Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 21 October 2025 05:37 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

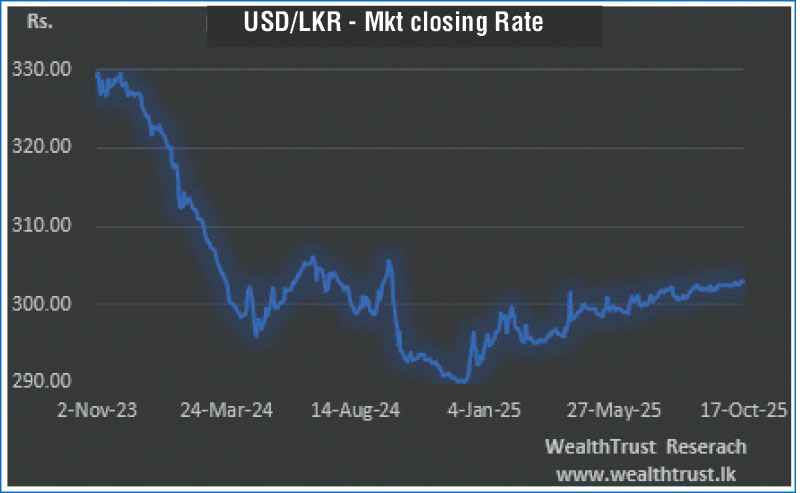

The USD/LKR rate on spot contacts in the forex market, was seen depreciating during the week to hit a fresh low of Rs. 303.20, a level last seen on the 24 September 2024 before closing the week at Rs. 302.90/00 and against its previous weeks closing level of Rs.302.60/68.

The USD/LKR rate on spot contacts in the forex market, was seen depreciating during the week to hit a fresh low of Rs. 303.20, a level last seen on the 24 September 2024 before closing the week at Rs. 302.90/00 and against its previous weeks closing level of Rs.302.60/68.

The daily USD/LKR average traded volume for the first four days of the week stood at

$ 90.22 million.

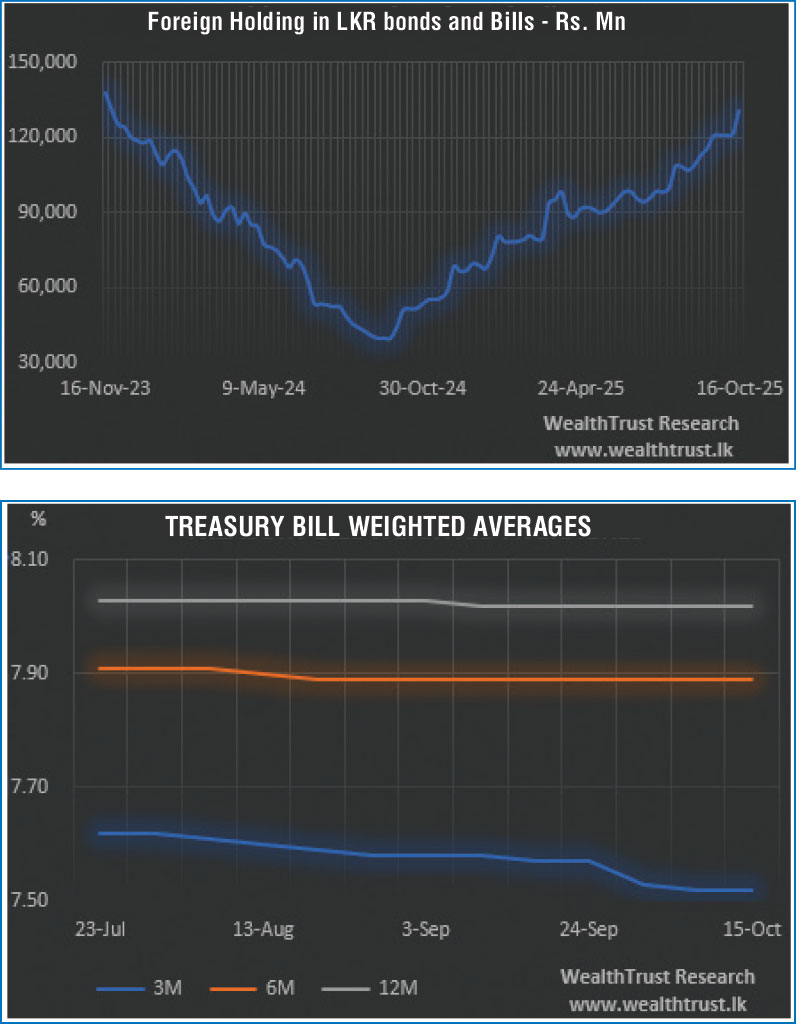

Meanwhile, the foreign holding in LKR Government Treasuries increased further by Rs. 9.43 billion for the week ending 16 October 2025, recording its highest week on week increase in 30 weeks, while its overall holding exceeded Rs. 130 billion to stand at Rs. 130.35 billion for the first time since 23 November 2023.

