annual average was registered at -1.6%.

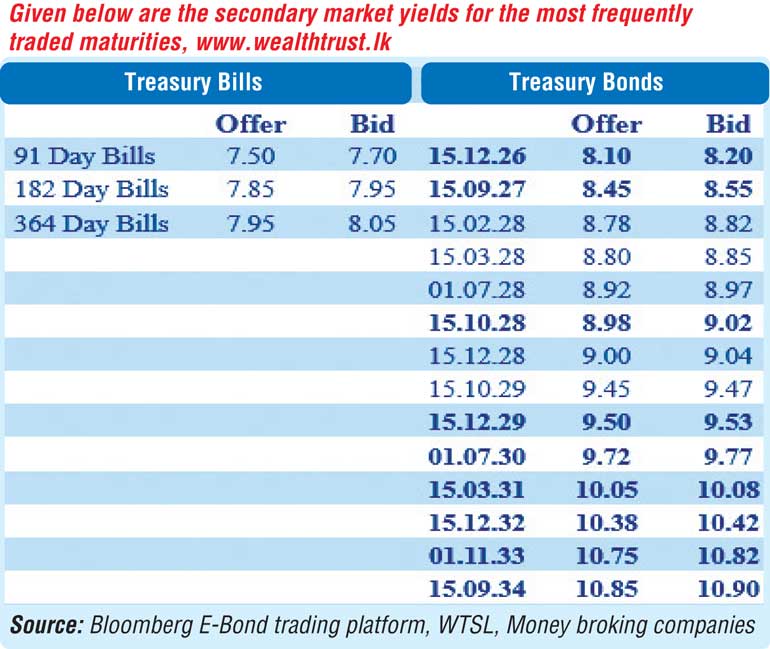

Meanwhile, activity in the secondary bond market increased and was witnessed across the yield curve yesterday. The maturities of 2028’s (i.e. 15.10.28 & 15.12.28), 2029’s (i.e. 15.10.29 & 15.12.29), 15.03.31, 15.12.32 and 01.11.33 were seen changing hands at levels of 9.00% to 9.02%, 9.46% to 9.52%, 10.06%, 10.35% to 10.45% and 10.77% to 10.82% respectively, with demand concentrating on the 2031 and beyond durations.

The total secondary market Treasury Bond/Bill transacted volume for 30 July was Rs. 30.27 billion.

In money markets, the net liquidity surplus increased marginally to Rs. 114.10 billion yesterday from its previous days Rs. 106.24 billion while the weighted average rates on overnight call money and Repo rates stood at 7.80% and 7.83% respectively.

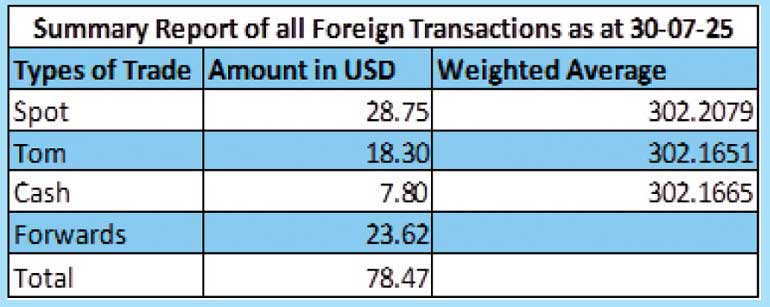

Forex Market

In the Forex market, the USD/LKR rate on spot contracts remained mostly unchanged yesterday to close the day at Rs. 302.10/302.20.

The total USD/LKR traded volume for 30 July was $ 78.47 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)