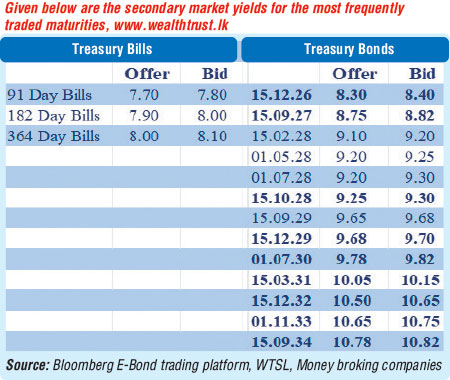

In the interim, the primary market continued to produce steady results as the weighted average rates on the 01.07.30, 01.11.33 and 01.07.37 maturities were registered at 9.80%, 10.72% and 11.01% respectively, equivalent to its pre-auction yields and the weighted average rates on the 91-day, 182-day and 364-day bills remained steady at 7.52%, 7.89% and 8.02%.

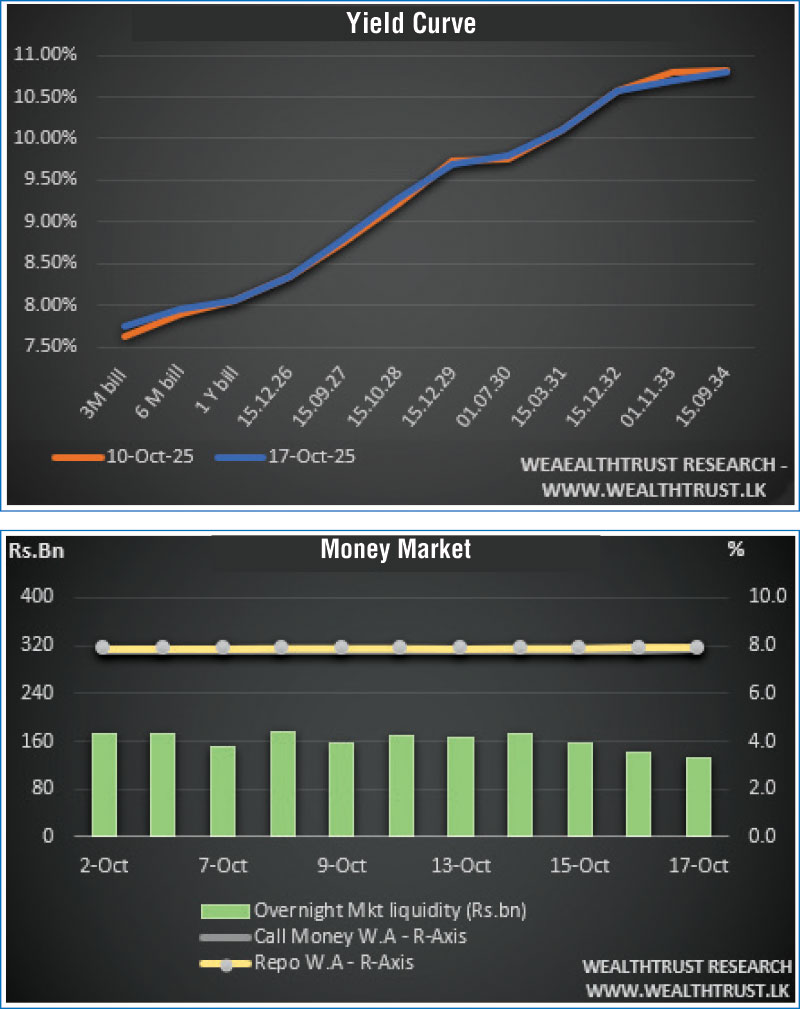

Nevertheless, the trading activity in the secondary Bond market moderated during the week, while yields remained mostly unchanged, week on week.

The limited activity was seen on the maturities of 2026’s (i.e.15.05.26 and 01.08.26), 2027’s (i.e. 01.05.27 and 15.09.27), 2028’s (i.e.15.02.28, 01.05.28, 01.07.28, 15.10.28 and 15.12.28), 2029’s (i.e.15.06.29, 15.09.29, 15.10.29 and 15.12.29), 2030’s (i.e. 15.05.30 and 01.07.30), 15.12.31, and 2023’s (i.e. 01.06.33 and 01.11.33) at levels of 8.27% to 8.35%, 8.70% to 8.83%, 9.10% to 9.34%, 9.65% to 9.71%, 9.78% to 9.80%, 10.21% and 10.70% to 10.72% respectively.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 19.75 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 7.87% and 7.90% respectively for the week while the total outstanding liquidity surplus was registered at Rs.133.22 billion by the end of the week against its previous weeks of

Rs. 169.15 billion.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking Companies)